Mad Hedge Technology Alerts!

Automation is taking place at warp speed displacing employees from all walks of life.

According to a recent report, the U.S. financial industry will depose of 400,000 workers in the next decade because of automating efficiencies.

Yes, humans are going the way of the dodo bird and banking will effectively become algorithms working for a handful of executives and engineers.

The x-factor in this equation is the $150 billion annually that banks spend on technological development in-house which is higher than any other industry.

Welcome to the world of lower costs, shedding wage bills, and boosting performance rates.

We forget to realize that employee compensation eats up 50% of bank expenses.

The 400,000 job trimmings would result in 20% of the U.S. banking sector getting axed.

The hyped-up “golden age of banking” should deliver extraordinary savings and premium services to customers at no extra cost.

This iteration of mobile and online banking has delivered functionality that no generation of customers has ever seen.

The most gutted part of banking jobs will naturally occur in the call centers because they are the low-hanging fruit for the automated chatbots.

A few years ago, chatbots were suboptimal, even spewing out arbitrary profanity, but they have slowly crawled up in performance metrics to the point where some customers are unaware that they are communicating with an artificially engineered algorithm.

The wholesale integration of automating the back-office staff isn’t the end of it, the front office will experience a 30% drop in numbers sullying the predated ideology that front-office staff are irreplaceable heavy hitters.

Front-office staff has already felt the brunt of downsizing with purges carried out in 2022 representing a twelfth year of continuous decline.

Front-office traders and brokers are being replaced by software engineers as banks follow the wider trend of every company transitioning into a tech company.

The infusion of artificial intelligence will lower mortgage processing costs by 30% and the accumulation of hordes of data will advance the marketing effort into a smart, multi-pronged, hybrid cloud-based, and hyper-targeted strategy.

The last two human bank hiring waves are a distant memory.

The most recent spike came in the 7 years after the dot com crash of 2001 until the sub-prime crisis of 2008 adding around half a million jobs on top of the 1.5 million that existed then.

After the subsidies wear off from the pandemic, I do believe that the banking sector will quietly put in the call to trim even more.

The longest and most dramatic rise in human bankers was from 1935 to 1985, a 50-year boom that delivered over 1.2 million bankers to the U.S. workforce.

This type of human hiring will likely never be seen again in the U.S. financial industry.

Recomposing banks through automation is crucial to surviving as fintech companies like PayPal (PYPL) and Square (SQ) are chomping at the bit and even tech companies like Amazon (AMZN) and Apple (AAPL) have started tinkering with new financial products.

And if you thought that this phenomenon was limited to the U.S., think again, Europe is by far the biggest culprit by already laying off 102,000 employees in 2021, more than 10x higher than the number of U.S. financial job losses and that has continued in 2022, 2023 and 2024.

In a sign of the times, the European outlook has turned demonstrably negative with Deutsche Bank announcing layoffs of 40,000 employees as it scales down its investment banking business.

Don’t tell your kid to get into banking, because they will most likely be feeding on scraps at that point.

THE LAST STAGE OF HUMAN-FACING BANK SERVICES IS NOW!

Mad Hedge Technology Letter

March 28, 2025

Fiat Lux

Featured Trade:

(AN UP AND COMING SOCIAL MEDIA PLATFORM)

(RDDT), (GOOGL)

