Mad Hedge Technology Alerts!

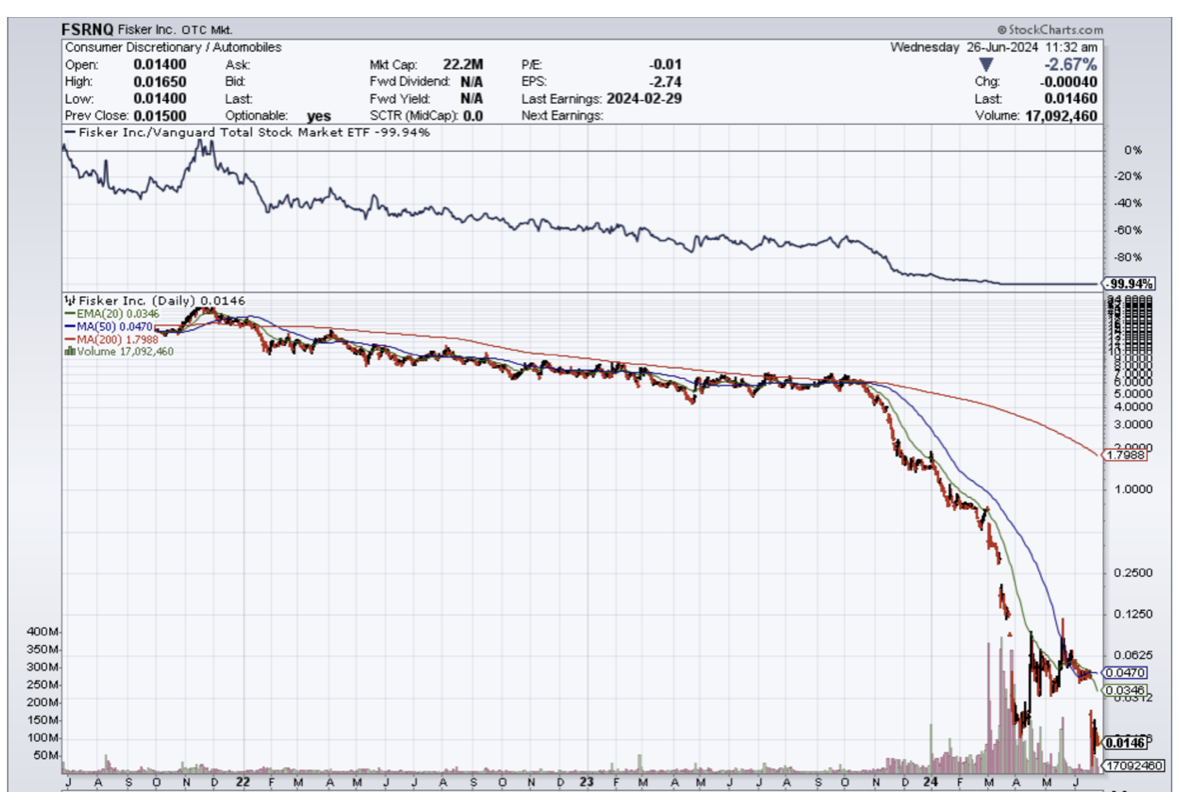

Fisker (FSRNQ) is bankrupt and I can tell you that I am not surprised.

The sushi has hit the fan.

