Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

March 22, 2018

Fiat Lux

Featured Trade:

(HOW LAM RESEARCH HAS CORNERED THE MARKET FOR SEMICONDUCTOR MANUFACTURING EQUIPMENT)

(LRCX), (MU)

Micron Technology (MU) is one of the hottest semiconductor stocks of 2018, and the Wafer Fab Equipment (WFE) used to produce the chips comes from Lam Research (LRCX) - a bedrock recommendation of ours for the past several years.

I have been shouting from the mountain tops for investors to not only dip their toe in but dive head first into Lam Research.

The chipmakers are allocating greater funds into WFE to keep pace with the vigorous consumer demand. Micron Technology (MU), Samsung Electronics and SK Hynix each amount to more than 10% of Lam's annual sales.

Overall, Lam's total shipments rose nearly 37% YOY reflecting the thirst for WFE.

The memory segment of 3D NAND flash, which you find in SSDs, flash cards, and arrays, and DRAM constituted 77% of shipments, up 11% from the previous quarter, highlighting the industry's shift to non-volatile memory - meaning big data.

The momentum shows no sign of slowing down. During a recent analyst meeting, Martin Anstice, president and CEO of Lam Research, gushed about expected "record levels" of WFE shipments in 2018. Higher WFE shipments are the most pronounced indicator of promising upcoming earnings results. It doesn't get any better than that.

Lam expects next quarter shipments of $3.175 billion. Gross margins should remain impressive at 46%.

Semiconductor equipment is truly a capital-intensive proposition, and bankrolling strategic R&D programs to maintain a technological edge as well as productivity leadership will continue full speed ahead.

These investments are key to the primary objective of growing at a faster pace relative to the industry.

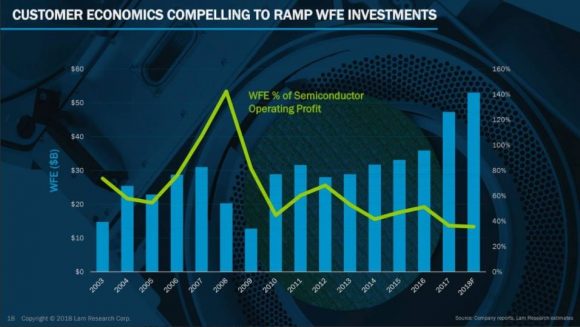

Lam's WFE capital investments in 2017 were a gargantuan $47 billion, up approximately 30% from the prior year. In 2017, 55% of investments leaned primarily toward NAND flash.

Exponential demand for data will support chip business, which includes a vast expansion in the need for silicon for autonomous vehicles, A.I., and the Internet of Things.

None of this could happen without the outperformance of the chipmakers. Lam Research is riding an influx of spending by its chipmaker customers taking advantage of higher ASPs (Average Selling Price) of DRAM chips, used in PCs and servers, and NAND chips, used in smartphones.

Mainstay customer Micron Technology said last month that it expected capital expenditure around $7.5 billion for 2018, up from $5.1 billion in 2017. Record amounts of cash flow allow Micron to double down on technology refinement as it positions itself for the next generation set of chips.

Equipment investment by clients is at a 15-year low as a percentage of profits. Money is raining down on the chip sector, and the economics that scale juice up profit margins to 47.6%.

To add more color, DRAM is the recipient of meaningfully higher levels of investments required to drive similar levels of bit supply growth compared to historical levels.

Lam leads the industry in enhancing performance and bit growth with annual increases in the low 20% for DRAM and high 40% for NAND.

The server phone content in DRAM and the smartphone bit growth for NAND will help facilitate the mass amounts of data going forward.

The average smartphone today has capacity of around 40GB of NAND content, and higher-grade phones have 256GB, and this number will only increase.

Lam's key markets in NANDs are growing faster as customers transition from 64-layers to 96-layer fabrication investments starting late in 2018 and into 2019.

NAND is such a decisive cog in the tech ecosphere that Lam has no choice but to oblige and invest in this space.

Undoubtedly, NAND is probably the poster child for a market with elasticity of demand. The sector adopted new technology and it is scaling it, which will result in relative cost reduction.

Chips with 3D NAND technology are relatively efficient, reducing the cost per GB (gigabyte) of storage and lowering power consumption.

Basically, chip companies won't gobble up Lam's products if the productivity yields are suboptimal, causing Lam to push the envelope with enhanced bit technology.

Carefully planned cost road maps create opportunities to carve out incremental demand for companies such as Micron and Samsung, and enhanced bit performance boost the degree of chip capacity.

Often overlooked but equally relevant is that 25% of Lam's business is perpetuating equipment. For example, it buys back used equipment, refurbishes it, and turns around and sells it as "certified pre-owned," such as a used-car or used computer business. This service side of the business harvests a higher margin than other segments at 75%.

Ultimately, humans live in a world where smart devices require the capacity to store collected data efficiently and cost effectively. Lam's equipment is one small input that goes into inventing these high-performance computing contraptions that create value either in an enterprise or in a consumer context.

The incredible profits amassed have given Lam the impetus to implement an aggressive, broad-based capital allocation policy.

Lam boosted capital returns to a more-than-doubling of the dividend from 50 cents to $1.10 per share per quarter, or $4.40 annually along with another $2 billion in buybacks on top of an existing $2 billion authorization. The catalyst was the US tax reform freeing up $6 billion in overseas cash.

Lastly, Lam expects double-digit growth in overall memory WFE in 2018 combined with annual growth in overall WFE shipments in the low-double-digit percentages. The year 2018 will be a great year for holders of Lam Research stock with no signs of disruption on the horizon.

The shares were up around 300% in the past 16 months and well deserved. The parabolic move is vindicated by sequential earnings' beats, boosting forward guidance and product improvement.

Investors finally realize the precious value in semiconductor companies and the equipment makers. Buy Lam Research on any weakness because entry points are few and far between.

__________________________________________________________________________________________________

Quote of the Day

"Jeff Bezos is opening a retail store and owns a newspaper. Turns out everything we thought about the Internet is wrong." - Aaron Levie, the co-founder and CEO of Box.

Mad Hedge Technology Letter

March 21, 2018

Fiat Lux

Featured Trade:

(HOW THE FANGS WILL MAKE A KILLING ON NEW GOVERNMENT REGULATION)

(FB), (GOOGL), (BIDU), (BABA)