May 31, 2011 - 'RISK OFF' Takes a Break

Featured Trades: ('RISK OFF' TAKES A BREAK)

2) 'RISK OFF' Takes a Break. If you had to pick a point where the 'RISK OFF' trade takes a short break, it would be right here. One month into the strategy, and virtually all asset classes have hit key points where you would naturally expect some serious resistance, which you never break on the first go around. You may recall that the 'RISK OFF' strategy bets on a rising dollar and bonds, and falling stock, commodities, oil, and precious metals.

Look at the chart below for the (UUP), the dollar long against a basket of currencies. The two year support line we broke in March now becomes upside resistance. Ditto for the chart of the S&P 500, which clearly will not give up the 100 day moving average at 1,314 without a fight.

Furthermore, major trend line support for the big cap index for the rally that has continued since the advent of QE2 talk last August kicks in right here. Will the end of QE2 break that support? My bet is yes.

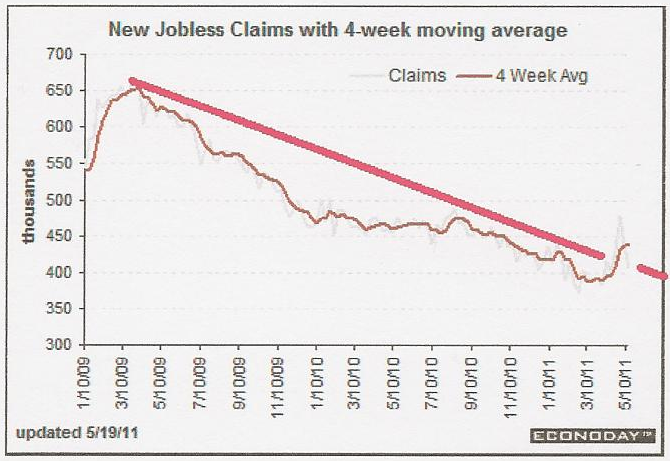

The steady drumbeat of poor economic data released this week suggest that I will be right. Many economists bet that Q1 GDP would get revised up from a pathetic 1.8% to 2% this week. It didn't. The heavy hand of foreclosure spawned high inventories kept new home sales in the basement. How there is anyone left in this industry still amazes me. And the best indicator of all, weekly jobless claims, showed more deterioration with a gain of 10,000 this week.

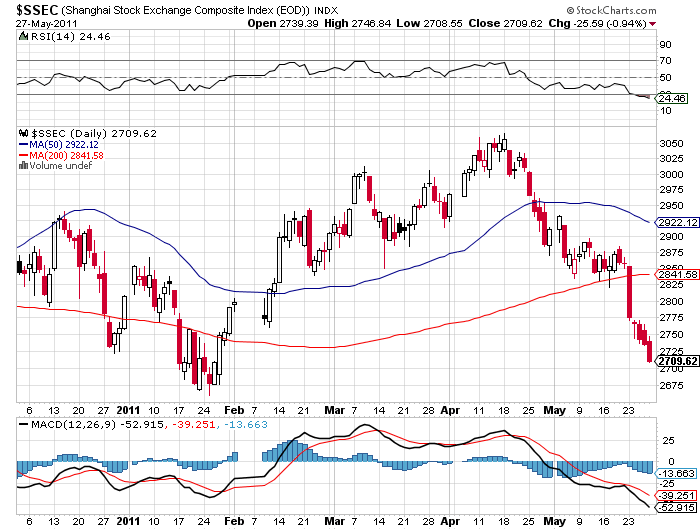

Data from Lipper Analytical Services show that $5.6 billion was withdrawn from equity mutual funds last week. And if you believe that the Shanghai stock market has any predictive power for our markets, they aren't buying this week's rally for one nanosecond.

Sure, it would have been nice to cover all of my shorts at the opening last Monday and resell them on the Friday highs. But my hard earned experience shows that when you try to get too cute like this, you leave the bulk of your gains on the table. June has delivered falling stock markets the last six consecutive years. Shall we shoot for seven, especially when the 800 pound gorilla in the room, QE2, is about to exit? I think so.

But devotees may have to endure a few more days of pain. On May 31 there will be some month end window dressing pushing prices up. Then you get new monthly cash flows on June 1. June 3 brings a May nonfarm payroll that is likely to be strong. The 'RISK OFF' is likely to resume June 6, D-Day.

-

-

-

-

-

The 800 Pound Gorilla is About to Leave the Room

-

I'm Shooting for Seven