May 5, 2010 - The Leverage Window Just Opened Wider

Featured Trades: (UBR), (UPV), (UMX), (UXJ), (TMV)

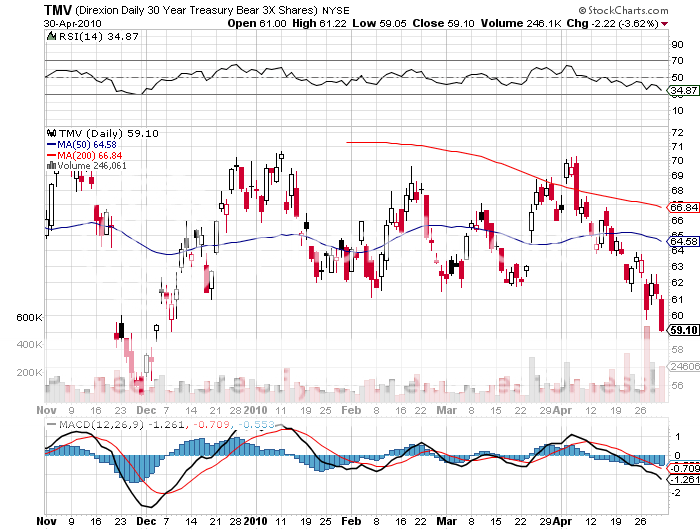

1) The Leverage Window Just Opened Wider. Just as the public debate on risk control gets underway on Capitol Hill, a number of instruments have been launched that will allow unsophisticated retail investors to ramp up their leverage, big time. It's like handing out free fireworks right after your hometown burns down.? Last week, Proshares launched a gaggle of new leveraged ETF's on key benchmark international stock indexes that give individual investors opportunities to bet the ranch in ways they previously never thought possible. They include 200% leveraged long ETF's on Brazil (UBR), Europe (UPV), Mexico (UMX), and the Pacific ex-Japan (UXJ). These funds carry 0.95% expense ratios, rather hefty for index funds. Short versions of these ETF's already trade. While it's great to have a broader range of instruments to trade in the international arena, remember that these are truly double-edged swords. When you're right, the cash pours in; when you're wrong, you hemorrhage dollars like a hemophiliac spills blood. You also have the additional risks of tracking error, poor management, and liquidity. While on this topic, I'll mention another ETF which should carry a surgeon general's warning on every trade ticket, as with a pack of cigarettes. The Direxion Daily 30 Year Treasury Bear 3X ETF (TMV) gives investors a 300% short bet on the long dated Treasury bond. Triple the 4.6% current yield you are shorting and throw in the expense ratio, and long term investors are facing a 15% per annum headwind. Unless the US embarks on a Grecian style default on its debt in the very near future, it will be tough to make money holding this instrument. That is, unless you are a day trader, in which case, the cost of carry is zero. That is surely the purpose for which this potentially toxic instrument was intended.