May 3, 2011 - A Day With Harry S. Dent

Featured Trades: (A DAY WITH HARRY S. DENT), (STOCKS), (SPX), (QQQ), (EEM), (BONDS), (TLT), (JNK), (TBT), (DOLLAR), (UUP), (FXE), (OIL), (USO), (DIG), (PRECIOUS METALS), (GLD), (SLV), (DENT)

1) A Day With Harry S. Dent. I listen to Harry S. Dent, not because he is an iconoclast, one of the few original thinkers out there, and a complete wild man, although these are all admirable qualities to be found in a global strategist. I listen to him because he has been right.

Go no further than the titles of his books. They include The Great Boom Ahead (1993) (click here for the link),? The Roaring 2000's (1999) (click here for the link),? and The Great Depression Ahead (2008) (click here for the link) .

-

-

His unique blend of demographic research, identification of global consumer spending patterns, and long term cycle analysis, really makes Harry one of a kind. Foreign governments, major hedge funds, financial advisors, and individuals are all just wild about Harry. They have found his advice indispensible when navigating the sticky shoals of international finance.

So when an opportunity arose to spend a day with him sorting through the tea leaves, working through alternative scenarios for the future of disparate asset classes, and testing each other's' theories, I was on the next plane. It was nothing less than a Vulcan mind meld. And the late night Jack Daniels and 15 year old Macallan made sure we were both on a different planet.

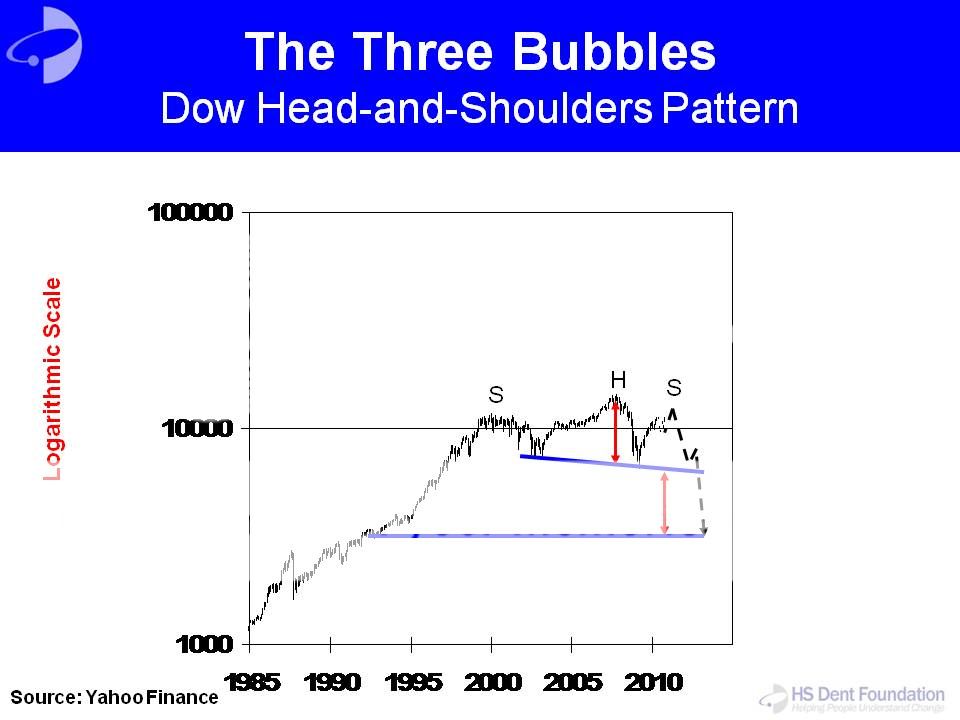

Harry argues passionately that we are witnessing the end of the third great bubble in debt, hot on the heels of earlier forays into madness in technology stocks and real estate. Add public and private debt from all sources, and it totals $130 trillion, the greatest accumulation of IOU's in history. The Federal Reserve is now manipulating all markets, and the exercise is certain to end in tears. The only way out from this will be to suffer an economic and financial crisis worse than we have seen to date.

