Mad Hedge Technology Alerts!

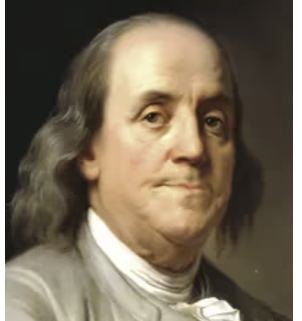

“An investment in knowledge pays the best interest.” – Said Benjamin Franklin

Mad Hedge Technology Letter

April 10, 2024

Fiat Lux

Featured Trade:

(PODCASTS A NEW EXPERIMENT FOR SPOTIFY)

(SPOT)

The dominant music streaming platform Spotify is trying harder these days.

When I say trying harder, I mean trying harder to become profitable because after almost a generation of when burning cash was ok, investors suddenly demand a business that doesn’t run a minus every year.

Zero rates have had an oversized effect on the balance of business in 2023 and 2024.

Failure isn’t rewarded with gaudy executive compensation and more vested shares.

Belt tightening by cutting staff and streamlining operations is the paradigm we are finding ourselves in.

Spotify was the prototypical loss maker in tech that was given a pass because it grew users fast.

Now that interest rates are high, tech companies are penalized by going to the debt markets too much and the effect is magnified if a company needs a high amount of debt.

Logically, SPOT has made diversifying revenue a top bullet point in their strategic future and that is exactly what they are doing.

SPOT has also discovered it can generate additional money from the most diehard music fans. Currently, all listeners pay the same rate for access to a musician’s catalog. But there are fans willing to pay far more to support an artist they love, as evidenced by the rising price of concert tickets, merchandise, and even vinyl for Korean artists.

SPOT plans to raise the price of its popular audio service in several key markets for the second time in a year, a crucial step toward reaching long-term profitability.

The streaming giant will increase prices by about $1 to $2 a month in five markets by the end of April, including the UK, Australia, and Pakistan, according to people familiar with the matter.

It will raise prices in the US, its largest territory, later this year, said the people, who asked not to be identified discussing confidential plans.

The higher prices will help cover the cost of audiobooks, a popular service introduced late last year.

Spotify offers customers up to 15 hours of audiobook listening a month as part of their paid plan. While the company pays publishers for books, it has so far only collected additional revenue from listeners who exceed the limit.

Spotify paid record labels, artists, and others more than $9 billion last year – from $13.2 billion in revenue.

Last year, SPOT posted its best year of user growth ever, with 113 million new sign-ups to its free and paid services.

Spotify had 602 million users at the end of 2023, including 236 million paying customers.

The success of the price increase has given management confidence to seek even more. Under the new pricing, individual plans will go up by about $1 a month, while family plans and so-called duo plans for couples will rise by $2.

In the last 365 days, the stock has catapulted from $134 to over $300 per share.

The stock is absolutely resonating with investors and moves by management have been aggressive to branch out from the music royalty business.

Buy SPOT on the dip.