Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

April 5, 2018

Fiat Lux

Featured Trade:

(GOOGLE IS FIRING ON ALL CYLINDERS ... BUY THE DIP),

(GOOGL), (FB), (AMZN), (AAPL), (MSFT)

Google (GOOGL) makes bucket loads of money and even makes Facebook's (FB) business model look dwarfish.

Total revenue in 2017 came in at more than $110 billion, up 23% YOY and almost three times larger than Facebook's annual revenue of $40.65 billion in 2017.

It's easy to comprehend why the big keep getting bigger if you understand the basic trajectory of technology companies.

A new report from the search consulting firm Adthena chronicled the flow of ad dollars into digital e-commerce and found that retailers are spending 76.4% of total ad budget on Google shopping ads.

Last year was a record-breaking year for total digital ad revenue, and this year the industry is slated to grow another 20%.

Young people aren't watching television as they used to and are more comfortable using computers, tablets, and smartphones to gorge on their entertainment and work.

By 2020, digital ads will comprise 44.6% of total ad revenue as cord-cutting by consumers accelerates and broadband streaming becomes the norm across all of America and the world.

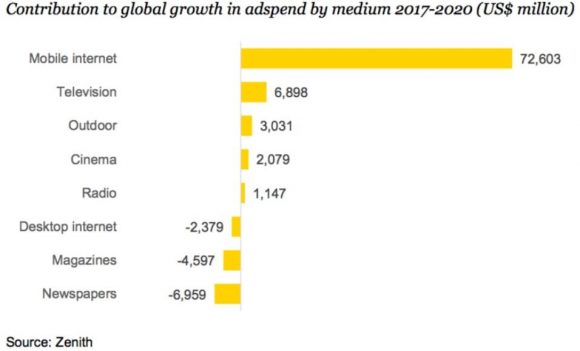

Mobile is the triumphant victor here as the majority of dollars will migrate to smartphone platforms.

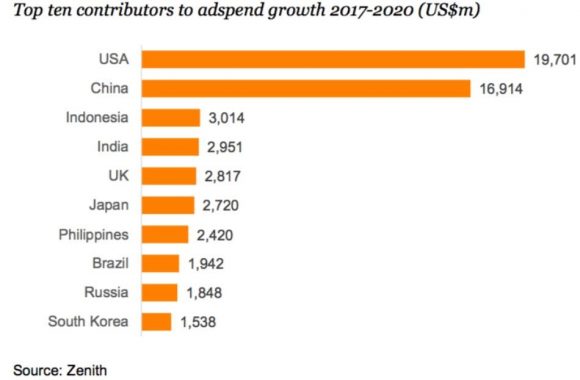

China and America will overwhelmingly make up the bulk of digital ad spend, and Europe will remain a distant third.

Last quarter, Alphabet missed Wall Street expectations on the bottom line failing to reach earnings per share (EPS) targets of $9.98. The $9.70 miss wasn't a total failure but disappointing enough for Alphabet shares to nosedive.

Alphabet has positioned itself perfectly for the future and has many irons in the fire.

Google's ad business remains its go-to segment totaling $27.27 billion in revenue in Q4, a main driver of outperformance.

Cost per click (CPC) decreased slightly less than what analysts expected, but that was the trigger for a quick dip in share prices even though Alphabet beat on the top line.

In total, it is immaterial if Alphabet misses slightly on this metric. And, coincidentally, Alphabet is changing the way it calculates ad fees by switching over to cost per impression (CPI), which charges advertisers for raw viewing of an ad.

This pricing mechanism will create higher margins that slightly suffered last quarter because advertisers now are charged for users not clicking an ad as well.

(CPC) has been eroding for years. Alphabet attributes the slight dip to the widespread migration to mobile and the importance of YouTube ads, which yield lower rates than desktop ads.

Alphabet's "other revenues" segment, including its burgeoning enterprise business, hardware sales, and app store Google Play, posted $4.69 billion in revenue, bringing total Google revenue to $31.91 billion in Q4 2017.

Google search, the premier legacy business in tech, still comprises 85% of total revenue. Crucially, the cash mountain procured aids in capital allocation. Alphabet heavily reinvests back into different parts of the business or M&A.

Certainly, it has laid some eggs such as the Google glasses and its attempt at social media through Google+, which flamed out, too.

Many of these new projects originate from the 20% of work time that is allocated to free-spirited entrepreneurship. This initiative has harvested benefits spawning from Google news and other supplementary projects.

Alphabet's innovative qualities feedback into their core product as well, but management understands it needs to evolve to meet the capricious needs of users.

Google founders Sergey Brin and Larry Page thirst for a fresh injection of vivacity into their business and added several outside valuable pieces that include YouTube, Motorola, and Nest Labs for around $17 billion.

These growth engines will fit nicely under the umbrella of firms that Google has collated.

The cloud segment has become a "billion dollar per quarter business." It is dwarfed by the ad revenue but is still the glue that holds the firm together because of the heavy reliance of big data storage to power its firm.

The cloud is still a small sliver of the business and trails Amazon (AMZN), and Microsoft's (MSFT) cloud businesses, but Google drive cloud platform was "the fastest growing major public cloud provider" in 2017.

Apple (AAPL) has even subcontracted Google to store iPhone data on its Google cloud. I bet you didn't know that.

The cloud will continue to gain momentum for Google. Developing the best search engine in the world makes the company specialists in harvesting data because refining a search engine takes an extraordinary amount of data to fine-tune the user searches to perfection.

There are a few headwinds Alphabet is coping with, predominantly traffic-acquisition costs (TAC) as a percentage of revenue will continue to rise, but the increase in velocity will taper off by mid-2018.

Google's total (TAC), which includes funds it pays to phone manufacturers such as Apple that integrates its services, such as search, hit $6.45 billion, or 24% of Google's advertising revenues.

The rising cost of finding eyeballs will squeeze margins.

Another bogey on the horizon is Amazon's foray into the digital ad sphere. It possesses the quality of data to claw away market share and could damage the comprehensive duopoly that Alphabet enjoys with Facebook.

Large cap tech is competing with each other in almost every critical industry guided by the invisible hand of a massive treasure trove of big data. This is unavoidable.

Alphabet's other gambles such as smart-home hardware maker Nest Labs and health-care company Verily are bets on the future as all big tech firms position themselves to compete in a myriad of emerging industries.

These products aren't expected to harvest profits for years and lost Alphabet a combined $500 million last year.

There are a few companies that are perfectly aligned with the direction of future business and technological development, and Alphabet is one of them.

Whether the autonomous vehicle subsidiary Waymo or its smart-home investment in Nest Labs, Alphabet is diversified into most of the cutting-edge trends moving forward.

If the sushi hits the fan with its up-and-coming segments, Alphabet can always fall back on what it knows best - selling ads.

__________________________________________________________________________________________________

Quote of the Day

"We want Google to be the third half of your brain." - said co-founder of Google and president of Alphabet, Sergey Brin.

Mad Hedge Technology Letter

April 4, 2018

Fiat Lux

Featured Trade:

(SPOTIFY KILLS IT ON LISTING DAY),

(SPOT), (DBX), (GOOGL), (AAPL), (AMZN), (CRM), (NFLX), (FB)