Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

March 15, 2024

Fiat Lux

Featured Trade:

(POACHING FOREIGN TECH)

(TSLA), (OCDO.L)

Europe is reeling and now it is becoming Silicon Valley’s playground.

The evidence is all over Europe and quite clear-cut at this point.

The royal 7 from the likes of Tesla (TSLA) and Apple (APPL), who have been responsible for most of the stock market gains this year, are leading the charge to cherry-pick the best tech companies in Europe.

Many European companies are now waving the red flag amid commercial electricity costs spiking 100% in many Western European countries.

The unrelenting electricity increase has caused a mad rush to relocate the best European talent to the United States.

Or, if they don’t relocate out of their own will, many are buy-out targets just like the recent news of British online grocer Ocado.

They are on the verge of tasting the sweet hand of acquisitive cash from Amazon (AMZN).

Poached or not poached – Silicon Valley is dominating.

Ocado Group shares jumped the most in more than five years.

Even though the acquisition never came to fruition, this is the type of environment we find ourselves in, as European tech takes the Silicon Valley money before they can go themselves organically without any external help.

Ocado’s stock soared in 2018 on a landmark deal to build warehouses and license software to US supermarket chain Kroger Co., boosting the grocer’s credentials as a technology company. Ocado has partnerships with several grocers, but investor focus has shifted to profitability as demand for automated warehouses slows.

Amazon wasn’t only interested in Ocado, they had to abandon the iRobot deal.

Amazon’s deal to buy Roomba maker iRobot fell apart after iRobot said the deal had “no path to regulatory approval in the European Union.”

iRobot also announced layoffs of around 350 employees, or around 31 percent of its workforce as part of a restructuring.

Ocado has developed, leading automated warehouse technology that could be of great use to Amazon if it tried to take over the European supermarket industry, which it might.

Many American tourists might experience how outdated and obsolete many European supermarkets are these days.

On the corporate side, when I talk to many European workers on the ground in Milan and Brussels, the consensus is that finding a job at an American big tech firm is considered the proverbial golden paycheck.

European counterparts are mired in inefficiency and unproductivity, and the politicians who exist as 27 European Joe Bidens are ruthlessly driving the industry into the ground by taxing and regulating the hell out of them.

European workers also take 2 months of vacation every year along with 15 to 20 federal holidays per year.

When I read the tea leaves, the next expansion of Silicon Valley is to gobble up anything of perceived value in Europe and anything in any European Union country is fair game.

This buying spree could trigger another leg up to big tech and expand margins.

American tech possesses the powerful balance sheets to wield around the world and dominating the European supermarket industry would add to the top line.

Amazon has already forayed into the food industry with Whole Foods in America so this should be viewed as something similar to that.

Look for big tech to enter strategic European industries and eventually buy something like Manchester United or any other high-quality asset.

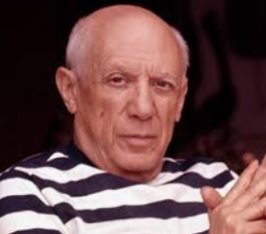

“Computers are useless. They can only give you answers.” – Said Artist Pablo Picasso