Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

September 1, 2023

Fiat Lux

Featured Trade:

(BEST BUY PUTS IN A SHIFT FOR TECH)

(BBY), ($COMPQ)

When interest rates go from zero to 5%, fundamentals tell investors that tech stocks are the most likely to drop.

This was an ironclad rule of the market for centuries until it wasn’t.

In 2023, tech stocks ($COMPQ) continue to climb a wall of worry with this fantasy deriving from the Fed is about to “pivot” narrative.

Traders still believe that the Fed is going to turn around and slam the breaks on this quantitative tightening cycle to breathe life into the economy.

Tech stocks and bond yields going up in tandem is highly rare and the Mad Hedge Technology Letter was able to catch the wave of excitement in the first half of the year.

The Fed pivot is based on people with money believing the Fed will just bail out the whole stock market once things go sour.

Hence, the good news is the bad news paradigm we keenly observe in tech stock price action.

Another data point dropped in the tech market with retailer Best Buy delivered its earnings report.

They issued another unspectacular report with a lowered outlook.

For many tech companies, the lockdown sales will never go back to 2021.

I feel like a broken record here because tech earnings are doing just enough to hop over the low bar. Best Buy (BBY) is just another one of emblematic of tech performance today.

Comparable sales, a key metric that includes sales online and at stores open at least 14 months, decreased 6.2% compared with the year-ago period as customers bought fewer appliances, home theaters, and mobile phones. Gaming systems, on the other hand, were sales drivers in the quarter, the company said.

Best Buy is seeing a reversion to pre-lockdown sales levels analogous to Home Depot and Lowe’s, Best Buy profited from lockdowns, fueled by big purchases that people don’t frequently repeat.

Over the past year, consumer electronics retailers have borne the brunt of disastrous Bidenflation and consumers’ shift back to spending on experiences.

Management said the company is on track with its brick-and-mortar plans for the fiscal year. The company plans to close 20 to 30 stores, remodel eight stores to turn them into more experiential shops, and expand outlet stores from 19 to about 25.

The past 2 weeks have reverted back to the tech bulls as they pull us back from the latest weakness in July.

It’s almost getting comical at this point that we are inching back to all-time highs when so many tech companies aren’t doing anything special in terms of not only growth but negative revenue trajectory.

This isn’t the stuff of legends and in a normal world, these aren’t the type of earning reports that fuels bullish price action.

However, since the Fed is perceived as bail-out trigger-happy, investors are juicing up the stock market based on this hope that the Fed will reroute rates back to 0% when the economy needs to be saved. As long as this counter-intuitive narrative persists and tech companies don’t deliver ugly earnings, the pain trade is ostensibly higher. Welcome to the world where Best Buy does -6% sales, iPhone sales sink, yet we go higher and higher.

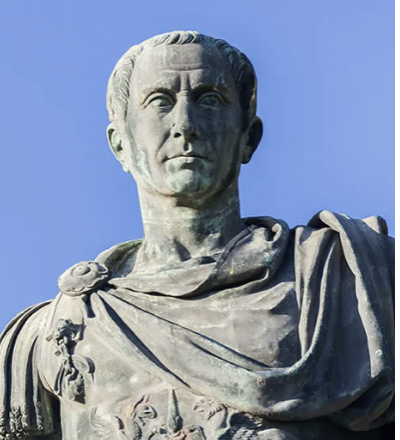

“If you must break the law, do it to seize power: in all other cases observe it.” – Said Roman Leader Gaius Julius Caesar