May 6, 2011 - A Chat With Charles Biderman of Trim Tabs Research

Featured Trades: (A CHAT WITH CHARLES BIDERMAN OF TRIM TABS RESEARCH)

3) A Chat With Charles Biderman of Trim Tabs Research. Those of us in the research boutique business have long been familiar with Trim Tabs Research, the creation of Charles Biderman.

Trim Tabs tracks in real time the movement of capital into and out of the stock market. It has developed a number of proprietary leading indicators. It uses these to make reliable long term predictions of the direction of stock markets. I know that hedge fund legend, George Soros, uses these methods, with recurring success. Suffice to say that these days, Biderman is pretty negative.

Charles sees fundamentals for both the economy and the stock market deteriorating rapidly. Since the crash began, personal income has fallen from $7 trillion to $6 trillion, and it has yet to recover. How you get a consumer spending recover out of that, is beyond him.

Biderman argues passionately that the Fed is currently rigging all markets. There is an 88% correlation between an expansion of the balance sheet at the Federal Reserve and the S&P 500. Since 2008 that balance sheet has grown from $800 billion to $2.7 trillion. When it flattens out or shrinks, as we are guaranteed after June 30, does the movie run in reverse? If it does, you don't want to be long stocks.

Our current form of government was set up when it took four weeks to ride a horse from Mount Vernon, Virginia to New York City. That's how long it took George Washington to get to his first inauguration. Our inability to reform the system is how we got to a budget that projected $3.6 trillion in spending against $2.1 trillion in revenues. Charles thinks that President Obama will do whatever he has to do to hold the economy together for 18 months when he gets reelected. After that anything can happen.

To learn more about the ever useful products of Trim Tabs Research, please visit their website at http://www.trimtabs.com/global/index.htm .

-

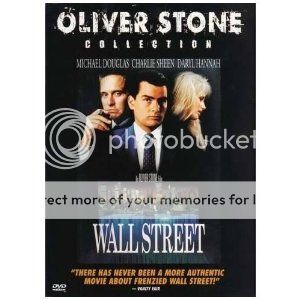

Get Ready to Watch This Movie in Reverse