Mad Hedge Technology Alerts!

A $599 cheaper iPhone with worse features is clearly a sign that Apple (AAPL) is on its way down from peak innovation.

This new cheap phone won’t save the company, but the company doesn’t really need saving.

The company is on auto-pilot mode. Let me explain.

At this point, CEO Tim Cook has done the calculations and he has decided that the company doesn’t need to innovate.

Apple needs to milk its subscriber base whom are famously loyal to its ecosystem.

Apple users are the least likely to just jump ship and switch to the Android ecosystem.

Cook knows that which is why he can push through annual increases in service charges.

Apple’s balance sheet is also another key part of the story and Cook will wield it with extreme efficacy through shareholder returns.

It could be true that we are past the stage of Apple delivering big growth numbers.

That looks to be a thing of the past.

Now, competing with China on cheaper phones is a massive step back and it won’t flow through to the bottom line.

It’s easier to argue that this phone will cannibalize sales of Apple’s more expensive phones.

We have arrived at this point and it is sad for most technologists.

Apple AAPL expanded the iPhone 16 family with the launch of a cheaper iPhone 16e version powered by the latest A18 chip and supporting Apple Intelligence.

iPhone 16e is available in a 6.1-inch display size and has the best battery life ever on this display size offered by Apple. The iPhone 16e, available from Feb. 28, will cost $599 compared with $799 for iPhone 16 and $999 for iPhone 16 Pro.

Although iPhone sales decreased 0.8% year over year to $69.14 billion in the first quarter of fiscal 2025, Apple saw better iPhone 16 sales in those regions where Apple Intelligence was available. iPhone’s active installed base grew to an all-time high and saw a record level of upgrades in the reported quarter. The iPhone was a top-selling model in the United States, Urban China, India, the U.K., France, Australia and Japan.

AAPL maintained its lead over Samsung for the second consecutive year, with a market share of 23% compared with the latter’s 16%. Xiaomi trailed both Apple and Samsung with 13% market share. Global smartphone shipments increased 7% year over year to $1.22 billion units in 2024.

Apple has more than 1 billion paid subscribers in its ecosystem and the focus is entirely on them. There are only 8 billion people on this planet and Apple has decided it is not worth going after the other 7 billion.

If they haven’t adopted an Apple phone or tablet then this last cheap phone is the last chance. Even then, the reason they most likely haven’t adopted an Apple device is because they cannot afford it.

