Mad Hedge Technology Alerts!

Every new bull market in technology brings its excesses, and this time is more different.

Today, I'll outline some of the more egregious cases, which you and your money should avoid like the plague.

Spoiler alert: You are better off just parking your money in Apple (AAPL) or Microsoft (MSFT) and then forgetting about it.

The thirst to own a little sliver of technology in the greatest bull market of all time has reached a fever pitch with capital allocating to marginal assets.

Serious investors need to avoid the madness.

The excess was bred from the realization of how valuable data extraction and generation is to profitability.

The investment climate is reminiscent of the dot-com bubble during the 1990s that spawned companies with no intention of ever turning a profit.

This time, loss-making is blatant.

Ride-share vehicle services such as Uber and Lyft are great at losing money, and passengers would stand aside if prices became exorbitant.

Paying a derisory sum to ride in someone else's car while being chauffeured around is part of the allure of this business model.

The result is an artificially low price for the benefit of consumers amid a vicious price war with competitors.

The biggest problem with these ride-share services is they create nothing.

They are not building a proprietary operating system or creating technology that did not exist before.

Hence, these types of companies execute risky strategies that backfire.

Any technology company that expects to be in the game long term must create something unique and organic that other companies value and cannot copy.

These ride-hailing companies simply use an app on a smartphone, and this smartphone app can be created by any half decent high school app programmer.

Uber lost $4.5 billion in 2017, and that was great news for CEO Dara Khosrowshahi because Uber is losing less than before.

If you thought a tech company glorifying an annual loss of $4.5 billion was strange, then analyzing the state of the ride-share business model for the industry one degree further out on the risk curve will leave you scratching your head.

And by the way, Uber will try to soak your wallet when it launches its initial public offering next year.

Enter dockless ride-sharing bicycles.

Dockless bike-sharing has mushroomed around the world, spreading like wildfire fueled by grotesquely large injections of venture capital.

Ofo, a Chinese firm, initially raised more $1.2 billion and another $866 million from Alibaba (BABA) from a recent round of fundraising. CEO Dai Wei has stated that his company is worth north of $2 billion.

Mobike lured in more than $900 million in venture capital.

China is the epicenter of the bicycle ride-sharing experiment. More than 40 firms have sprouted up creating a bizarre scenario in major Chinese cities because of these companies dumping bicycles on every public street corner.

According to Xinhua News Agency, more than 2.5 million bikes are littered throughout the city by 15 companies in Beijing alone.

Local American firms have jumped on the bandwagon, too, with examples such as LimeBike, based in San Mateo, CA, that raised $12 million from Andreessen Horowitz in 2017, and topped up another $50 million from Coatue Management.

Meanwhile, Spin, the first stationless bikeshare company in the US, raised $8 million led by Grishin Robotics.

More than 40 bike-sharing companies have beat down the price of renting a bicycle to the paltry rate of 1 RMB (renminbi) ($0.15 USD) per 30-minute trip.

The intentional dumping at absurd price levels is not sustainable. The business model is predicated on collecting an initial deposit of $15 before a customer can hop on a bike.

The deposit has proved high risk as some companies have disappeared or gone bust.

Bluegogo, the third leading company in this space, emptied out its headquarters office, locked the doors, and failed to notify employees who claimed their wages had been garnished.

By last count, Bluegogo had distributed roughly 700,000 bicycles, and was estimated to have 20 million users, each paying $15 deposits to use the service.

Bluegogo was considered a legitimate competitor in the space along with Mobike and Ofo.

The $300 million dollars in Bluegogo deposits floated up to money heaven, and the deposits will never be repaid to customers.

Didi Chuxing, China's version of Uber and subsidiary of Tencent and Alibaba (BABA), purchased the bankrupt bike-sharing company, paid the work staff, and slipped them inside its portfolio of emerging tech firms in January 2018.

Mingbike, which failed in Shanghai and Beijing, migrated to emptier pastures in third and fourth tier Chinese cities and sacked 99% of its staff.

All told, $3 billion to $4 billion has been funneled into these bicycle-share monstrosities in the past 18 months.

It gets a lot worse in terms of high risk.

