Mad Hedge Technology Alerts!

Is the $1 billion Amazon (AMZN) just spent for a doorbell company ludicrous, or genius? This question becomes incredibly pertinent as the battle for the front door heats up.

Transcending cultures since the time of antiquity, a door is a portal to a man's kingdom, his inner space.

Doors were first used inside Egyptian tombs some 5,000 years ago, and the Roman god Janus was the overseer of doors long before Jeff Bezos came along. Doors still continue to encapsulate beginnings, endings, transitions, and time.

A door is first and foremost an entrance. A potential entrance for Amazon to capture market share before the rules of the road are set.

Once entering the main door, hallways are linked with other rooms and other doors that lead to other worlds, which Amazon will pursue once they enter the home.

An open door represents the future and opportunity for a new market. A locked door typifies failure, rejection, and imprisonment. Amazon has created a $700 billion business that stops right outside your door. It's time for them to take the next step.

What would be the monetizing synergies if consumers offer access to that front door and Amazon slowly moves deeper into the house?

The goal is to remove any layers, material or psychological, that stands between Amazon profits and customers.

The door must be beaten down, and convincing consumers its permissible to enter the family sanctuary could fuel another round of tech prosperity and hyper- accelerating tech integration into daily lives.

It is fundamentally impossible to live a practical life in 2018 with analog instruments such as quaint pencil and paper. Consumers are increasingly addicted to technology, and future business applications revolve around harnessing tech acumen which cannot be rooted out retroactively.

The FOMO (Fear of Missing out) phenomenon that has gripped the business world is putting a turbocharger on this trend.

Remember that big tech companies aren't regulated like normal companies and have a built-in license to destroy any industry they desire.

This is immensely bullish for tech stocks. Regulation just cannot keep up. Tech companies believe that they should not be liable or accountable for any unintended consequences. Witness the Russia affair.

By contrast, media companies are harshly regulated by the government, and their content is subject to intense scrutiny. Remember Janet Jackson's infamous "wardrobe malfunction" at the Super Bowl? Unfortunately, media companies do not receive a free pass like the FANG's.

The FANG's free pass has put the family abode directly in the firing line. Alphabet (GOOGL) understands this to full effect; the new $229 Nest Doorbell will be distributed with a free Google Home Mini this spring.

Google Nest was purchased for $3.2 billion in 2014, and was launched by former Apple (AAPL) engineers Tony Fadell and Matt Rogers.

Google Nest has been accused by Ring CEO Jamie Siminoff of stealing their product innovation. Ring is the distinct best of breed in this industry and complements Amazon Key, which automatically opens doors for verified delivery workers.

This was the first adventure into this space by CEO and founder Jeff Bezos and supplements Amazon's Alexa which can cross-integrate with 3rd party devices in over 35,000 unique ways.

In a world where the demarcation of ecosystem lines are clearer and clearer by the day, the FANG's are seducing users into a proprietary closed ecosystem and padlocking anyone that is currently inside.

Facebook (FB) and Google do not sell anything, they just want user time, especially platform user time, to accumulate data to hawk ads to advertisers.

Apple, which does sell something physical, wants customers to buy iPhones, HomePods, and pay for its mish mash of services that integrate under the umbrella of the Apple smart home.

The FANG's have similar yet competing strategies. It is unknown how fast homes will become smart, as we are in the first stage of smartification. But there are a certain set of battleground products such as smart locks, thermostats and security cameras already.

Thermostats are easy to use, and various firms contribute energy rebates for thermostats upgrades.

The $1 billion spent on Ring, or Google's $3.2 billion tab for Nest Labs are FANG's intent to take a major stab at overtaking the place you sleep at night by making it socially acceptable for corporate tech to venture and operate inside houses.

The goal is to create a seamless, automated, enjoyable experience all on one pay tab called the smart home. After a consumer buys multiple products from the same tech company, they investigate further how to connect and integrate all these offerings together.

