Mad Hedge Technology Alerts!

Thursday wasn’t a great day for technology stocks ($COMPQ).

It’s not always smooth sailing from the bottom left to the top right.

It never is.

Stocks like Amazon (AMZN) were down more than 4% and other lower-tier growth stocks were down a lot more.

The price action in tech was a knee-jerk reaction after Fed Chair Jerome Powell signaled “higher for longer” for US interest rates ($TNX).

Powell was slightly a little bit more hawkish than consensus had it, and I don’t believe that will have any weight in the short or long term.

Funnily enough, Fed Futures are still pricing in no interest rate hike at the next meeting, even though Powell said there is one more hike.

There is still a deep-seated psychology that the Fed will pivot and this concept that the Fed has our back is not going away with itty bitty hikes.

Is there much of a difference between 5.25% and 5.5%?

The answer is no.

I would say that Powell's slow-walking this whole rate situation has done a lot more damage than good.

In more than 3 years since inflation was supposed to be transitory, inflation is still stuck at 3.7%.

Imagine living in a house with severe water damage to the wall and allowing it to fester over 3 years.

Tech continues to do well relative to expectations because Powell’s minuscule rate hikes have been sanitized to the investor audience.

Investors are scared of uncertainty and Powell is full of certainty.

Investors also don’t believe Powell will do anything to scare the tech market as we approach a federal government shutdown yet again.

Powell keeps pedaling this version of economic success, possibly because it is an election year.

Talking up tech stocks isn’t bad and Powell said that a soft landing is not the Fed's baseline expectation; it's merely a "plausible outcome."

Ultimately, tech investors believe Powell will pivot.

The proof is in the pudding.

Let’s look at the short and long end of the treasury curve.

The 10-year US treasury is yielding 4.43% and the 30-year US treasury bond is yielding 4.53%.

This means for an extra 20 years of duration, investors are rewarded an extra measly .10% worth of juice, precisely because investors think Powell will drop the front end of the curve like a hot potato.

Investors are just waiting it out.

Thus, Powell has telegraphed that we are basically at the peak of rates which is highly bullish for tech stocks.

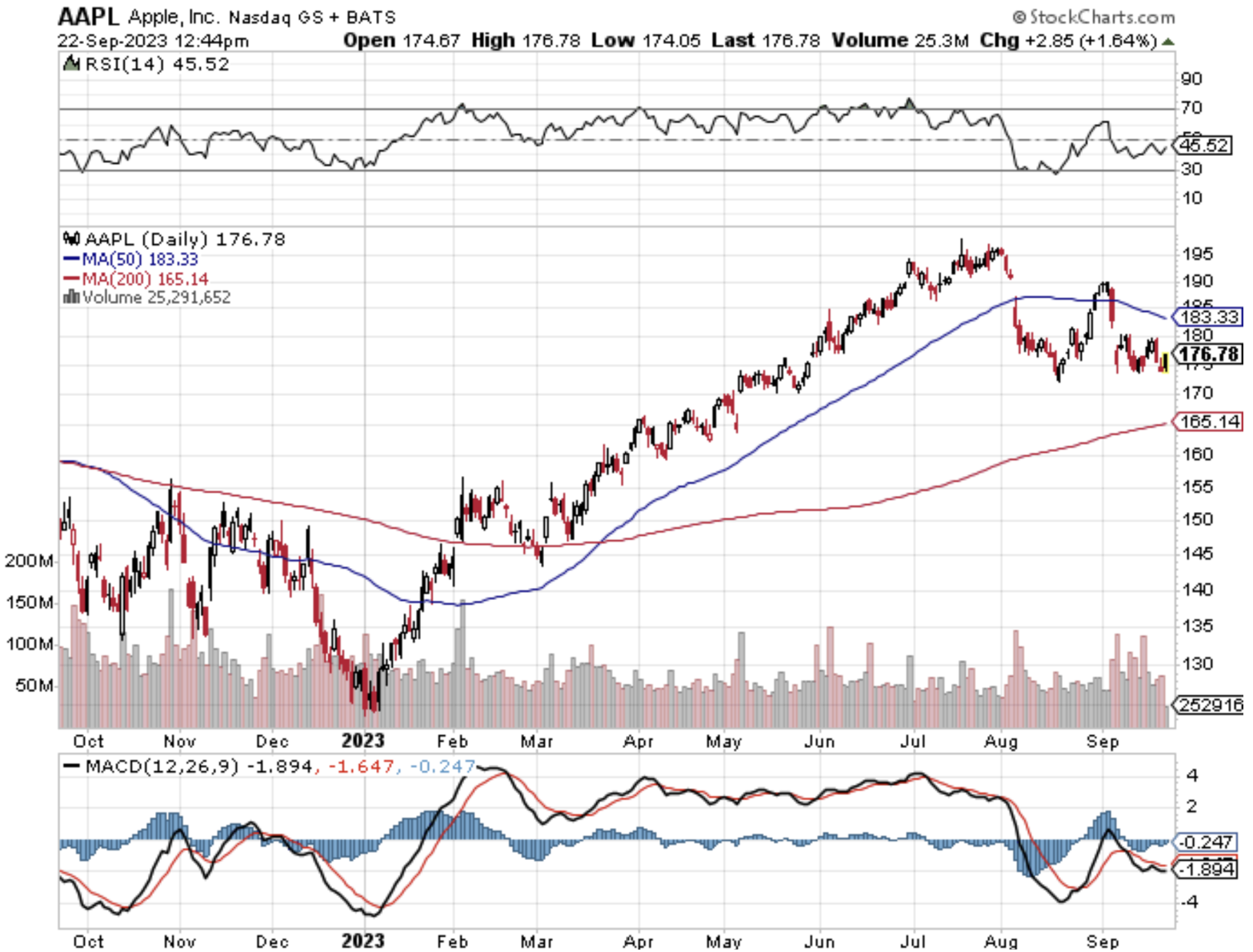

Tech stocks are down just slightly in the past 30 days which I would characterize as a massive victory in relative terms.

In normal financial times, tech stocks would be thrown out with the bath water and we haven’t seen that happen.

Any selloff has been pristinely orderly and that’s a bullish sign in the short-term.

I am not saying that tech stocks have unlimited upside, but I do believe there is a solid bottom under them and they will most likely bounce around in a range-bound fashion.

Remember that for most of this year stocks like Apple (AAPL), Nvidia (NVDA), Meta (META), and so on rose while treasury yields spiked.

I don’t see why this correlation will screech to an immediate stop.

The likely bet is it continues but at a slower pace.

“All money is a matter of belief.” – Said Scottish Economist Adam Smith

Mad Hedge Technology Letter

September 20, 2023

Fiat Lux

Featured Trade:

(THE BOND KING IS WRONG ABOUT TECH STOCKS)

($COMPQ), (UUP), (MSFT)