Mad Hedge Technology Alerts!

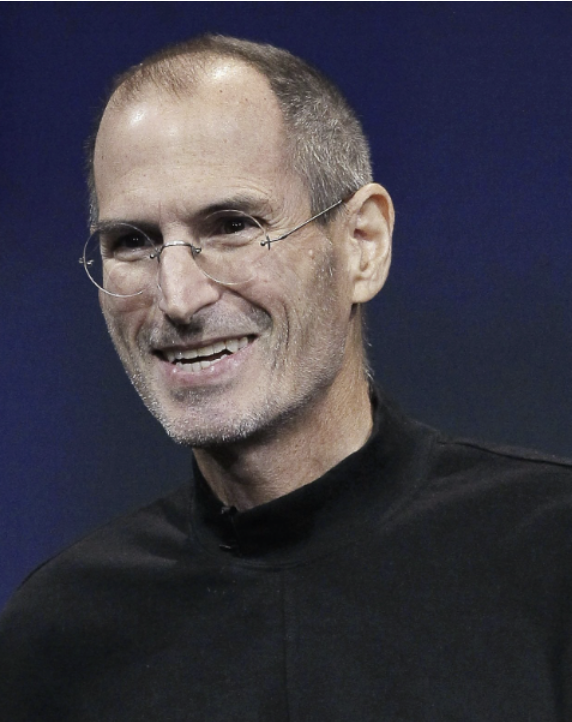

“Your time is limited, so don’t waste it living someone else’s life.” – Said Apple Co-Founder Steve Jobs

Mad Hedge Technology Letter

January 26, 2024

Fiat Lux

Featured Trade:

(WESTERN DIGITAL HAS POTENTIAL)

(WDC), (NVDA), (AMD)

Chip stocks have been the talk of the town in the tech world.

It’s hard not to notice as stock valuations skyrocket.

These aren’t normal times anymore.

A secular trend that could be the biggest we have seen for a generation is taking hold.

That trend today is AI, and this 800-pound gorilla in the room is causing institutional money to pour into the chips that will help AI and the top firm is clearly Nvidia (NVDA).

After NVDA, there is a solid group of others like AMD, but even after that, there is still more ammo left in the shotgun.

Investors could look at an intriguing name - something like Western Digital (WDC).

WDC has a $19 billion valuation and in the long term future could be considered a bargain looking back.

Its earnings weren’t great with another quarter of decelerating revenue.

Western Digital (WDC) reported a narrower-than-expected loss for its December quarter, with revenue just squeaking past expectations.

The business model has been affected due to the impact of structural changes the company implemented in its flash and HDD businesses.

Last quarter, the company said it would spin off its flash memory business, which has been grappling with a supply glut after talks of merging the unit with Japan's Kioxia stalled, by the second half of 2024.

The company said its second-quarter loss included $156 million underutilization-related charges in Flash and HDD.

Western Digital has struggled as demand for memory chips cooled in the past couple of years, but underlying shares have rallied in recent months.

WDC stock had gained nearly 40% since the end of October.

Cloud represented 35% of total revenue, with the quarterly growth attributed to higher “nearline” or onsite data storage shipments to data center customers and better nearline pricing. The increase in client revenue was driven by an increase in the average selling price of flash memory and customer revenue was driven by a seasonal surge in flash bit shipments.

Revenue came in at $3.023 billion, down 2.5% year-over-year but up 10% quarter-over-quarter.

In addition to the recovery in both Flash and HDD markets, I believe storage is entering a multi-year growth period.

Generative AI has quickly emerged as yet another growth driver and transformative technology that is reshaping all industries, all companies, and our daily lives.

Importantly, industry analysts estimate that the edge now represents approximately 80% of total NAND bit shipments, an increase from approximately 75% in 2022, which is another indication that cloud demand was significantly pulled in during the pandemic.

In addition, I believe the second wave of generative AI-driven storage deployments will spark a client and consumer device refresh cycle and reaccelerate content growth in PC, smartphone, gaming, and consumer in the coming years.

WDC has done some nice business specifically in the cloud division with some serious growth.

WDC is also at the center of the generative AI trend and they could be the recipient of “the tide lifts all boats.”

However, I don’t like how revenue as a whole isn’t growing causing major uproar in the investor community.

Splitting up the company should do the trick of weeding out the bad revenue from the good.

I do believe that WDC represents good value for buy-and-hold investors in the mid-$50 range.

This isn’t an ideal stock to trade in and out and even on an earnings beat, the stock sold off which isn’t what investors like to see in terms of price action.

There isn’t enough investor confidence in the stock yet, but that could change in the future.