The triggering factor will be the continued collapse of the residential real estate market. Continued shrinking home equity means that there will be ever fewer buyers in this market. That makes a laughing stock of current bank valuations, which have yet to be marked to market, and still obscure massive losses from the last crash. Have you enjoyed Uncle Ben's wealth effect through rising stock prices? The movie run in reverse makes Freddie Kruger look like a cream puff, and the outcome will be ugly.

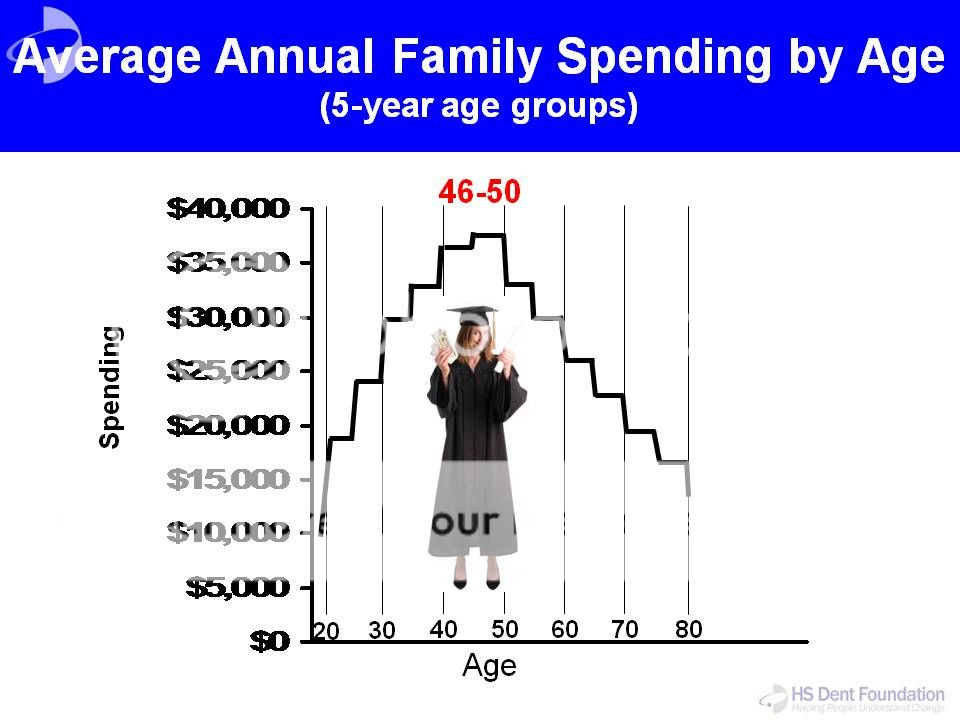

A key part of Harry's work revolves around generational spending patterns. Americans see spending peak when they reach the ages of 46-50, and bleed off from there. He blends this perspective in with historical data on demographics and some traditional Eliot Wave Analysis to produce one of the most refined long term views in the marketplace.

The big problem is that we have 90 million baby boomers followed by only 70 million 'echo boomers'. Falling family sizes from the1940's onward are going to come back to haunt us. Adjust for the falling earnings of the next generation, and their net consumer spending could drop by half. As I am fond of telling those who attend my strategy lunches, don't plan on selling your house to your kids, especially if they are still living in the basement.