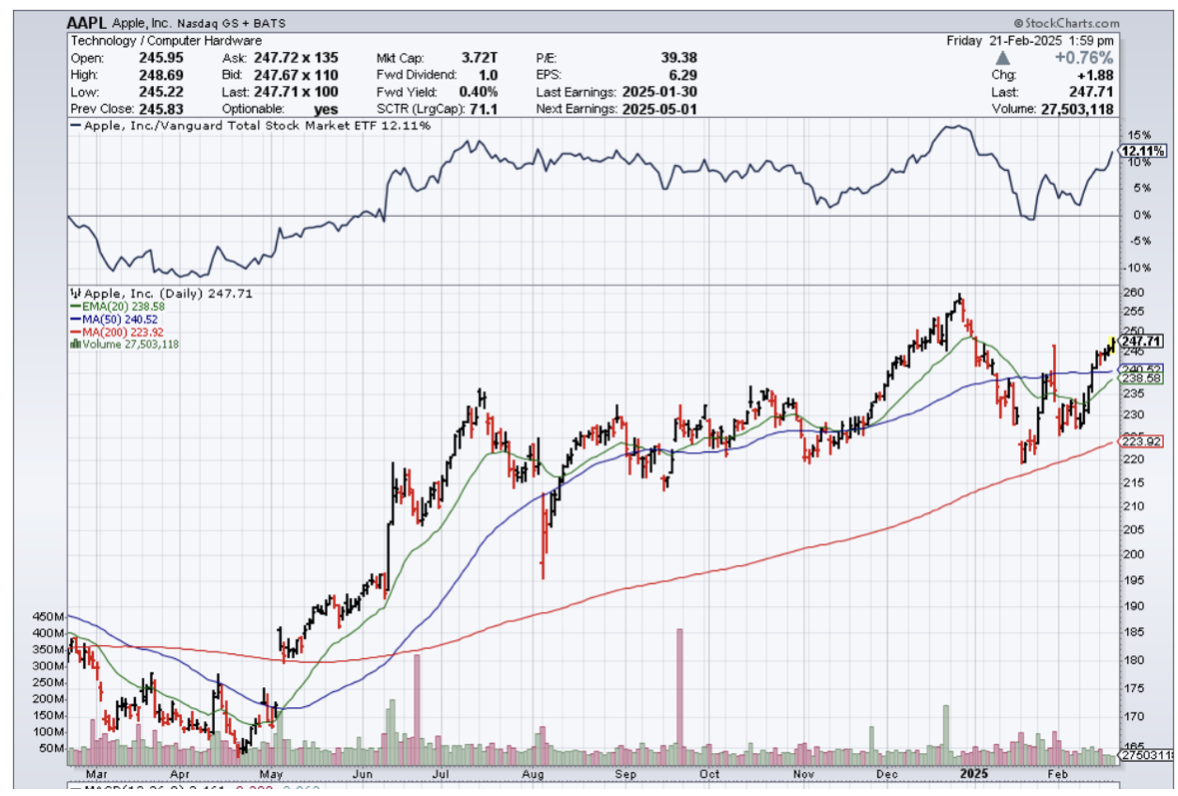

Apple shares are down 1% this year at the time of this writing and I still believe this is a buy-the-dip stock even with a weakening business model.

Apple knows they can withstand earnings whenever they want by just increasing their dividend.

Another headwind is that Apple is not one of the leaders in AI and shareholders will wait to see how that plays out.

Buy the dip in Apple, but don’t hold it long-term.

Mad Hedge Technology Letter

February 19, 2025

Fiat Lux

Featured Trade:

(THE EYEWEAR PIVOT NOBODY SAW COMING)

(META), (ESSILORLUXOTTICA)

Meta (META) migration into the eyewear business is a little bit of a head-scratcher until peeling back the layers and really understanding what is going on.

EssilorLuxottica’s agreement to prolong its long-term collaboration with Meta Platforms for the development of smart eyewear over the upcoming 10 years is a massive victory for Meta CEO Mark Zuckerberg.

This milestone offers meaningful insight into the direction of where the business model is heading.

Many have expected that Meta would start to branch out into other venues once their core businesses start to stagnate.

The digital ad game and social media platforms only go so far in terms of growth these days, and shareholders are waiting on the next big thing.

Short-term prospects are what drives the stock movement, and Meta is looking for that pixie dust.

EssilorLuxottica is the largest maker of eyewear in the world and the owner of many eyewear brands and retailers, including Ray-Ban, LensCrafters, and Pearle Vision in the U.S.

EssilorLuxottica also acquired Heidelberg Engineering, maker of imaging and healthcare machinery and technology, largely for the ophthalmic and eyecare markets worldwide.

Prescription glasses are not cheap, ranging into the thousands of dollars for designer frames and lenses.

If Meta can figure out how to do this all online without going to the optician, imagine the juicy margins they could extract from this sort of venture.

Meta and EssilorLuxottica have a relationship for the production of the Ray-Ban smart glasses. The glasses’ latest version gives consumers video, camera, and Bluetooth headset capability in a stylish eyewear frame with a cool brand on it.

Heidelberg Engineering makes complex, sophisticated, expensive equipment that you may be exposed to if you’re examined in an ophthalmologist’s office. Buying Heidelberg makes EssilorLuxottica more entrenched in the industry where it is the established leader.

The tie-up with EssilorLuxottica is the perfect onboarding situation to understand how to perfect the optimal glasses and lenses and then to transfer it into an online experience.

Remember, even if this investment is for VR purposes, the application revolves around virtual eyewear as well.

Meta now understands they need to secure a monopoly on eyewear, and it is a conscious decision to make that a launching point into more of their products.

In the future, Meta wants consumers to access Instagram, Whatsapp, and Facebook through EssilorLuxottica eyewear products.

Meta also hopes to secure the first mover advantage while other big tech firms lack the deep knowledge of eyewear. There have already been numerous failed attempts at smart glasses, and so Meta founder Mark Zuckerberg is doubling down with a relationship with Europe’s most deeply entrenched premium eyewear firm.