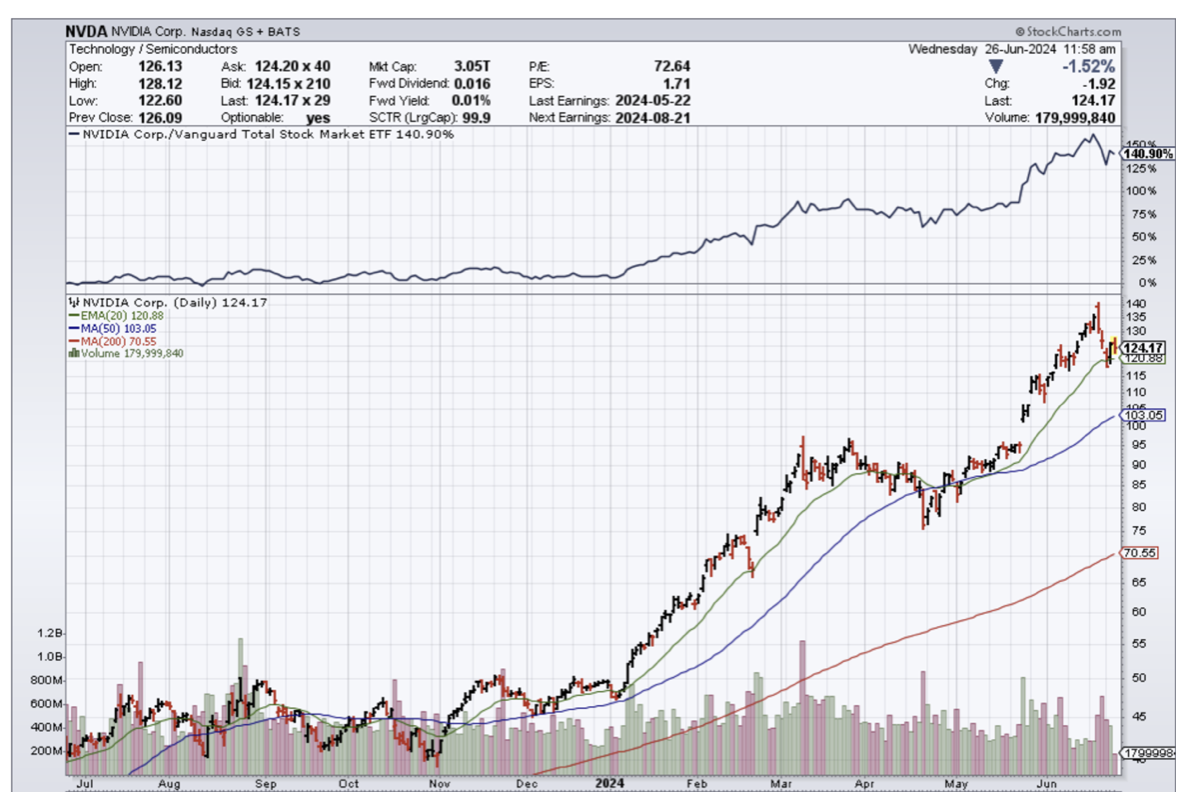

The non-Nvidia (NVDA) tech firms minus big tech are really having a tough time staying liquid and dare I might say profitable.

Many already knew Fisker was in trouble.

They also have a terrible car which doesn’t help its case.