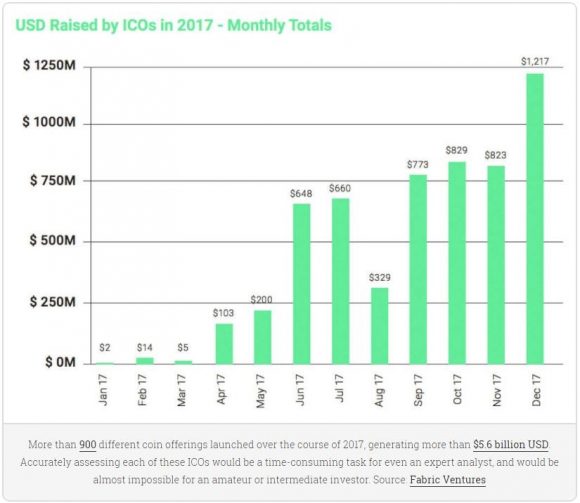

Another frontier of interest that has gone absolutely bananas is the ICO (Initial Coin Offering). ICOs are an unregulated new cryptocurrency venture raising funds by crowdfunding. A certain percentage of coins is sold to early investors in exchange for legal tender or Bitcoin.

This controversial means of raising money is a hotbed for scams galore. Of 1,000 that now exist, maybe 10 are legit.

These criminals are taking advantage of the headline effect of cryptocurrencies, promising every Joe and Jane early retirements and an easy way to provide college funds for children.

It's true that a founder of a cryptocurrency demonstrably benefits financially from leading this new form of payment.

Simply put, these ICOs function as Ponzi schemes with the last one to buy holding the bag when the sushi hits the fan after the founders run for the exits.

These fraudulent ICOs take on some of the characteristics of real Ponzi schemes such as guaranteed profits, promising their blockchain technology will solve all of the world's ills, no detailed roadmap except collecting funds, and lack of an online digital footprint.

Adding to the outsized risk is the confusion of which jurisdiction these companies are in and absence of any proper compliance.

OneCoin was a cryptocurrency promoted by offshore companies OneCoin Ltd (Dubai) and OneLife Network Ltd (Belize), founded by Ruja Ignatova. Many of the shady characters crucial to OneCoin were architects of similar Ponzi schemes, which was a dead giveaway to authorities.

Bulgarian enforcement officials raided and hauled away servers and other sensitive evidence at OneCoin's office in Sofia, Bulgaria, at the request of the prosecutor's office in Bielefeld, Germany.

German police and Europol also busted 14 other companies connected to OneCoin.

OneCoin CEO Ignatova was imprisoned in India for swindling investors after being investigated by Indian authorities in 2017.

The Ministry of Planning and Investment of Vietnam even issued a rebuttal that a forged document OneCoin used as proof to show it was the official licensed cryptocurrency in Vietnam was fake. It stated there was no possibility this document could ever exist.

SEC chairman Jay Clayton recently chimed in after being asked if all ICOs are fraudulent, boldly stating, "Absolutely not."

Uber and Ofo also are not frauds, but that does not mean investors should take a flier on it.

The strength of technology has attracted the marginal character to its doorstep; separating the wheat from the chaff is more important than ever.

These nascent industries can look good in the shop window, and slick advertising campaigns numb our rational decision making, but investors need to stay away at all costs.

The bicycle-sharing industry is a way for cash-rich venture capitalists to hoard data for applications irrespective of operating at a profit. The ICOs are charlatans attracted to the fluid cash flow tech companies command desiring a share in the spoils.

Keep your money in your pockets and wait for my next actionable trade alert.

__________________________________________________________________________________________________

Quote of the Day

"Stay away from it. It's a mirage, basically." - said legendary investor Warren Buffett when asked about cryptocurrency.

Mad Hedge Technology Letter

April 6, 2018

Fiat Lux

Featured Trade:

(THE IMPLICATIONS OF INTEL'S LOST APPLE CONTRACT),

(INTC), (AAPL), (AVGO), (QCOM), (AMD), (NVDA)

There is plenty of turmoil in chip land these days.

Investors should not freak out, or worse, dump their Intel (INTC) shares on pain of death.

Take a deep breath ... and I'll explain why Intel is still a great stock into which you should dip your toes.

