Mad Hedge Technology Alerts!

“Recession is when a neighbor loses his job. Depression is when you lose yours.” – Said Former US President Ronald Reagan

Mad Hedge Technology Letter

June 14, 2024

Fiat Lux

Featured Trade:

(ON BOARD THE AI TRAIN TO UNCERTAINTY)

(AAPL), (MSFT)

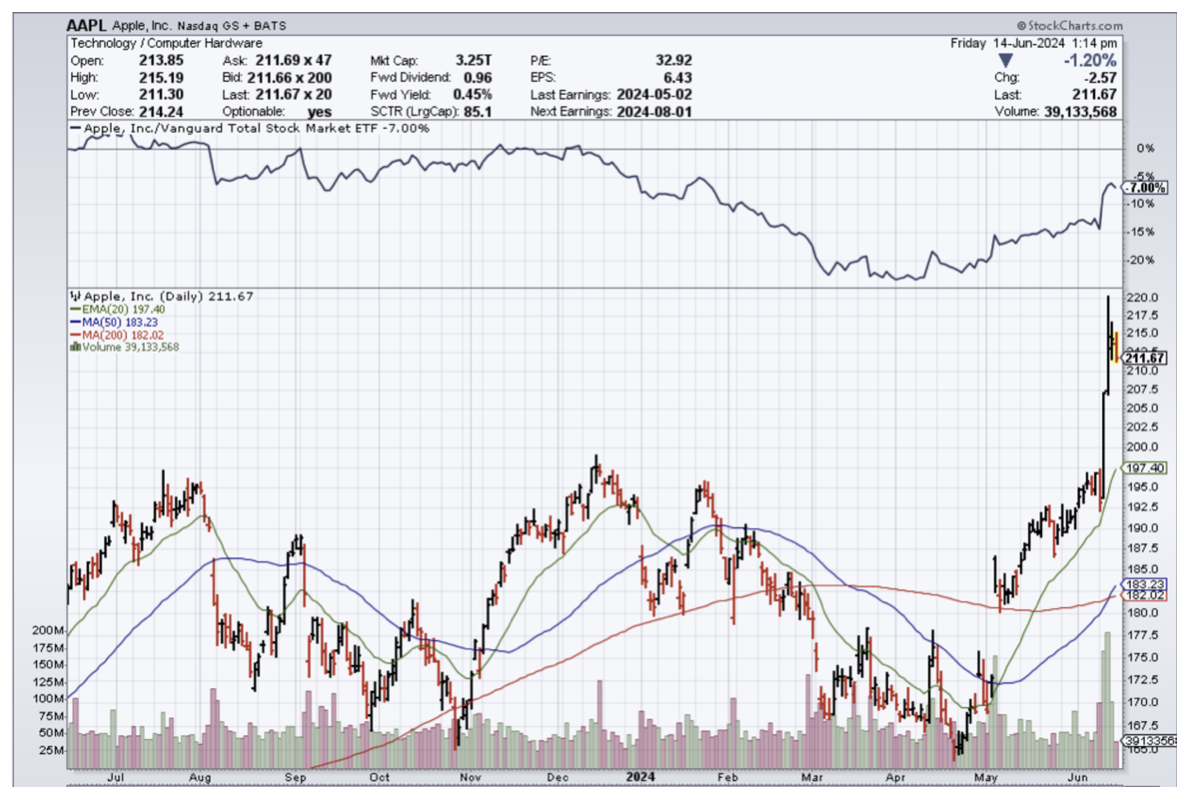

Apple (AAPL) has been on a one-way street to nowhere lately with their China business falling into the backstreet dumpster.

They had to do something before desperation took hold in the Cupertino headquarters.

It’s not like they could turn to Steve Jobs to figure this all out.

Tim Cook is an operations manager masquerading as the CEO and has little vision if any.

Announcing something AI was not a shocker as even legacy firms like Oracle and Dell had done the same with great success. But this isn’t data center stuff, the AI here will affect the Apple iPhone software.

Out the window goes privacy on your little iPhones – do people still even care about that?

Privacy was handed over to Sam Altman’s OpenAI.

Doing a deal like this opens up Pandora’s box and ensures that the Apple of the future will look a lot different than the one today.

Not everyone will like it, but that is tough. It is business.

