Mad Hedge Technology Alerts!

It’s hard to believe that Uber (UBER), the ride-sharing company, is where it’s at now and by that, I mean delivering profits.

It was just only a few years ago when burning money was something they were known for and beginning the next lender to fund them was a common request.

That was the era of cheap money where 0% interest rates created companies like Uber and this capital was the oxygen they needed to keep trying until they could make it work.

Much of the early years were characterized by a fierce competition with competitor Lyft (LYFT) offering subsidies to drivers.

Fast forward to today and they also have a sparkling food delivery business and are projected to continue to grow in the first quarter of 2024.

The company carved out a profit of $1.43 billion in the final three months of 2023, which included a $1 billion benefit from its equity investments as well as income from its operations.

The company has turned an annual profit once before, in 2018 on the back of its investments, but it wasn’t earning money from its operations until now.

The company’s performance in the last three months of 2023 suggests that demand for its ride-sharing and food-delivery services remains robust.

From 2016 through the first quarter of 2023, Uber bled cash close to $30 billion in operating losses.

The company posted its first quarterly operating profit in the second quarter of 2023. The company was founded in 2009.

It was also better than Lyft at responding to a sudden driver shortage after the economy reopened from lockdowns. That helped Uber gain market share.

Lyft is still twisting in the wind of mediocrity and has yet to post its first operating profit.

Uber expanded advertising on its app over the past year. It says it has continued to become more disciplined about spending on discounts to consumers and incentives to drivers. It says it has also become better at combining deliveries and reducing errors, which has improved its operational efficiency.

In the last three months of 2023, the company’s mobility revenue grew 34% and its delivery revenue expanded 6%, while its revenue from freight declined 17%.

After bottoming around $19 per share in the middle of 2022, the stock has been on a rampage and now sits nicely at over $81 per share.

No doubt the stock benefited from last year's slew of capital betting on the Fed to drop interest rates.

I even anointed Uber as my number 1 stock of 2023 and their performance delivered in spades.

What we are witnessing is the maturity of the company and I am not saying they are going to deliver profit back to the shareholder like a FANG, but the conversation will start and that should carry momentum.

The US economy is still going strong growing a few percentage points per quarter and that means US consumers are still spending and that is good for ride-sharing and food delivery.

Uber is sitting nicely as they are a monopoly in this area of technology services.

I am bullish Uber.

Mad Hedge Technology Letter

February 14, 2024

Fiat Lux

Featured Trade:

(A BIG RISK WITH AI)

($COMPQ)

What makes AI mesmerizing and, at the same time, weird is the fact that the technology is accessible to everyone.

Remember when computers were so expensive only a handful of people like Bill Gates had one.

This time it’s different.

AI isn’t like that since it’s a piece of software used on a laptop and the cost of computers has trended lower over the generations.

From simple text or image-generating bots to highly sophisticated machine learning algorithms, people now have the power to create large volumes of realistic content at their fingertips which is one manifestation of AI.

The problem with this is that it underpins illegal activities and encourages scams.

With the help of natural language generation tools, fraudsters can put out vast quantities of texts containing false information quickly and efficiently.

This AI-generated content with false or inaccurate data manages to find its way into places that matter.

In fact, it's possible to create entire websites populated by fake news that drive massive organic traffic and, thus, generate massive ad revenue.

One notch down from straight-up scams is a public feeding frenzy over artificial intelligence companies and stocks that encourage some companies to make hyped-up claims.

I would be extremely reticent of overseas companies that have a history of not protecting tech companies from IP theft like China.

China and digital media don’t go too well together, because much of the content is “borrowed” and from now on it will be AI-produced.

It could be the case that many of these scams will originate from the East.

That’s one part of the world that will use AI to take corporate shortcuts and when they can take an inch, they usually take a million miles.

If a company is raising money from the public, though, it needs to be truthful about its use of AI and associated risks.

They also shouldn’t lie about whether they use an AI model or how they use AI in specific applications.

The media has consistently been highlighting AI as an existential threat and that means at the business level too.

As nefarious actors deploy AI in ways that create reckless or knowing disregard for the risks to investors, this could increase the cost of doing business

It also could have a knock-on effect where people just don’t trust what is on the internet at all anymore and will simply remove themselves from it.

By that time, this might turn out to mean removing themselves from their VR headsets in 2030, but the impact is the same.

