Mad Hedge Technology Alerts!

The pain trade for tech stocks just recently was up and that has now been broken.

It has been a tough fall and the Nasdaq ($COMPQ) has gone from up handsomely for the year to down 8%.

The tough point in this was that it was hard to go bearish until we finally crossed the Rubicon.

That moment is here and I think we are in a clear “sell the tech rally” mode for the short-term.

I don’t believe that investors are willing to bid up tech stocks in the short-term considering there is nothing coming down the pipeline from the business models that suggest we are in for some outsized growth.

I do believe that surprises will be to the downsides with many tech companies rerating their stocks negatively.

Then there is the issue that the American consumer is tapped out, and the ex-America rich countries are doing even worse.

For right now, I don’t believe traders should aggressively buy the dips.

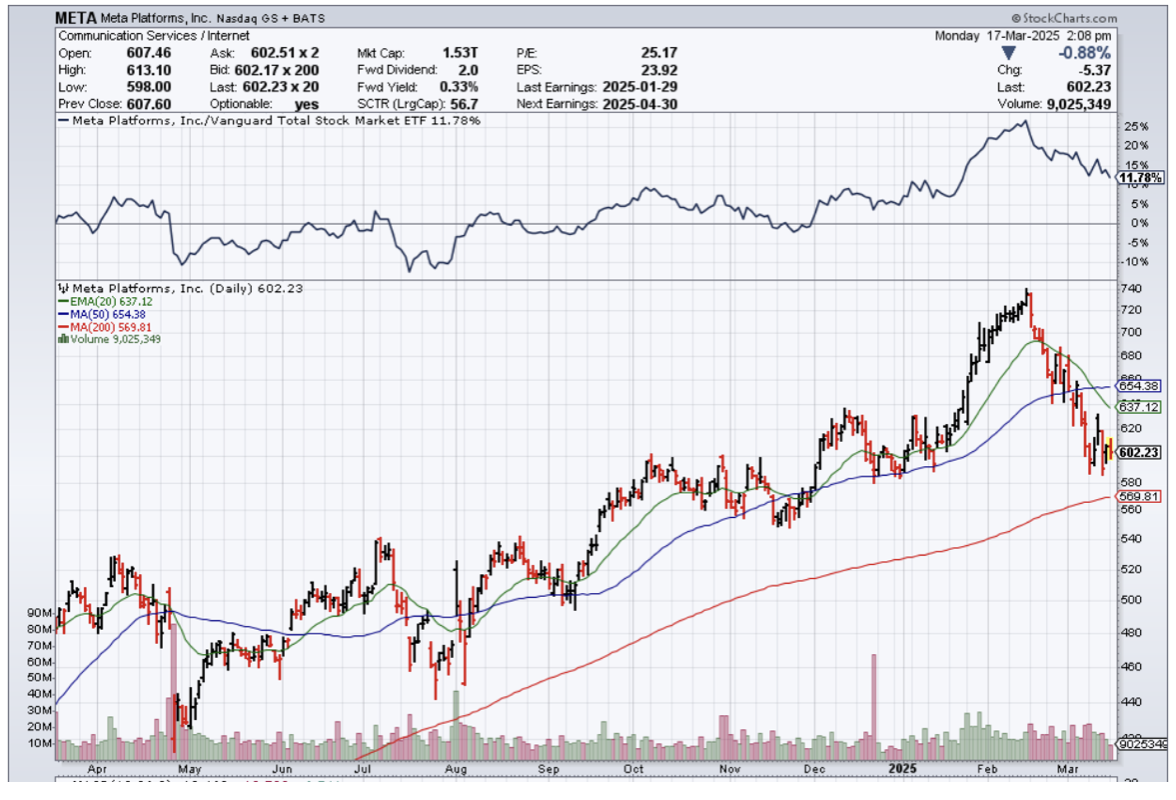

My META (META) trade went horribly wrong and that shows that even the best of class got clobbered by the market.