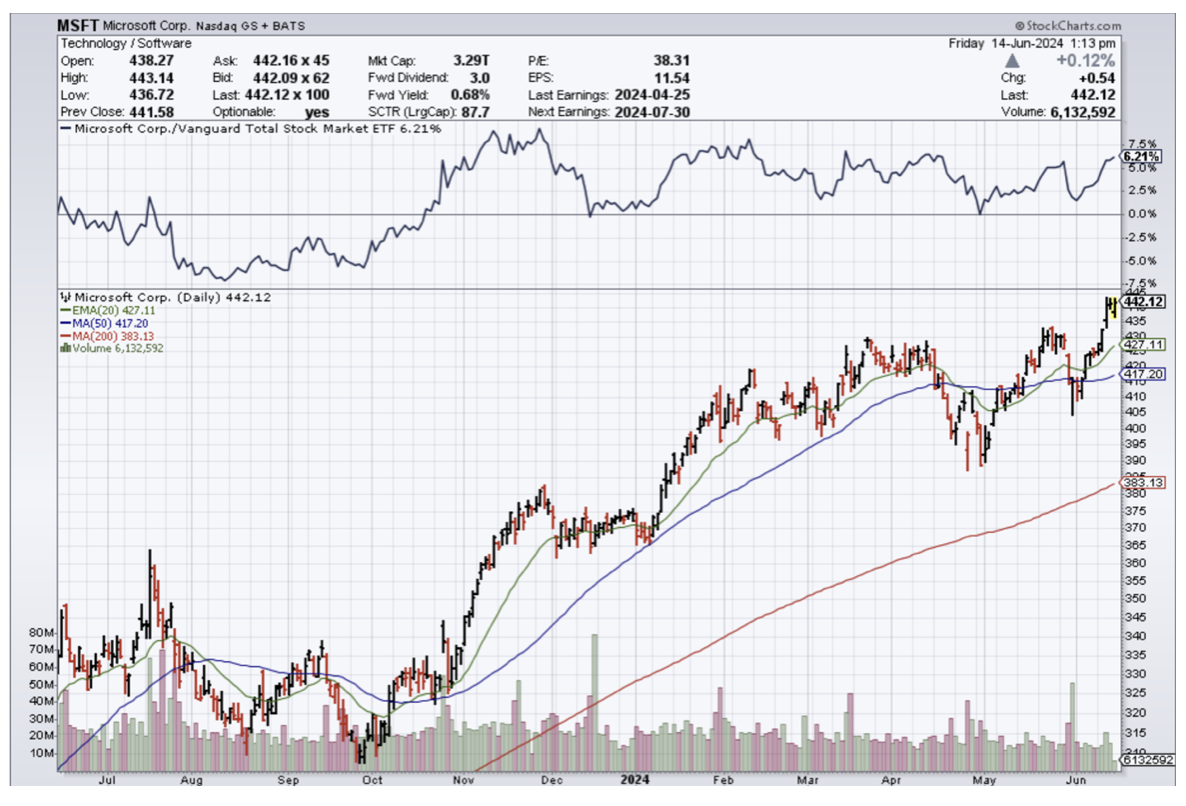

The CEO of Apple, Tim Cook announced an unexpected and deep cooperation with the company OpenAI, which develops the chatbot ChatGPT, and the biggest loser has to be Microsoft.

MSFT usually doesn’t lose at its own game so this one is a bit of a surprise.

Apple has so far only flirted with the idea of its integration. The company surprised and took many people's breath away.

It is a paradox that the biggest investor in OpenAI is its rival Microsoft. The cooperation agreement took place behind closed doors to the dismay of Microsoft CEO Satya Nadella.

Thanks to artificial intelligence, Siri will be able to access all data stored in the user's phone and cloud through a secure channel.

Siri will no longer have a problem understanding the wider context of your question, connecting the answer with previous questions, or deciphering what you wanted to say if you accidentally mixed up the words.

CEO of OpenAI Altman now has fulfilled a longtime dream by striking a deal with Apple to use OpenAI’s conversational artificial intelligence in its products.

MSFT thought it had a big lead in AI over its peers and apparently, OpenAI, being the newest hottest thing in tech, has decided to sleep with everyone in bed instead of just picking one. MSFT has a right to be angry when they handed over $13 billion to OpenAI and that perceived lead in AI has evaporated.

It will be quite funny to see the software and the algorithms in these firms slowly merge into one product backed by the same AI company.

It screams of too many mouths to feed with just one nipple.

OpenAI has taken full advantage to entrench itself as the preeminent force at the forefront of technological modernity. They are the biggest winner here.

Right away, I wouldn’t say that Apple hit a home run even though the price action in their share price suggests so.

They are simply just boarding a train to uncertainty with the rest of big tech, and this maneuver looks highly defensive in nature.

Since Apple has stated they committing no money to the deal then it has to be coined as a win. It's $13 billion less spent and at a risk the software could turn clunky and unusable.

At that point, they could just terminate the relationship. This move was highly controversial inside of Apple headquarters, but management thought it was worth the risk.

Apple stock has most likely reached a short-term peak.

Lastly, I found it interesting that the Former head of the National Security Agency, retired Gen. Paul Nakasone has joined OpenAI which could mean that OpenAI will also be integrated into the Armed Forces. Apple won’t have much of a say in OpenAI going forward so we will see how it pans out.