Thus, the tech climate fiercely focuses on admission into a new ecosystem by any means necessary.

If Amazon can seize the house, it will seize everything that is inside.

Smart homes will not work if the smattering of products and services derive from all different makers. You have to choose a common platform.

Unsurprisingly, home security companies sold off on this news, and this new trend has thrown a spanner into the works for firms such as ADT Inc. (ADT) who have curated a 30% market share. They are the first on the chopping block.

This Boca Raton, Florida company specializes in offering security to residential and small business enterprises. They possess far more weight in the industry compared to rivals Johnson Controls International (JCI) and private firm Vivint.

ADT went public in January 2018 and expected to garner a price of $17-$19. ADT is trading below $11 today. Some of the headwinds analysts have previously mentioned are "increased competition", but nobody thought competition would come in the form of the most powerful company ever to be created in the history of mankind - Amazon. Ouch!

Ironically, in January 2016, Vivint, formerly known as??APX Alarm Security Solutions Inc, agreed to cooperate with Amazon and Nest. Vivint Element team is working on its own smart thermostat and the Vivint Ping Camera for front doors.

This is not a coincidence and the mutual connectivity in tech is everywhere. There are fewer degrees of separation between companies and industries than ever before.

Everyone is overlapping to the point where Amazon refuses to sell Google Nest products on its interface and Google stripping YouTube from all Amazon streaming devices. The more successful these smaller players become, the greater chance of a takeover by a more liquid player.

The FANG's have become juggernauts and any remnant of competition is undercut before it can become a threat and neatly placed under the umbrella of their greater visions.

This strategy has been rampant with botched attempts like Mark Zuckerberg's failed purchase of Snapchat (SNAP) for $3 billion in 2013 and Yahoo's failed buy of Facebook for $1 billion in 2006, just before Zuckerberg launched the fabled news feed.

Even though Vivint is not owned by a FANG, Blackstone Group acquired them for more than $2 billion in 2012.

If you look back in time, Amazon should have never become Amazon. Walmart should have bought it before it gained any traction. Same goes for search - Yahoo should have bought out Google before it became Google. Such is the incredible value of 20/20 hindsight.

Siminoff's Ring is now part of Amazon's death star. Ultimately, if doors are associated with privacy and protection and Amazon can successfully maneuver around these certain sensitive elements, its share will go ballistic.

Is That Google Watching?

Mad Hedge Technology Letter

March 5, 2018

Fiat Lux

Featured Trade:

(IS THERE A TURNAROUND PLAY AT WESTERN DIGITAL?),

(WDC), (MSFT), (NVDA), (STX), (INTC), (CSCO), (SNAP), (GPRO), (APRN), (CRM), (NFLX)

There is a new investment theme that is starting to permeate Silicon Valley.

It hasn't gone mainstream yet but is starting to attract attention because of the spectacular numbers it will bring in.

I call it the "Legacy Turnaround Play."

It goes something like this. Find an ailing technology dinosaur from the Jurassic Period (i.e. the 1990's), infuse it with new management and technology, and the shares go ballistic.

The poster boy for the strategy is none other than the former beast of Redmond, Washington, Microsoft (MSFT), founded by my friends Bill Gates, and the company supervising adult, Paul Allen.

Up until the Dotcom bust, it looked like Microsoft would rule the universe forever. Almost two decades later, its Windows operating system still runs 70% of the world's computers.

The day Bill Gates retired from active management was the day (MSFT) went ex-growth. Steve Ballmer was never more than the custodian of a gigantic legacy business that went nowhere. The shares remained stuck in the doldrums for 15 years.

Also on that fateful day the Gates Foundation sold the bulk of its Microsoft shares, investing tens of billions of dollars into US Treasury bonds. I know this because I reviewed the fund's holding many years ago. It was one of the wisest investment decisions ever made.

Steve Ballmer mercifully retired in 2014, hiring Satya Nadella to replace him. The pick was controversial at the time because Nadella hailed from India.