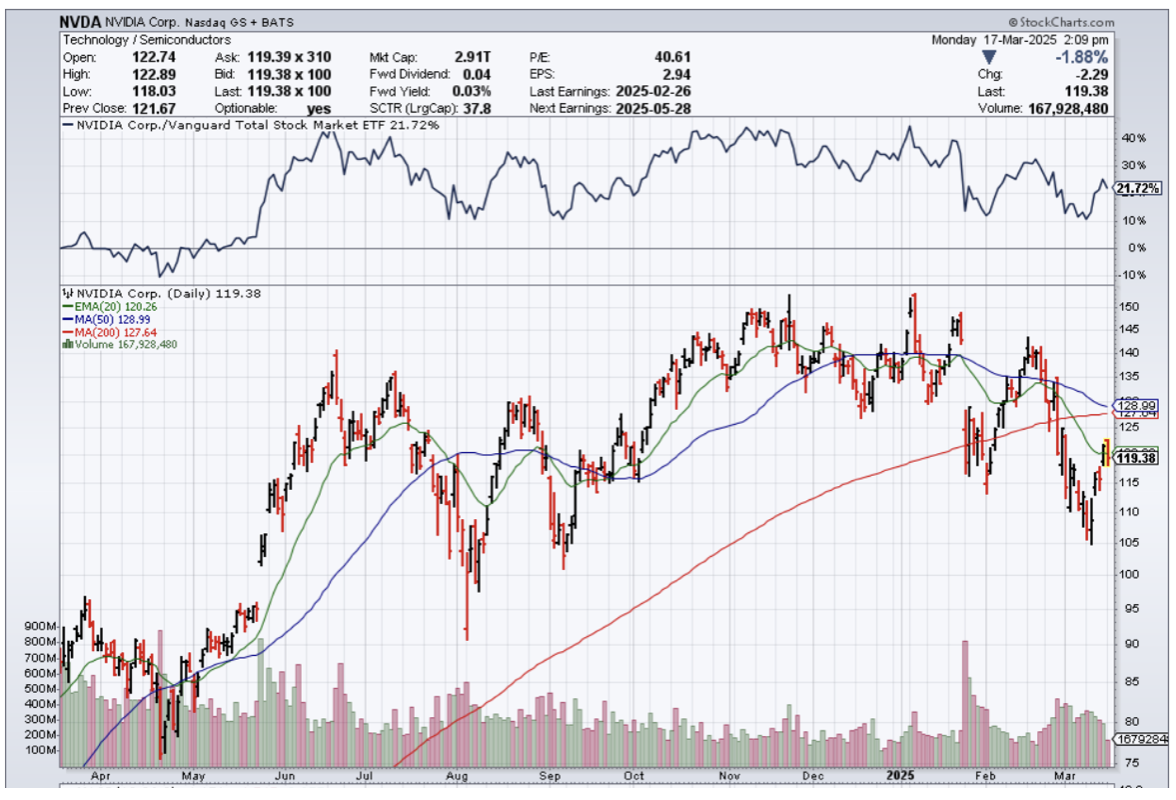

Our bellwether barometer Nvidia (NVDA) is also demonstrably down from its highs of $150 per share and I don’t believe it will reach that level for the rest of the foreseeable future.

Don’t get me wrong, I do believe we can stage a bear market rally just from the very fact that we are in extremely oversold conditions.

It’s also clear that the problem in American politics is now rearing its ugly head and stocks will need to stomach a lot of headline risk in the short-term.

When countries’ politics devolve into 3rd world level type of politics then markets will tell investors to get ready to bear risk and America is no exception.

In response, investors have retreated from risk assets and taken profits on their holdings of the tech giants, which have been the biggest winners, by far, during the bull market in US stocks that began in October 2022.

Over the past decade, investors have been taught time and time again that it pays off handsomely to buy Big Tech stocks when they are down. Even prolonged slumps like the one that sent the Nasdaq 100 down 33% in 2022 proved to be a great buying opportunity as beaten-down stocks like Meta soared to new heights in the two years that followed.

There’s the near-universal belief that tech giants are still the highest quality companies in the world, thanks to their market dominance, immense profitability, and balance sheets loaded with cash. The question is whether these advantages are already baked into the share prices, and may now be under threat if the economy slows and big bets on artificial intelligence don’t pay off as expected.

Since closing at a record high 17 trading sessions ago, the Nasdaq 100 has bounced back on six days. But so far, none of the advances have lasted long.

Instead of catching a falling knife, traders should wait to get confirmation that we have support.

It is easier said than done, but the headline risk has shot to the forefront as the biggest risk to tech stocks when we wake up.

It is also clear that the federal government wants the market to digest as much political risk as possible at the beginning of the new term to smoothen its policy targets for the rest of the 4 years.

Whether it will work is up to debate and I don’t believe tech stocks are able to just shrug off these imminent risks as of yet.

It could be until the summer or fall when tech stocks start to become immune to belligerent politics and until then, we will most likely to see lower lows.

The market has rolled over and we have to shake and bake with it.

“Innovation distinguishes between a leader and a follower.” – Said Apple Co-Founder Steve Jobs

Mad Hedge Technology Letter

March 14, 2025

Fiat Lux

Featured Trade:

(TECH SECTOR HEADING TO A NEW SPACE)

(DBX), (MCHP), (META), (MSFT)