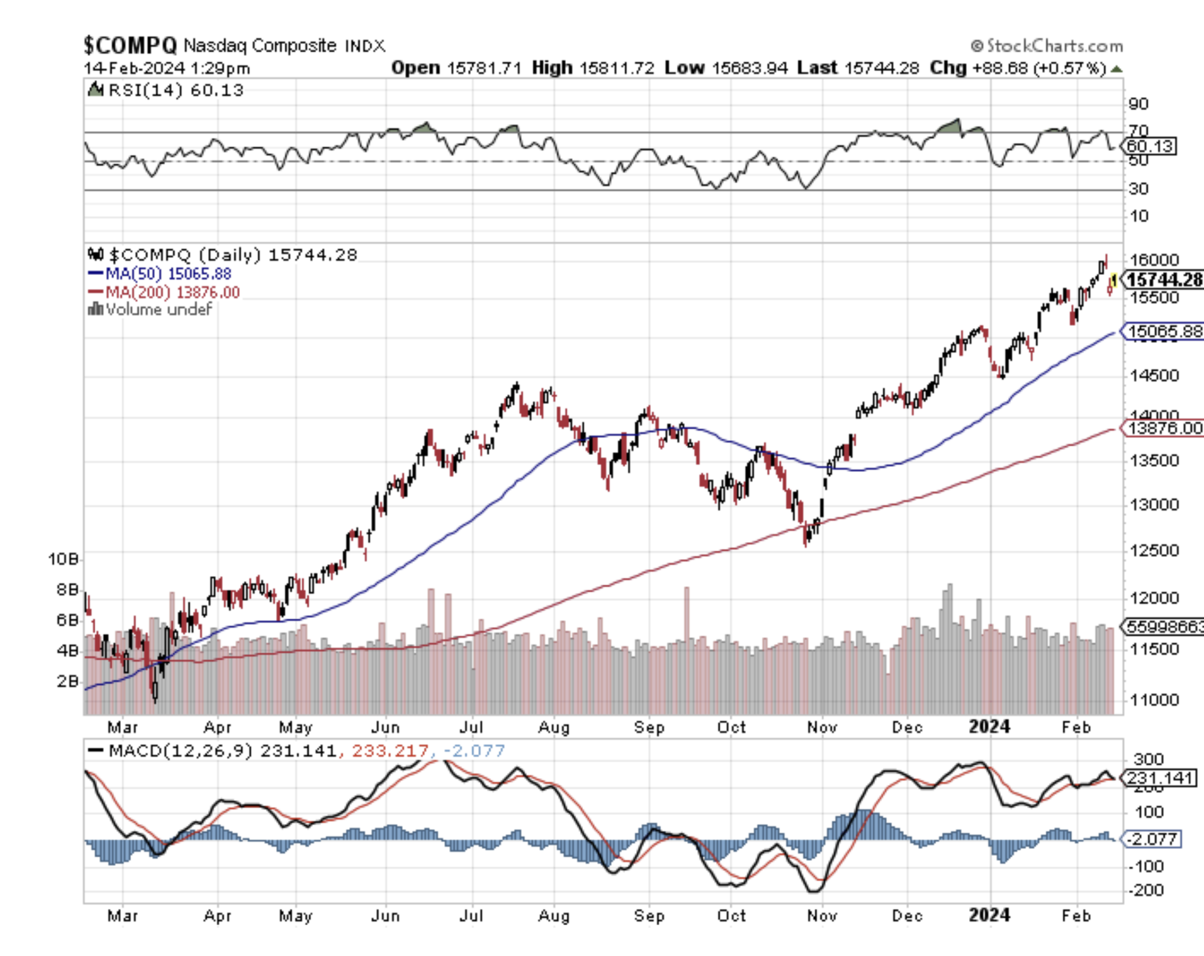

Tech firms ($COMPQ) can only spin profits if the consumer spends half their time on a device and if that goes away, these companies go away too.

Ultimately, tech companies need to be careful how they deploy AI and how the spread of AI affects them at the business level, but also at an existential level.

There’s still a chance that AI could destroy a lot of what has made American corporations so strong after the 2nd world War.

In fact, it could end up like a virus gutting the spirit in which tech firms can do business and obviously, the most to lose are the biggest and most successful tech firms.

On the flip side, AI could become a force of good and boost profits 100-fold if used in the right way, but there is still a real chance AI will ruin Silicon Valley.