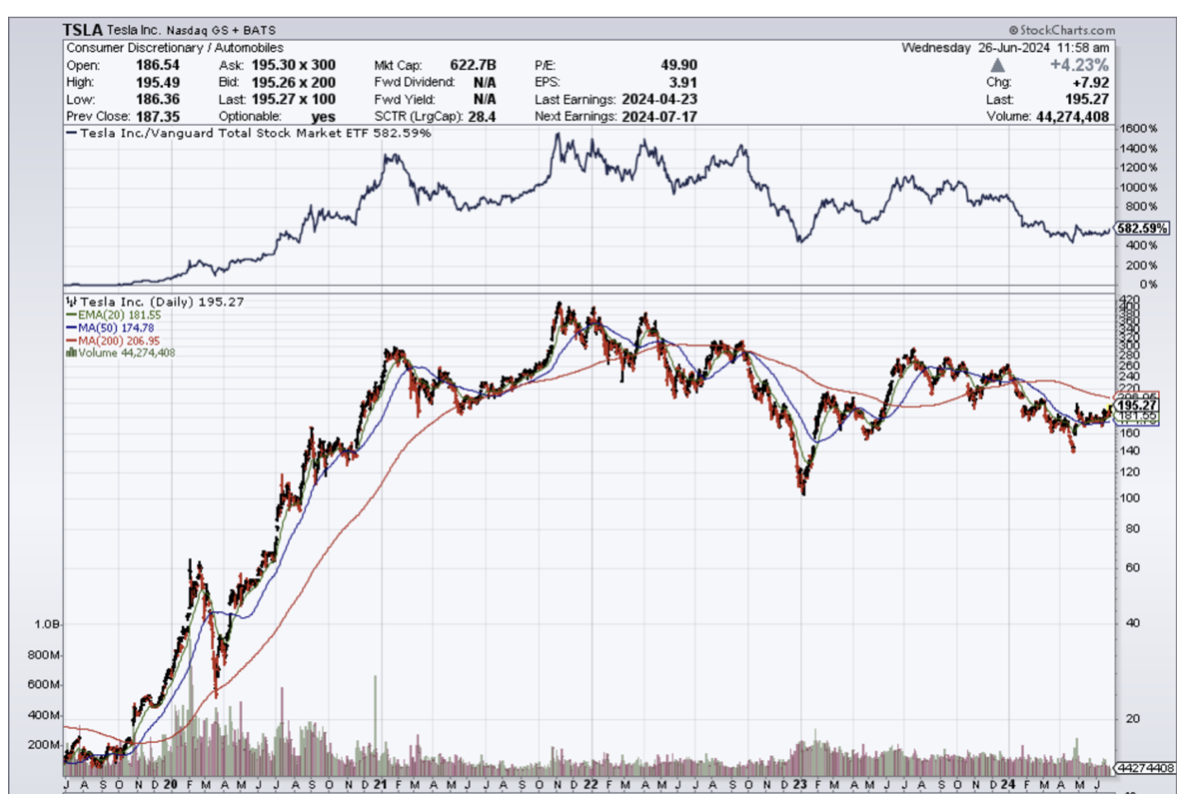

If Tesla (TSLA) is having a hard time selling EVs then imagine what it is like for Fisker to sell an utter clunker.

FSRNQ’s car has been coined as the worst EV on the market by many prominent bloggers.

Fisker management told us they might run out of cash before 2024 is over.

Definitely not shareholders like to hear in an industry that is looking more like a race to zero than an industry able to price itself at a premium.

I believe many car executives are ruing the fact of the multi-decade knowledge transfer to the Chinese about building quality cars.

How do we take tabs of the situation at Fisker?

It only sells one car called the Fisker Ocean electric SUV. Last year, around 10,000 of the SUVs were made but only about half had been delivered to customers.

In a recent interview with Automotive News, the company’s founder and CEO Henrik Fisker admitted that the Ocean had quality problems. He blamed the issues on software from different suppliers that worked poorly together and said they were being addressed through updates.

Worldwide sales of plug-in vehicles could rise 21% this year, which represents a smaller rise than the 35% increase in 2023.

The company listed between $500 million and $1 billion of assets, and between $100 million and $500 million of liabilities, in its petition filed in Delaware. The filing protects Fisker from creditors while it works out a plan to repay them.

While Fisker Ocean sport utility vehicle production started on schedule in November 2022, the first SUVs lacked basic features including cruise control. The California-based company told customers it would deploy capabilities it had promised them the following year, via over-the-air software updates.

Fisker produced 10,193 Oceans last year but delivered only 4,929 vehicles to customers.

Fisker follows a handful of other EV startups into bankruptcy, including Charge Enterprises, the installer of EV charging stations that filed for Chapter 11 protection in March. Other EV makers that have filed for bankruptcy include Lordstown Motors, Proterra and Electric Last Mile Solutions.

Anecdotally, EVs didn’t calculate properly how difficult it is to convince the 2nd wave of buyers.

For example, everyone in my family that will buy an EV has already bought one.

One Gen Z relative of mine swears he will never buy an EV because it doesn’t amount to more than a “toy car” with a battery that needs to be plugged in. He prefers a Ferrari or a Maserati where he can hear the engine roar. There is a high chance he will never be persuaded to buy an EV or if he does get persuaded, it will take 10-20 years for him to come around.

That is what EV makers face in bringing forward the next buyer.

Therefore, look at the bottom of the barrel EV production, they are all facing Chapter 11 and this is just the beginning.

Fisker’s share price peaked at around $30 per share in 2021 and now shares trade at $.02 per share. I would not buy the stock even at these levels.

Tesla’s halving of its share price also most likely means it is fairly priced for right now as we wait for a catalyst to send us either up or down.

The walls are closing in on the EV industry in the short-term and I advise readers to head to higher ground, let’s say the chip industry for a better crack at tech stocks.

“Only when the tide goes out do you discover who's been swimming naked.” – Said American Investor Warren Buffett

Mad Hedge Technology Letter

June 24, 2024

Fiat Lux

Featured Trade:

(E-COMMERCE PARTNERSHIPS WILL THRIVE)

(TGT), (SHOP), (WMT)