May 8, 2023

(THE MONDAY BRIEF ACCORDING TO JOHN)

May 8, 2023

Hello everyone,

According to John, the U.S. banking sector may be in for a shake-up in the future.

• It’s the last unconsolidated U.S. industry along with healthcare.

• In the U.S. there are five railroads, four airlines, three trucking companies, three telephone companies & two cell phone providers … and 4000 banks.

• England has five major banks.

• Australia has four major banks.

• Germany has two major banks.

• Do you think the banking system in America could be seen as a bit anachronistic?

•

Much like its federal system where the 50 states run themselves like mini countries.

The U.S. could pivot from 4000 banks to 4 major banks.

And the JPMorgan takeover of First Republic may be the genesis of such a movement.

John boils down the details here:

Look at the details of the (JPM)/(FRC) deal and you will become utterly convinced.

(JPM) bought a $90 billion loan portfolio for 87 cents on the dollar, despite the fact that the actual default rate was under 1%. The FDIC agreed to split losses for five years on residential losses and seven years on commercial ones. The deal is accretive to (JPM) book value and earnings. (JPM) gets an entire wealth management business, lock, stock, and barrel. Indeed, CEO Jamie Diamond was almost embarrassed by what a great deal he got.

It was the deal of the century, a true gift for the ages. If this is the model going forward, you want to load the boat with every big bank share out there.

So, I guess that is a big hint to buy the big banks or at least one of them now or in the future. Perhaps Bank of America could be a good pick – that’s Warren Buffett’s choice. But JPMorgan, Citibank, Wells Fargo – are all good choices too.

The next question to consider here is where are the big banks concentrated?

The East Coast – New York.

So, there will be a transfer of funds out of the Midwest and the South to the coast, which may well collapse local economies because of lack of funding. The west coast will do well because of technology companies churning out large cash flows.

John says the other big story here is:

… the dramatic change in the administration’s antitrust policy. Until now, it has opposed every large merger as an undue concentration of economic power. Then suddenly, the second largest bank merger in history took place on a weekend, and there will be more to come.

John’s performance details …

So far in May, I have managed a modest +0.55% profit. My 2023 year-to-date performance is now at an eye-popping +62.30%. The S&P 500 (SPY) is up only a miniscule +8.40% so far in 2023. My trailing one-year return reached a 15-year high at +120.45% versus -3.67% for the S&P 500.

That brings my 15-year total return to +659.49%. My average annualized return has blasted up to +48.86%, another new high, some 2.79 times the S&P 500 over the same period.

Some 40 of my 43 trades this year have been profitable. My last 20 consecutive trade alerts have been profitable.

John says that…

You Only Need to Buy Seven Stocks This Year, as the rest are going nowhere. That include (AAPL), (GOOGL), (META), (AMZN), (TSLA), (NVDA), (CRM). Watch out when the next rotation broadens out to the rest of the market.

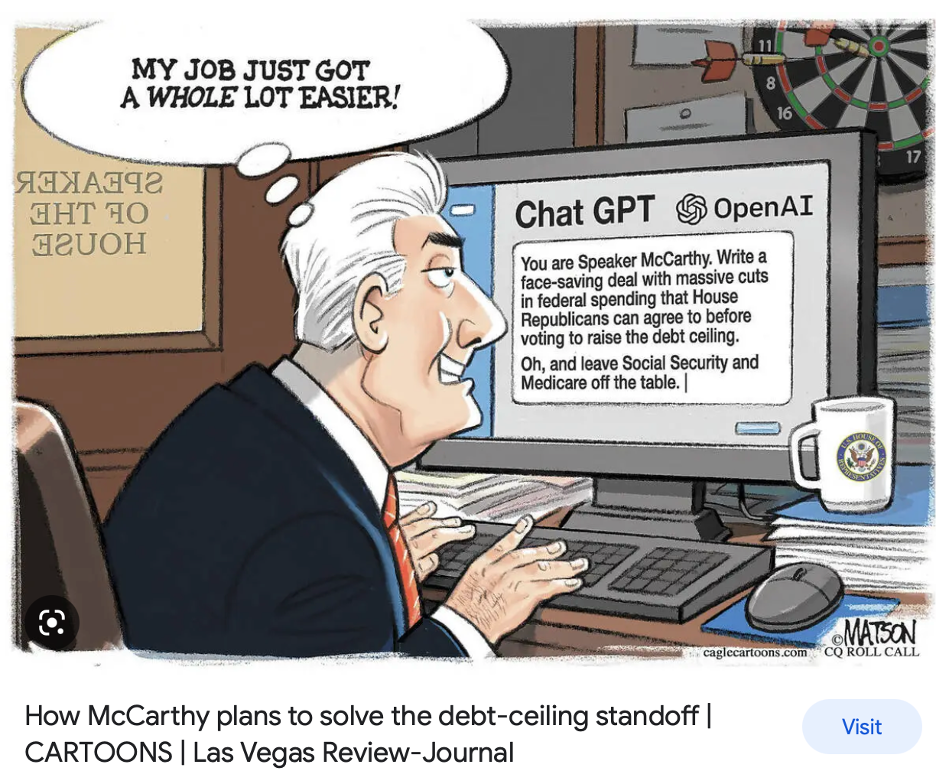

The next drama in the works is the Government Default date which has been moved up to June 1. Expect a lot of people to talk about this endlessly.

What would happen to the market if they didn’t raise the ceiling?

Maybe a 20% dive in the market. Jot it down on a sticky label and paste it to your laptop as a reminder that it could happen, so you can be prepared.

Non-Farm Payroll jumps by 253,000 – further proof that the labour market is still hiring, and AI is creating more jobs than it is destroying keeping the Fed focused on the wrong data.

So, do we conclude that rate hikes are over for now or perhaps we pause for a time and then hike again? (These are my thoughts).

Monday, May 8 – Consumer Inflation Expectations are out.

Wednesday, May 10 – U.S. Inflation rate is printed.

I’ll sign off today with thoughts from Warren Buffett. He held his annual general meeting in Omaha, Nebraska on Saturday.

“It’s been an incredible period for the economy but that’s coming to an end”. Buffett expects earnings at the majority of Berkshire’s operations to fall this year as a long-predicted downturn slows economic activity. Berkshire posted an almost 13% gain in operating earnings to $8.07 billion for the first quarter.

Wishing you all a fantastic week.

Health, wealth, and wisdom to you all.

Cheers,

Jacque