Although the boost to the bottom and top line won’t happen quickly with a possible relationship with EssilorLuxottica, this could anoint Meta as the gatekeeper to the new virtual world through this new eyewear tech.

It’s becoming clear that Meta is running up to certain upper limits in regards to the growth of their 3 platforms, and they are looking for another super booster to prop up profits.

I don’t believe that Meta will be allowed to acquire this eyewear company because of anti-competitive laws, but adopting its best products and practices and hiring their best talent seems a lot more on brand from Meta.

Meta has never been shy at poaching outside talent and rewarding them handsomely.

On the flip side, EssilorLuxottica would be smart to adopt some tech now by hiring the right people and trying to digitize the experience further otherwise, Meta will get what they are coming for.

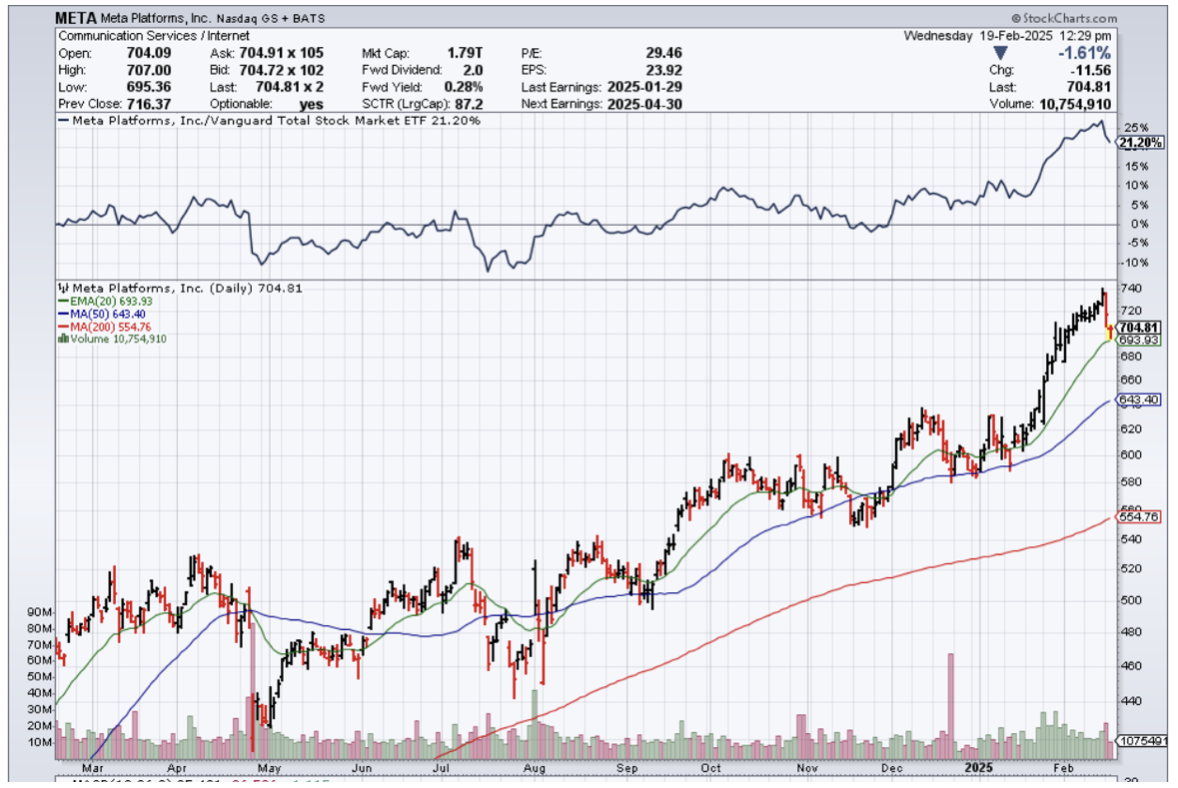

Meta pushing the envelope is one of the big reasons why they have stayed ahead of other big tech companies and why the stock has done so well the past few years.

Meta stock is a great short-term and long-term proposition for patient and impatient investors.