Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

April 4, 2025

Fiat Lux

Featured Trade:

(TECH STOCKS HURTING)

($COMPQ)

That was quick.

The Global Trade War has gone ballistic in a short amount of time and, tech stocks haven’t had time to digest this type of news.

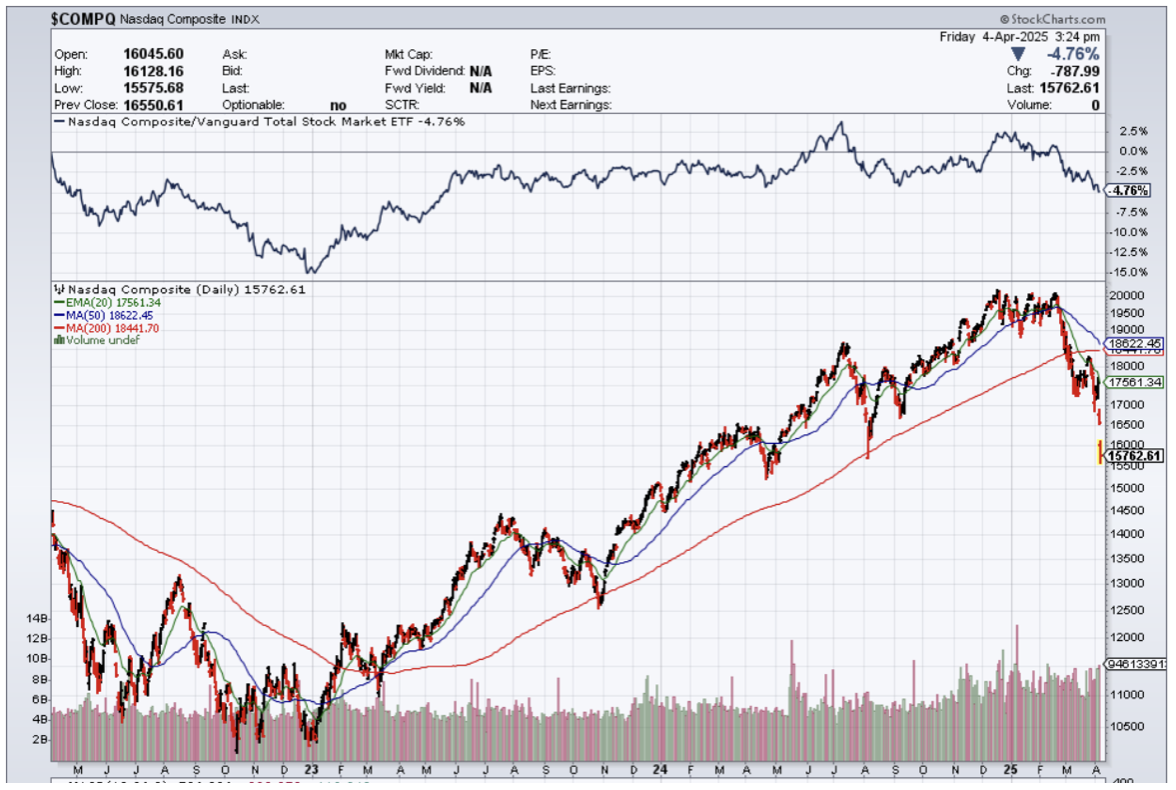

Today’s sell-off at the time of this writing is over 5% intraday and around 10% over the past 5 days.

It is bad for everyone and accelerates an era of deglobalization that is picking up around the world.

China has hit back at new U.S. tariffs with sweeping levies of its own on American products, sharply escalating the trade war between the world's two biggest economies.

China's finance ministry said on Friday a 34% tariff will be imposed on all U.S. imports after the U.S. did the same to China.

Remember that many tech products are produced in China which is why the price of iPhones is only $1,000.

If iPhones are to be produced in the U.S., I expect a price of around $4,000 per iPhone.

The truth of the matter is that the U.S. onshoring manufacturing won’t make prices lower for average Americans.

Escalating trade rules between your biggest trading partners is a high-risk high-reward strategy.

It could easily backfire for the United States whose government also promises lower prices on tech devices and groceries.

In the short term, I don’t understand how lower consumer tech prices are on the table. There is no path to achieve that. In almost every model I play out, prices will go higher for almost everything.

This will be difficult for tech firms to pass on the costs to the end consumer. The consumer will simply not buy, kind of like a silent protest.

China's commerce ministry said it is adding 16 U.S. entities to an export control list, banning them from acquiring Chinese products designated as dual-use, for civilian and military purposes.

China’s economy is weakening and it will be fascinating to see what this does to the Chinese tech sector. The only guarantee is that Chinese factory workers who make American products face losing jobs in mass quantities.

Uncertainty is what the market hates and politics is delivering us a big dose of it.

In the short term, I see more volatility with governments escalating the fight further and getting entrenched in some of their positions.

Clearly, countries in Europe and China see the way they do business as normal, and having such a relative tax advantage has always helped foreign companies compete in the U.S.

The strategy is so good that American companies also began offshoring work to cheaper countries.

Almost every tech company publicly traded on the markets has the bulk of employees stationed outside of America.

At the same time, big tech companies are automating jobs and really shrinking their balance sheet to endure the turmoil.

Workers have lost negotiating leverage, and tech companies, in many cases, require 5 days per week in-office work.

What does this mean for tech?

Nothing good in the short-term.

Revenue targets will get slashed.

American jobs will be aggressively cut.

Management will force less workers to do more work for less pay while middle managers will get fired.

Expectations of less revenue have become more normalized in management circles in Silicon Valley.

Tariffs causing the cost of living to explode will mean less money on the table for tech.

For the time being, this will negatively impact the price of tech stocks. Brace yourself.

“The only way to do great work is to love what you do.” – Said Apple Co-Founder Steve Jobs