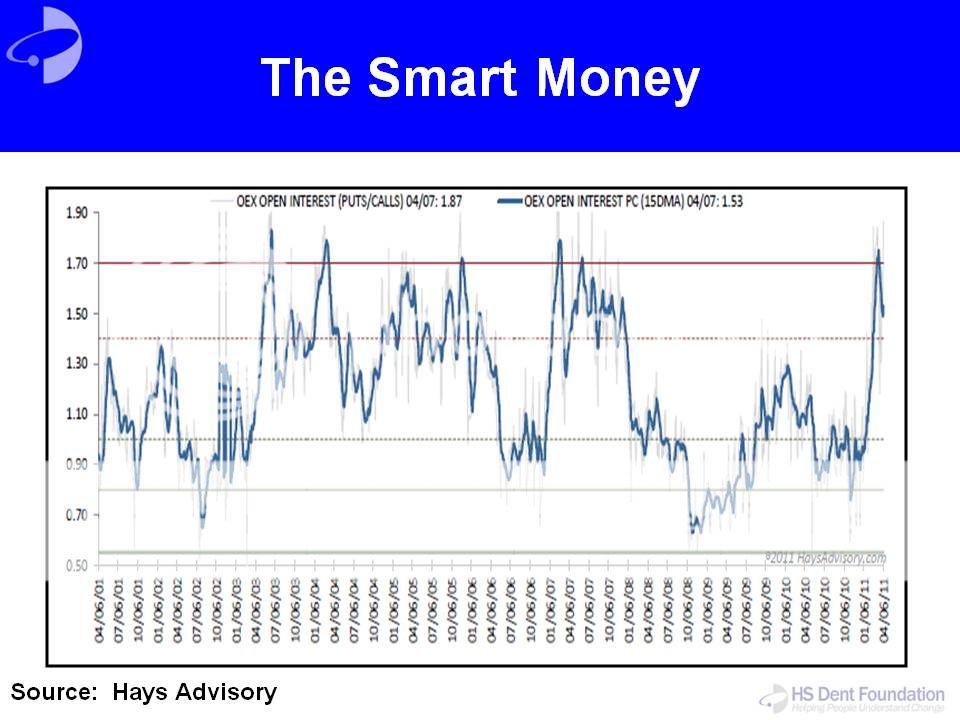

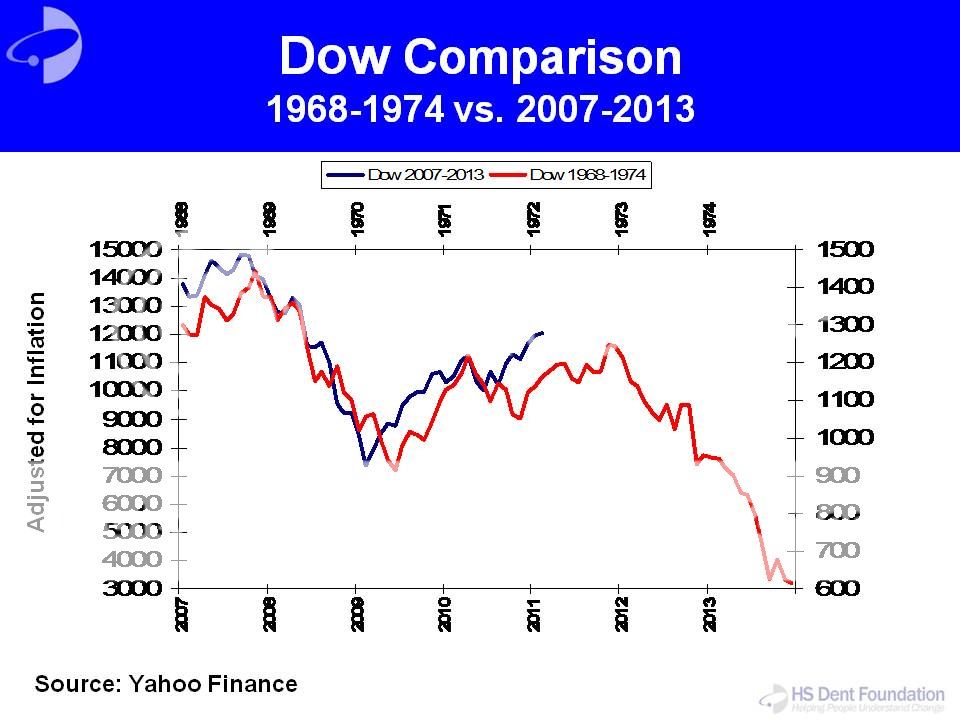

Stocks.? (SPX), (QQQ), (EEM). Stock markets on crack are about to join Lindsey Lohan and Charlie Sheen in rehab. Harry didn't bat an eyelash when he looked me straight in the eye and told me that the Dow was going to 3,300 by 2014. The only unknown is weather the crash starts now, or whether liquidity manufactured by the Federal Reserve can keep the party going for another six months. Put a gun to Harry's head, and he'll tell you that the peak isn't coming until August. But the smart money is getting out, with the put/call ratio, great leading indicator, rocketing to 1.9 in February.

There will be no place to hide, as this will be a global event, and that reallocation towards more defensive sectors will be a waste of time. The Australian stock market will vaporize from 6,000 to 1,000, while Hong Kong will