Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

February 12, 2018

Fiat Lux

Featured Trade:

(DON'T FALL INTO THE SNAP TRAP),

(SNAP), (FB), (GOOGL), (AMZN)

It is often said that the best performance of a share price is triggered when the fundamentals go from awful to merely terrible.

That has certainly been the case for long suffering SNAP (SNAP), which delivered one of the best performing stocks in an otherwise disastrous market last week, up an amazing 37%.

You can thank this ballistic move due to a surprise report delivering earnings of 12 cents a share, the first ever for the company. The company added 9 million daily users, taking their total to 187 million. The number of adds place rose by 400%.

So much for the silver lining. Now for the cloud.

SNAP is a minnow attempting to swim in an ocean filled with sharks and whales, like Alphabet (GOOGL), and Amazon (AMZN).

Ad prices fell by 70%. SNAP is expected to continue to lose money through 2021. What's worse, Facebook (FB) is about to eat their lunch, appetizer, entree, and dessert in all.

SNAP was one of the preeminent IPO disasters of 2017. It launched in March at $17 and then soared 44% on the first day to $29. It then collapsed to a low of $11.40, off a heartbreaking 60.68%. It was a classic case of investment banker incompetence, greed, and mispricing.

Snapchat, wildly popular with adolescents and young adults, is a social networking platform that took off when it debuted on NYSE in March 2017.

Based on photos and videos clips the user can "snap" and send to other users, only to disappear after viewing, this innovation allowed the young people of the world access to the ultimate social media dream: a quick and convenient way of documenting every waking moment of their lives (generally through the smartphone app).

Sadly, the exuberance was short lived.

Snapchat was the most accurate description of a technology laggard in 2017.

Imitation is the sincerest form of flattery and understanding the machinations at a technical level with give us more color.

The addition of a new feature, giving users the option of adding snaps to their "story", a chronological account of their day vanishing in 24 hours, seemingly caught the attention of other big players who were taking careful tabs on this progress.

Facebook (FB) seamlessly cloned the same core features responsible for Snapchat's (or Snap Inc.) rise to fame.

Modern-day tech is made up of unique networks that are often difficult to build; once built and scaled efficiently, however, the reach cannot be replicated.

Gaining eyeballs is what feeds Snap's success. As Facebook and it's daughter companies systematically mimic its best features, user preference to stay within the familiar Facebook ecosystem, rather than venturing into the unknown, has become more evident.

Facebook's Instagram will continue to position itself accordingly as competitors in the tech space start to cannibalize each other for user attention. This is definitely not a "rising tide lifts all boats" scenario. There are winners and losers in this game, and Snap's direct rivalry with Instagram doesn't make its prospects look good.

2018 marks a key year for Facebook; protecting the core user experience will be vital for harvesting user trust in the arena. This natural evolution has forced Facebook CEO Mark Zuckerberg to prioritize personal networks over brute commerce.

We can expect a short term hit to ad load, but an offset by improved quality user experience in the long term. Spinning off new ideas, fluid integration, and brisk execution illustrates the ability of Facebook management teams to adapt and reload.

Granted, Snapchat had a late start, a factor partly responsible for their showing up to a shootout with a butter knife. All the same, the daunting Instagram challenge seems grim because the digital ad duopoly is hard to disrupt and if their DAU growth is already this unimpressive then watch out below!

Tech titans plow a substantial portion of their cash back into developing their user experience, which is critical to engaging active users, stabilizing ad pricing, and increasing ad load. In short, it's an arduous task for Snap to compete with Instagram's unlimited resources.

M&A has taken hold in the tech world, with the behemoths identifying companies that would exhibit synergies fitting into their ecosystems; cash is certainly not a problem.

Examples are rampant: Amazon's purchase of Whole Foods, Facebook's purchase of Oculus Rift, etc. In cases where Goliath doesn't buy David out, he crushes him under relentless competition.

This means that even if Snap improves its user experience, Facebook can mobilize its developers to replicate these functions almost instantaneously, throttling any hope of making a comeback by moving in a different direction.

Snapchat is in the midst of rolling out a major redesign of its platform to commercialize their product, but does it matter? Facebook will simply take the best parts of the new redesign and integrate it into Instagram as free innovation.

Nor does it help that many companies felt it unnecessary to buy ads on Snap when Facebook and Instagram have more user engagement follow through and over 2 billion active daily users.

That's the game today: have the technology to imitate competitors and trap users inside an ecosystem; hyper-improve the experience, and any and every click of the mouse benefits the bottom line through data analytics, ads, and sales.

As the tech space has matured, the juggernauts have realized that speed and agility will help them offer a better user experience, regardless of where the innovation comes from.

Inevitably, Facebook ad pricing will rise due to less inventory, and this short squeeze will drive growth in earnings. Facebook ad offerings are, in effect, an auction and the price can be bid up. Any company that cannot afford Facebook's rates can logically migrate to Instagram where the pricing is a level lower and geared to a younger audience with lower spending power.

Simple supply and demand will exacerbate competition for these ads like the San Jose housing market. At the same time, it's unsurprising that the Snap revenue estimates have been guided lower and lower and actually there is no guidance for Q1 2018 while Facebook's revenue accelerates. This is not coincidence. Don't forget that a stock is worthy of your undivided attention if it sequentially beats earnings and raises revenue consistently like Nvidia (NVDA).

Snap catastrophically fails at the two most important metrics for tech growth companies: daily active user growth and accelerated revenue growth. Q4 2017 was a transition quarter but the odds are asymmetrically stacked against them.

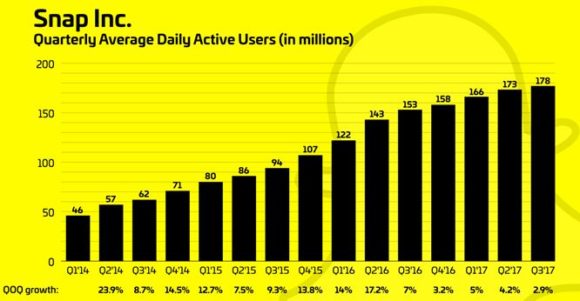

The torrid equity strength in the first month of the year failed to include Snap, while interest rate-sensitive stocks and large tech stocks skyrocketed. Moreover, Snap's daily active user growth has flattened like a pancake to 2.9% in Q3 2017 and Q4 showed anemic increases allowing the Mad Hedge Fund Trader to paint Snap as transitional at best.

With marginal stocks typically being victim to the steepest and swiftest declines, expect that if the market rolls over and consolidates further, Snap may likely be bludgeoned into nonexistence.

For Facebook, on the other hand, the only downside is they may need to start coming up with their own innovations.

Avoid SNAP. If you own SNAP get rid of it, and thank the heavens it spiked on earnings which gave traders a perfect exit point for Snap. After the broad market correction has run its course, Snap will not be the torchbearer of the next gap up. If you are looking for a Snap like replacement in your portfolio then Twitter (TWTR) would fit like a glove.

Global Market Comments

February 8, 2018

Fiat Lux

Featured Trade:

(SALESFORCE POWERS ON),

(CRM), (FB), (MSFT), (GOOGL), (AAPL)