However, he possessed a vision of The Cloud that was way ahead of its time and proved dead on correct. Since Nadella joined Microsoft, the shares have rocketed some 163%.

This has spurred a frantic search for the next Microsoft, and every legacy tech company is being put under a microscope to ascertain its possibilities.

Intel (INTC) and Cisco Systems (CSCO) are now in the running for "Legacy Turnaround" status, and their share prices are reacting accordingly.

The Silicon valley jungle telegraph has told me that another firm may be about to join its ranks.

That would be Western Digital (WDC). However, the burden of proof is still on the company's management.

You all remember the old Western Digital. Spun off from Emerson Electric Company, Western Digital was the world's largest manufacturer of chips for hand held calculators during the 1970s, the cutting-edge consumer technology product of its day. When the personal computer industry showed up, it moved rapidly into hard drives.

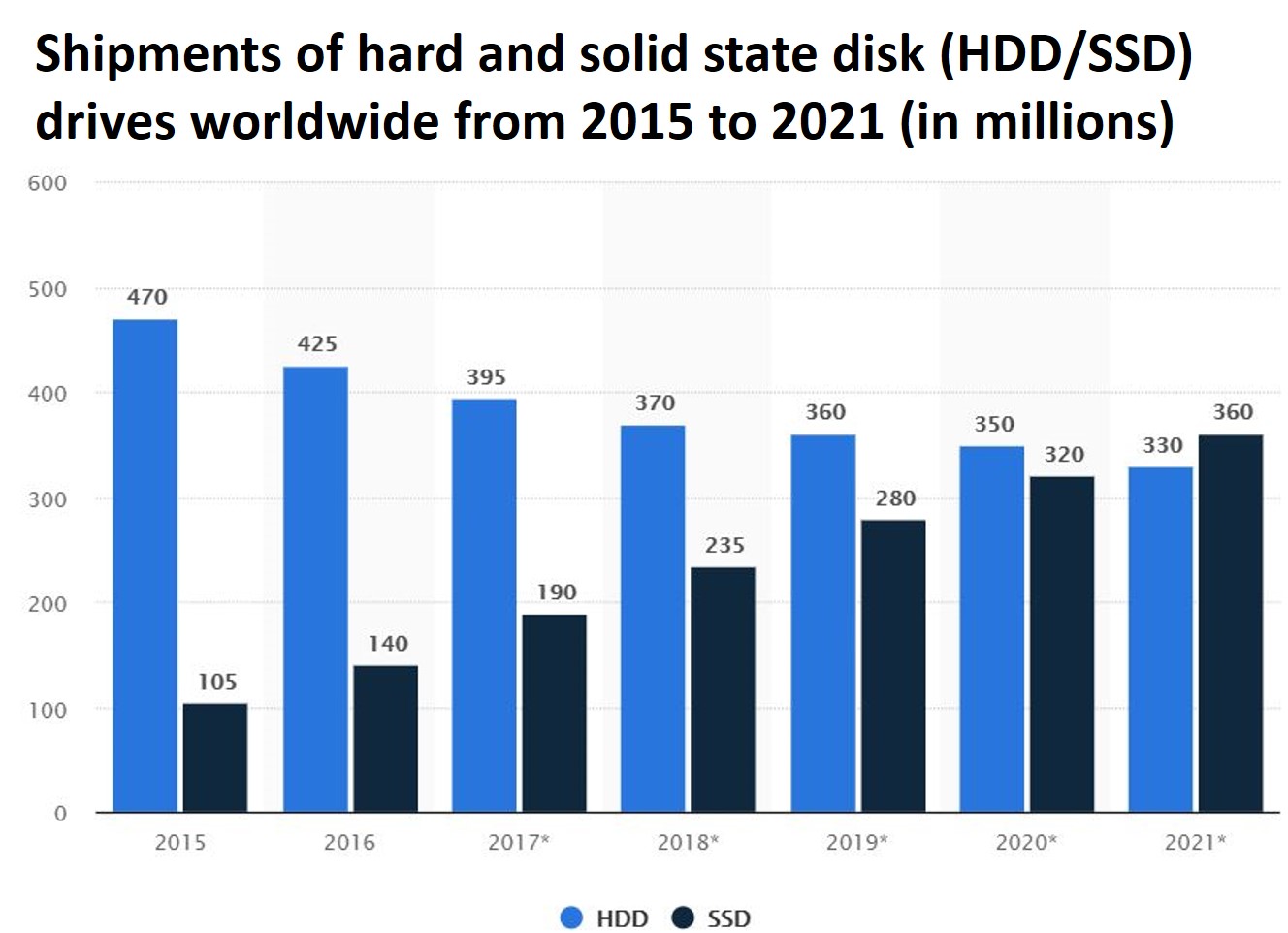

Since then, it hasn't really done anything new, except build bigger and faster hard drives in physically smaller sizes. The problem with that approached is that the world has been moving towards solid state storage now for years.