get pared back from 24,000 to 8,000. China is the greatest bubble and could take the biggest hit. The rising middle class will not take their first ever big recession lightly, and coming political turmoil is a given. Canada, with a great resource base behind it, a new government, and rising interest rates, will hold up better than most.

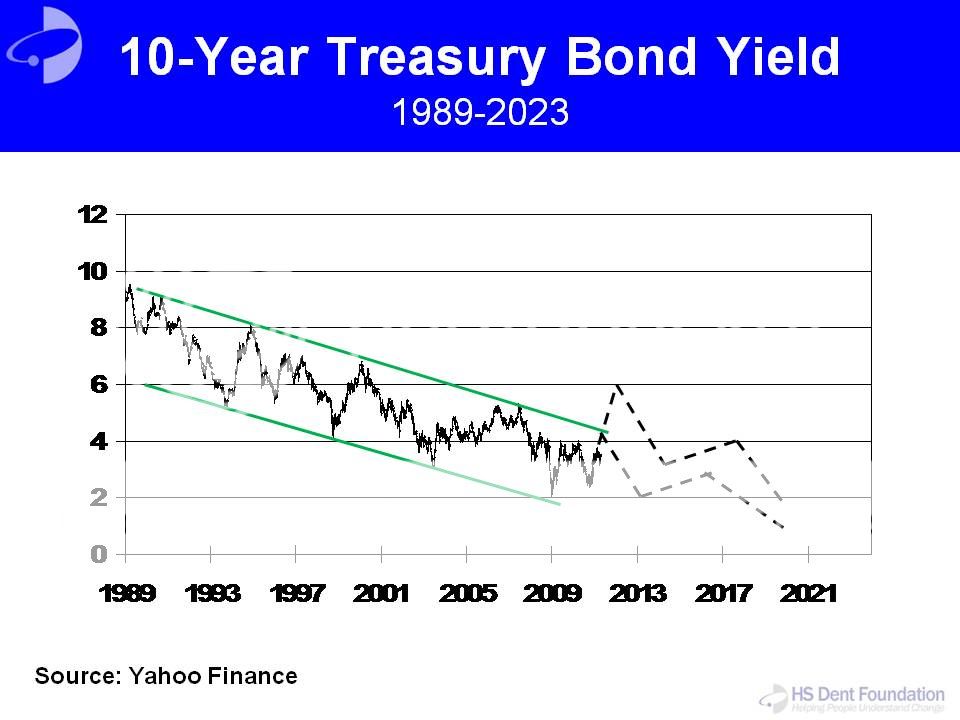

Bonds. While hard times for equities are ahead, bonds are about to enjoy the second coming. The traditional flight to safety bid is about to come back with a vengeance. The wholesale destruction of vast quantities of debt through default is having the unintended consequence that it is creating a bond shortage. Here we are, over two years into this recovery and the ten year Treasury bond is yielding 3.26%? Conditions for bonds are about to dramatically improve, and a 2% yield for this paper is potentially on the menu.