Apple (AAPL) reportedly plans to replace Intel processors in Mac computers with its own proprietary chips starting around 2020. It is useless for investors to prognosticate the worst-case scenario playing out because this announcement will not put Intel out of business.

This is not the first phase of the death of Intel and represents a fabulous entry point into a beacon of tech stability.

Apple started placing Intel CPUs into its MacBook Pro and iMac in 2006 and have enjoyed a fruitful relationship since then.

As technology mutates at lightning speed, Apple justifiably desires more control over its chip design to create the innovative end product it envisions and provide a smoother experience between mobile and desktop devices.

Intel's engineers cannot match the pace of Apple's chip improvements that use ARM-based processors, which Apple has stuck into devices using the iOS system, including the Apple Watch and the Apple TV.

Apple's latest gadgets are more powerful than its past Macs, and its future is better served by tailor-making its chip architecture for its devices.

Security will be bolstered by procuring more control over design construction.

Intel still boasts the world's most popular CPU chip line for laptops and desktop computers, and hyper-increasing global demand for silicon chips will fail to disrupt Intel's growth trajectory.

Remember that the CPU chip line is Intel's legacy business, and this lump of the operation will slowly fade away into oblivion anyway.

Apple's top-end computers will still use Intel's chips such as the iMac Pro and Mac Pro revision until they can transition to in-house chips.

This trend has staying power with Apple designing its own iPhone chips partially due to removing its heavy reliance on Qualcomm (QCOM). It also has locked horns in court for years adding tension to the relationship.

On a relative basis, iMacs are just a fragment of the overall laptop market at 7.3% during the fourth quarter of 2017.

Apple's announcement could shed $1.8 billion in annual gross profit from Intel's earnings.

Intel accumulated $62.8 billion in sales in 2017, and losing Apple's business is only a small hiccup in the bigger scheme of things.

In late 2017, Intel poached the former head of AMD's (AMD) graphics business to head up a new high-end graphics division.

Raja Koduri, the new chief architect and senior vice president of the newly formed Core and Visual Computing division at Intel, will enable the company to directly compete with AMD and Nvidia (NVDA) in the GPU market.

The competition with AMD is a big deal because AMD has caught up with Intel and could steal CPU market share.

AMD has built its own comprehensive lineup of PC CPU chips while Intel unveiled its eighth generation Core processors on April 3.

Acquiring new segments with its cash hoard is another way to move forward.

Rumors were rife with reports suggesting Intel would acquire Broadcom (AVGO) to create the biggest chip maker in the world.

This was a defensive maneuver to combat the possible combination of a Broadcom-Qualcomm merger that would damage Intel's market share in chips for mobile phones and cars.

By getting into bed with Broadcom, Intel could scrap the construction of the world's third-largest chipmaker, after Intel itself and Korea's Samsung.

Altera and Mobileye are companies Intel added to its lineup using its egregiously large cash hoard.

Mobileye, an Israeli company, provides advanced driver assistance software that prevents collisions. This purchase clearly bolsters its autonomous vehicle technology division.

Altera, a San Jose, Calif.-based company, manufactures integrated circuits.

Intel is likely to remain the dominant force at the very high end of computing.

It would be foolish to only analyze Intel based on its legacy business as it has veered into a different growth mode and is not just a chip company anymore.

Intel has been weaning itself from the secular downtrend of computer chips and strategically established an unmovable position in the massive cloud data center and server business.

The Data Center Group, Intel's second largest segment and most vital, grew 20% YOY, with $5.6 billion in revenue. Investors must keep close tabs on how this area performs because it is the lynchpin to emerging technologies such as artificial intelligence and 5G in terms of overall infrastructure.

Intel's data center performance represents the harbinger of success, and Intel is doubling down on this future growth driver.

Cloud capital expenditures will rise 30 percent in 2018 because chunks of money must be thrown at this segment to stay relevant from cutthroat competition.

Computing is at an inflection point in 2018. Priorities have rotated to the data-centric phase of development. And Intel's CEO Brian Krzanich, who just received a nice pay rise to $21.5 million per year, will fill us in at Intel's next earnings call on April 26.

To visit Intel's website please click here.

__________________________________________________________________________________________________

Quote of the Day

"Quality is much better than quantity. One home run is much better than two doubles." - said former Apple CEO, Steve Jobs in 2006.