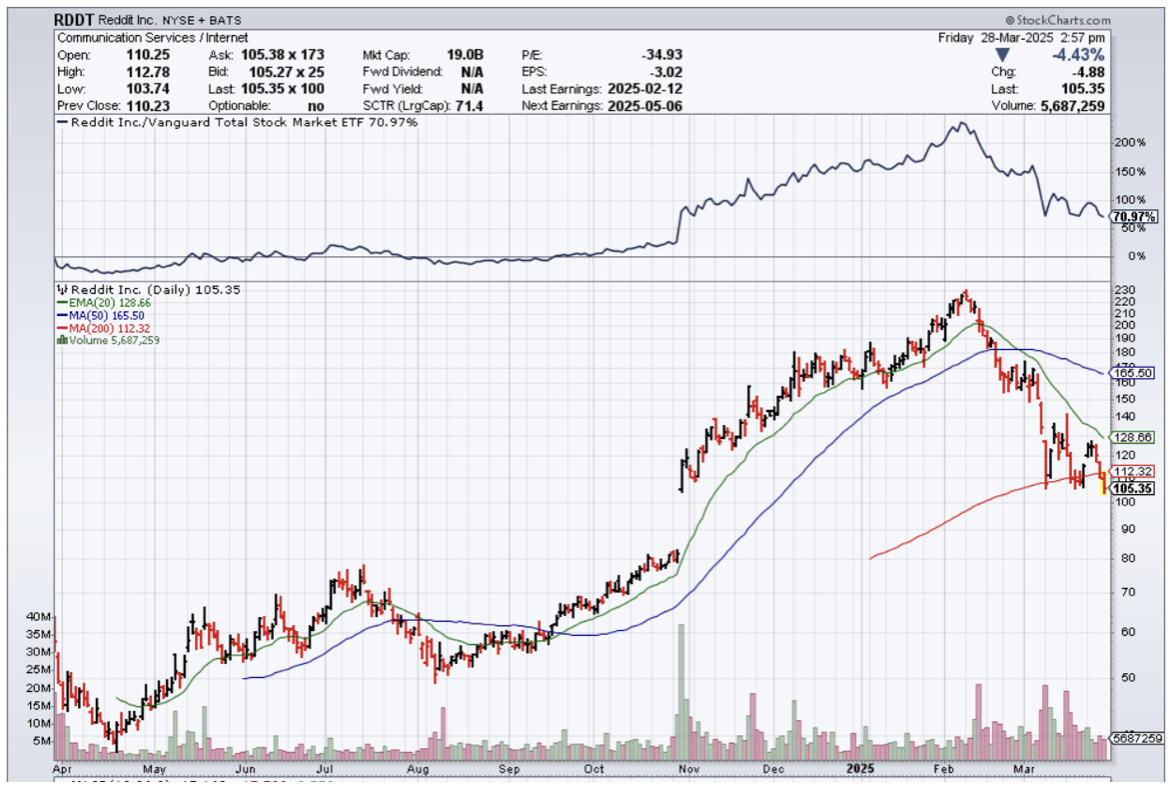

Social media stock Reddit (RDDT) has fallen dramatically from February and is one of those companies readers need to mark down as one to buy at a discount.

Even though the stock has more than halved, this platform is one that has made major inroads into the cultural and social fabric of English language discussion.

It is true in the short-term, it is facing tough comparisons to the bigger giants like Facebook, Instagram, and Snap.

There is clear evidence that the boost to traffic and visibility from Google’s (GOOGL) changes is hitting a ceiling, with a risk that we are entering a period of diminishing returns.

Reddit's daily active user growth will slow to 19% in 2025.

Google’s expanded relationship could turn on a dime and that looks like the likely outcome here.

Google’s search algorithm is not adding as many Reddit subscribers as it used to.

Reddit is not a behemoth, but everybody in Silicon knows this company.

The mid-term problem for Reddit boils down to the lack of profitability.

When you consider that the weakness in Reddit has coincided with a brutal macro-induced selloff, then Reddit is starting to crawl back into an attractive zone for long-term buy-and-hold investors.

When this tariff chaos starts to calm down, I do believe Reddit stock will turn sharply higher.

At its February peak, Reddit’s stock had risen over 500% from the $34 initial public offering price last March. Some of the enthusiasm was due to a series of deals in which Reddit was paid to allow its content to be used for training artificial intelligence models. More recently, though, there have been questions about the long-term growth prospects for the artificial intelligence industry.

Remember that Reddit is in the early stages of executing on a robust, multi-year user and monetization growth opportunity.

There is also the potential to add many other non-English language markets.

Reddit’s shares are extremely volatile and have had 66 moves greater than 5% over the last year.

There is also the critical issue of investors not knowing the company well enough because Reddit’s brand is still way too small.

The diminutive stature of Reddit’s brand footprint has translated into less marketing interest.

Smaller companies are susceptible to the whims of Google Search and Amazon e-commerce.

These types of bigger companies can stifle growth by becoming too reliant on search results making Reddit.com harder to find.

Surely, investors wouldn’t believe it is realistic if the stock continued its rise peaking at $230 per share.

The comedown has been remarkable, but to be honest, many other tech stocks have been beaten up pretty good too lately.

Reddit needs to fall another $20 and then I would say that is a great entry point into an upstart social media stock.

In the meantime, the global trade fights continue to hog center stage.

Pessimism continues to grow in the US, but we still haven’t hit a recession.