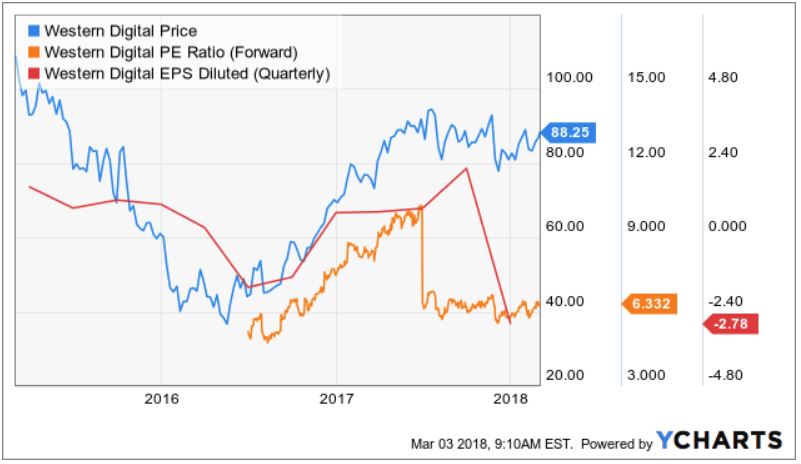

The hard drive is about to become one of the great dodo birds in the history of technology. Western Digital's shares are virtually unchanged in three years, completely missing the 2016-2018- tech melt up.

You can forget about buying Western Digital (WDC) for a quick-in-and out trade. HDD (Hard Disk Drive) sales are down a dreadful 5.6% YOY.

It was hard to identify a tech stock that didn't have a phenomenal year in 2017 unless it was tainted with terrible offerings like Snapchat (SNAP). The secular long-term growth story for technology is the crux of the bullish argument in equities.

A good chunk of Western Digital's business is derived from the declining HDD storage industry which is a continuing source of torment.

(WDC) is attempting to cross over into SSD (Solid State Drives) which is ripe for hyper-growth in tech storage. Gobbling up SanDisk in 2016 and Tegile Systems in 2017 were definitely positive steps in the right direction.

In 2014, HDD was a pristine $32 billion per year market, but sunk to $20 billion by 2017.

Begrudgingly, (WDC) dominate 40% of the HDD market along with Seagate (STX) who also control roughly 40% of market share.

