Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

April 5, 2023

Fiat Lux

Featured Trade:

(REVERTING BACK TO NORMAL STAFFING LEVELS)

(AMZN), (GOOGL), (META)

Tech workers are slowly losing their leverage in the job market that has largely been unforgiving to the average tech worker.

Part of that is due to inching closer to the much-awaited recession that everyone has been waiting for so investors can finally take advantage of 0% interest rates again.

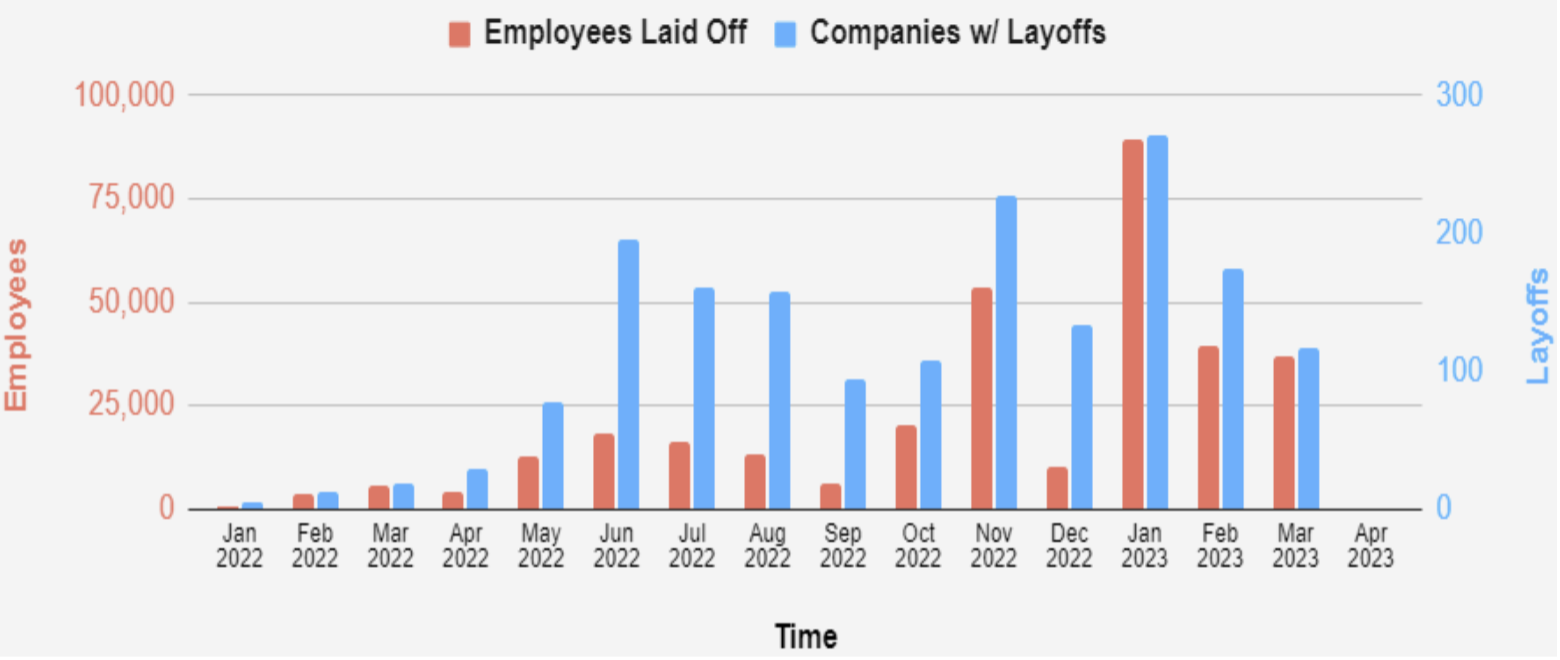

The number breakdown shows that around 330,000 tech workers have been fired by 1,600 tech firms.

In the first month of 2023, 167,000 of those cuts occurred representing an acceleration of tech firings lately.

Some of the noteworthy cuts have been 27,000 jobs at Amazon, 12,000 at Google, and 10,000 at Meta.

Sure, the top 10% are untouchable and can work from a nuclear submarine if desired, but the average joe schmoe is living on borrowed time in the tech sector.

News of Google removing free snacks and artisanal brewed coffee from the offices in Mountain View, California struck fear into the hearts of the ultra-pampered tech worker that has never known a staff reduction in their career.

Now many tech workers who gave the middle finger to their middle manager before the lockdowns are now romanticizing how good things were before 2020.

Many tech workers now regret moving on to van life or moving to the beach of Cancun to sell donkey rides to digital nomads.

They want their old job back and specifically, they want their old pay level back.

Empirical evidence suggests that the so-called Great Resignation is now morphing into the Great Regret.

Thousands of workers began quitting their jobs in early 2021 because they didn’t “feel” empowered or appreciated by their boss. Feelings were hurt. Tears were shed.

These workers who felt jilted jumped at the chance to increase their salary during the arbitrary lockdowns because of a tight labor market.

Now, as life returns to normal, many of the perks they signed up for are being rescinded and the cost-of-living crisis is dumping fuel on the bonfire.

A third of office workers said the cost-of-living crisis had changed how they feel about their current job.

Just under a quarter said they were tired of hybrid working, mostly because they have minimal access to the higher ups they need to connect with for specific promotions.

Lack of access equates to lower positions and the obvious knock on of lower pay, lower benefits, and lower team morale.

Many are also moonlighting secretly while working full time jobs which have resulted in a big reduction in efficiency.

The once game changing pay rises now pale in comparison to the rising cost of living.

More than four in five workers admitted to keeping in touch with their former managers, with almost a third stating that this was for the primary purpose of keeping the door open for future job opportunities

Painful rounds of deep lay-offs in the tech sector and warnings of a looming recession appear to have smashed the lingering leverage workers still thought they had to crowbar a nice wage increase.

As much as 330,000 tech layoffs jump out on paper, tech firms need to fire over 1 million employees.

The fat hasn’t been trimmed to the bone yet.

The recession will approach in 2023 and this will be the optimal chance to set the record straight for employers to grab back negotiating leverage from the renegade employees while shrinking down to a leaner operation.

Tech is in great position to weather the recession and will be the first industry to over perform after the recession ends.

Mad Hedge Technology Letter

April 3, 2023

Fiat Lux

Featured Trade:

(BULL CASE FOR NVIDIA)

(NVDA), (AI), (GPU)