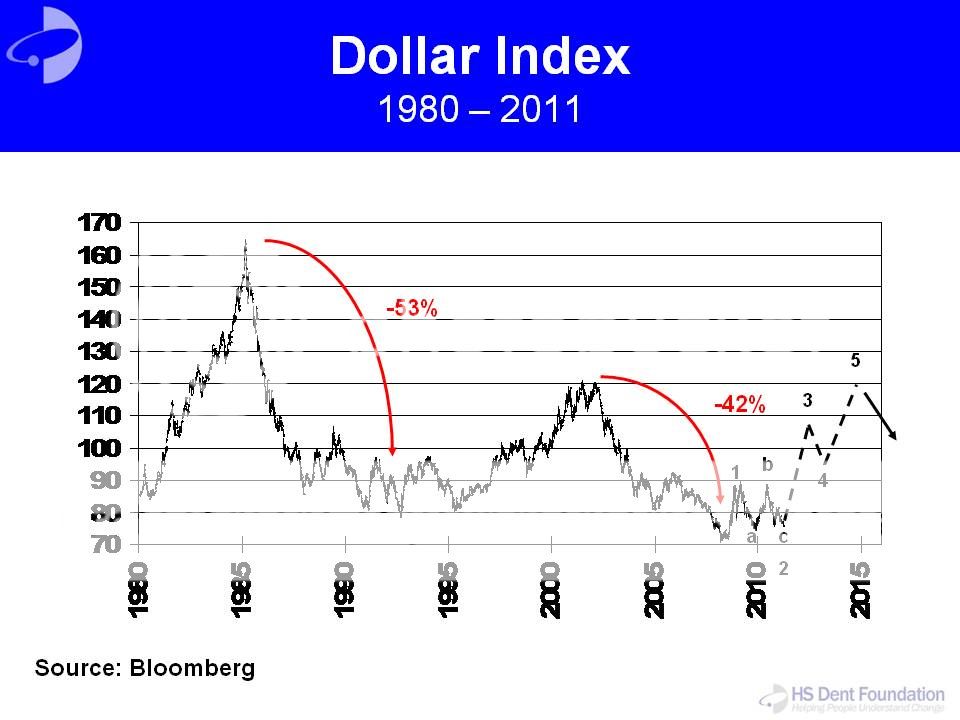

The Dollar. (FEX), (UUP) Just as we are going to see a return of the Treasury bond, the dollar will enjoy a renaissance as well. Harry argues that the collapse of the plethora of asset bubbles we now see will bring a multiyear bull market for the greenback that could take us up 40% from here. That could take the Euro (FXE) down to its foundation level around $0.90. Debt defaults not only create bond shortages, they foster dollar shortages as well.