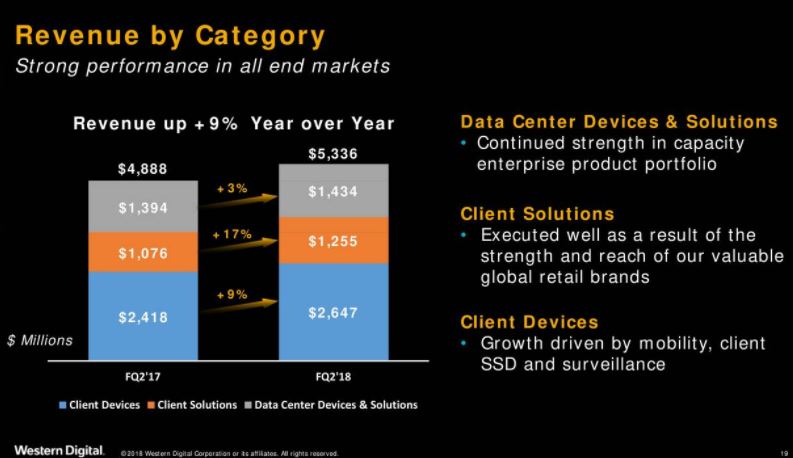

HDD revenues still comprise the biggest portion of WDC's total revenue.

Once that number shrinks down to 30-35% then a resurgence in the stock could be in the cards and management can start beating the drums of resuscitation.

(WDC) sold off hard after last quarter's earnings first and foremost because of the bitter tussle with Toshiba who is mired in years of chaotic management and mislead investors.

Traders dumped the stock after finding out guidance for earnings per share between $3.20 and $3.30 down from the previous quarter of $3.95.

Making matter worse, (WDC) lost over $800 million last quarter. (WDC) undeniably have a few dilemmas to solve.

Contrarians can argue that (WDC) is cheap on a PE multiple basis. However, (WDC) has been cheap for the last 10 years with no multiple expansion and could still be cheap 10 years from now.

This company has shown zero EPS growth. There is a difference between cheap and great value.

Client Devices revenue for the December quarter increased by 9% YOY, primarily driven by significant growth in SSD's. Their Client Devices segment was down 1% QOQ because of the heavy drag of HDD devices.

One warning sign is how management obscures revenue segments by "client devices" instead of filtering them out into separate categories in the earnings report clearly stating SSD and HDD unit sales.

Management is inherently camouflaging the HDD segment headwinds. It appears less harsh to the novice investor to group HDD weakness with SSD strength.

Data has been created at a record rate worldwide and the value of data is increasingly fueled by advancements in mobile, cloud computing, artificial intelligence and the (IoT) Internet of Things.

The intense growth in data is ramping up demand for larger and more reliable storage infrastructure. To be on the wrong side of this momentum is a death knell especially if you consider tech investors are willing to pay such a premium for growth.

Unfortunately, Western Digital (WDC) utterly fails because it's eggs are in the wrong basket and there is no growth story. The rhetoric is mainly a legacy business that must worry about survival even though revenues are increasing and during a climate of global synchronized growth.

Investors love tech but only the right tech. The wrong tech are companies such as Gopro (GPRO), Blue Apron (APRN), or the Footlocker (FL) of video games, GameStop Corp. (GME) have defective fundamental pillars that should be discarded right away.

The growth percolating in the pipelines is across the board but not in legacy tech dinosaurs with a deficient business model.

The guidance for total gross margin next quarter is 42% to 43%, and although quite healthy, analysts believe margin growth has peaked and further improvement in total revenue is limited.

There are better options in technology with more exciting charts and clear-cut growth stories like Netflix (NFLX), which sport a parabolic chart and a long runway.

Tech is the poster child of growth, and any tech company not growing is not worth investing in.

There is a chance that (WDC) has put in a double top adding to the technically bearish sentiment.

If you look at the rest of your portfolio of tech names we have recommended they are most likely higher probability longs.

Even if you analyze a broad swath of tech from software services such as Salesforce (CRM) to hardware products like NVIDIA (NVDA), accelerating users/units and higher revenue with secular growth is the constant variable.

There is opportunity cost of owning stocks that are falling in a rising market. Stay out of Western Digital until positive clues surface concerning the turnaround.

And especially stay out (WDC) until there is visible momentum and incontestable technical support.

Remember that great companies beat on the bottom and top line sequentially then confidently raise guidance. (WDC) is not a great company, not yet anyway.