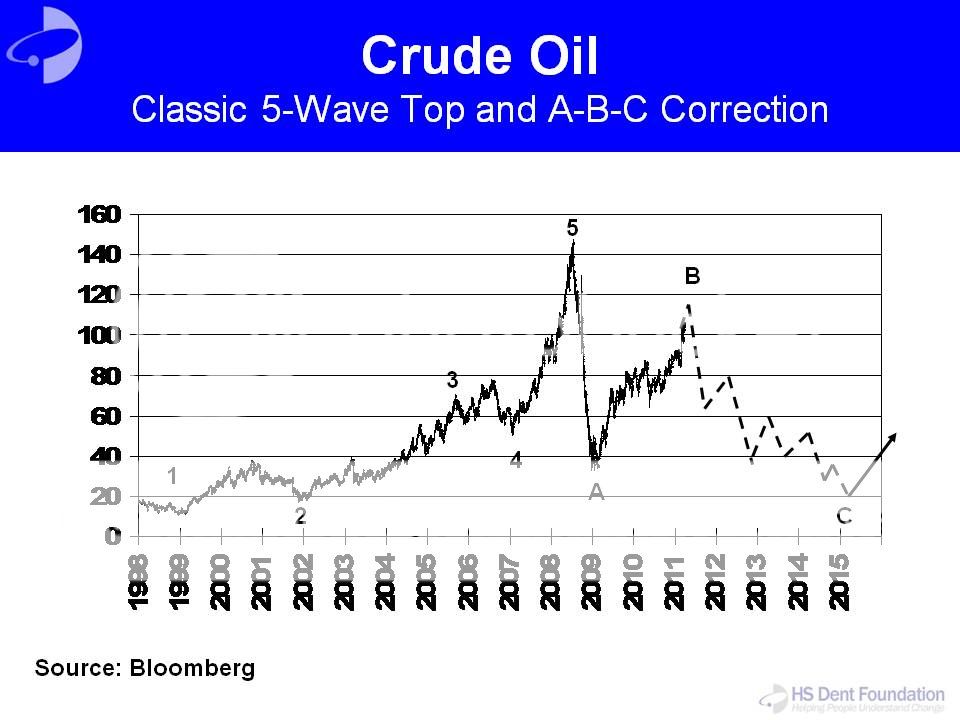

Oil. (USO), (DIG). If there is one commodity not expecting another Great Recession, it is crude oil. Slow the economy more than traders expect, and Texas tea drops in value by half. Strip out the monetary demand from those seeking a dollar alternative, and it halves again. Settle down the Middle East, and it halves a third time. Yes, Harry Dent is predicting that crude will fall from $115 a barrel today (and $128 for Brent), down to $15 by 2015. Yikes!

Precious Metals. (GLD), (SLV) If oil is wearing a toe tag, will gold be far behind? Coming deflation will cut the inflationistas off at the knees. A strong dollar sends those looking for alternatives into the Looney Bin. Take these frills away, and the barbarous relic becomes just a heavy rock that will take it from $1,550 an ounce, down to $250-$400. Gold bugs are about to get doused with insecticide. As for silver? How about a move from $50 to $4-$8?

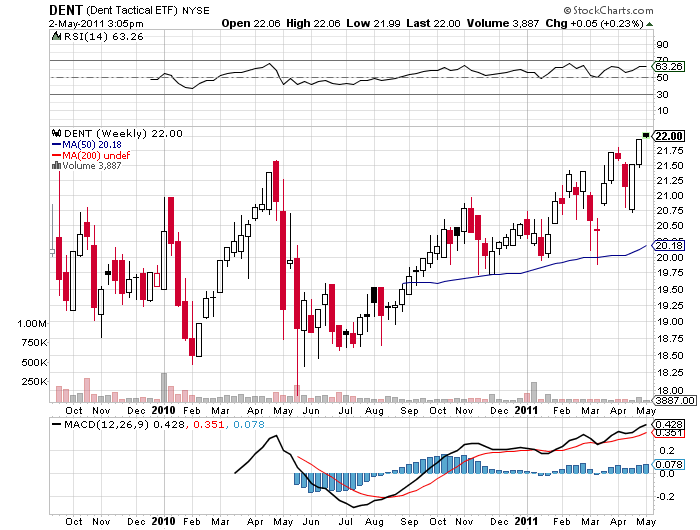

To prove that Harry is willing to put his money where his mouth is, he is advising the Dent Tactical ETF (DENT) which mirrors and executes on his views. The fund is up 20% in the past 12 months.

Harry was originally a 'good ole boy' from South Carolina, who like Federal Reserve governor Ben Bernanke, improbably went off to Harvard where he got his MBA. His career then took him to the top notch management consulting firm, Bain & Co. After years of consulting with Fortune 100 companies, he found gaping holes in their understanding of the global economy. That spurred him to take off and create his own research boutique to address these grievous shortfalls in understanding.

To learn more about Harry S. Dent, please go to his website at http://www.meetharrydent.com/