Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

February 8, 2023

Fiat Lux

Featured Trade:

(CHATBOT SINKS STOCK 8%)

(GOOGL), (MSFT)

Down 8% on a faulty chatbot conversation – that’s what happened to Google’s (GOOGL) stock today.

That’s why we need to pare back the euphoria and nonstop celebration of ChatGPT.

Hold your horses.

It’s an emerging technology and could end up with chatbots chatting with other chatbots for little or no value.

My point is that it can still go very wrong from here.

Google’s stock swan dived on Wednesday after its own iteration of A.I. chatbot erroneously answered a question about the first usage of space telescopes via its promotional material.

It all lends itself to surmise that Google is way behind in this game and Microsoft has the situation by the scruff of the neck.

Only just a few days ago, Microsoft integrated the AI technology into the front page of its Bing search engine, and is available for user downloads on the Bing app.

The drop in share price meant that Google lost more than $100 billion off its market cap.

The service called Bard is to compete with the popular ChatGPT.

Despite the chatbot’s claim in the ad, NASA reports that the first photo of a planet outside the Milky Way was taken by the Very Large Telescope in 2004 — nearly 19 years before NASA’s Webb telescope.

Unpreparedness by Google could translate into a significant loss of ad revenue for Google’s cash cow Google search.

The desperation of throwing Bard out there not on their timeline could mean they are exposing a product that isn’t up to Google’s standards.

An AI chatbot that consistently delivers false answers will turn off an advertiser quicker than no AI chatbot.

Investing in Google is still worth it even if it takes time to correct the quality of their AI. because it is logical to give a good company the benefit of the doubt.

Another problem is that Google could be stuck with bad AI for a few years before it turns the corner.

For better or worse, they were forced to go public with whatever they had just for the optics of competition even if they are badly lagging behind.

The worst-case scenario is receiving a direct blow to the cranium in terms of total ad revenue.

Google is still relying on search to drive the rest of its business.

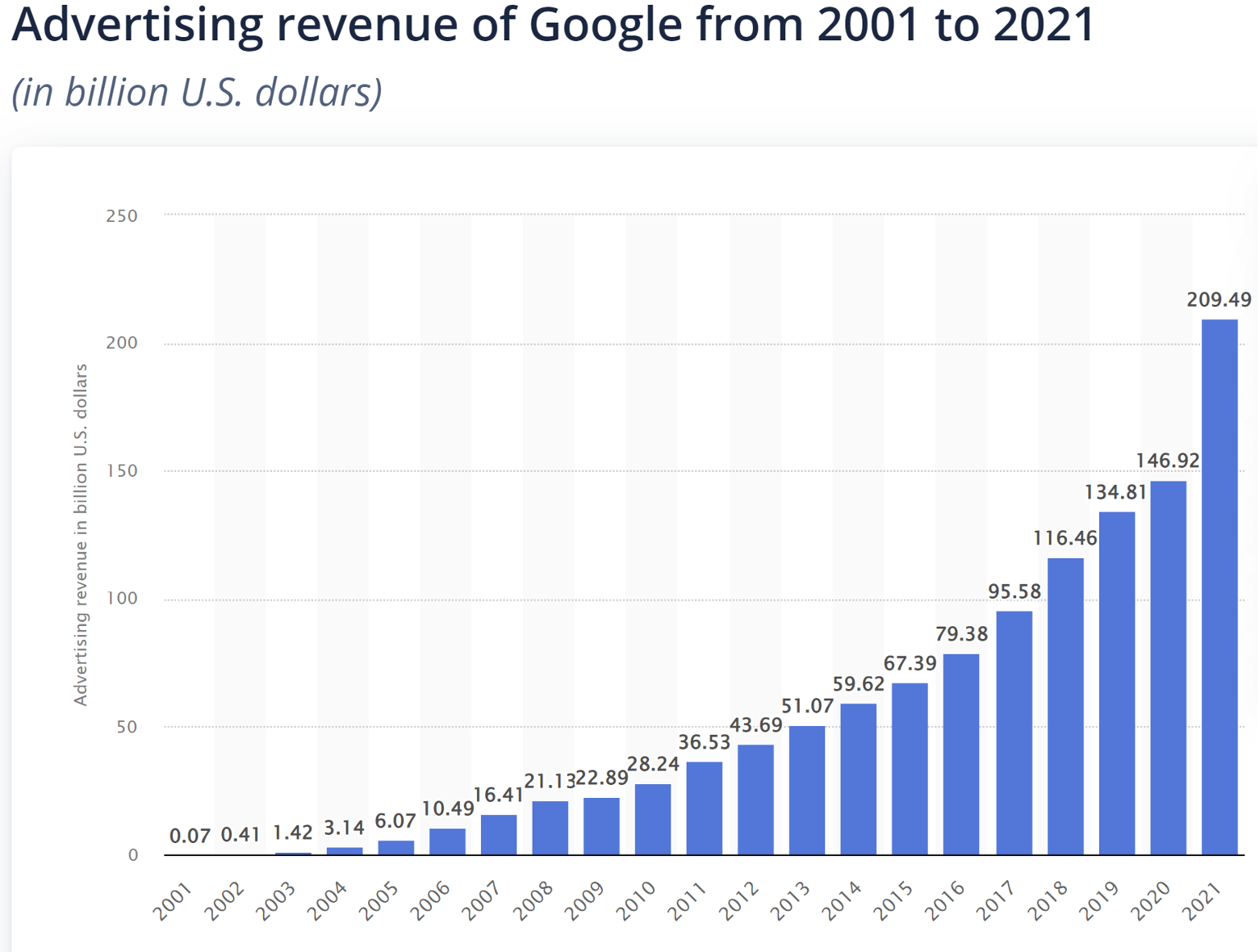

They earned over $200 billion in ad revenue in 2021.

This is the first threat to Google’s search model in a generation and the threat has them on their toes.

I do believe they possess the resources to solve this issue.

No doubt that Google CEO Sundar Pichai is throwing the kitchen sink to find and poach the best AI engineers to beef up the chatbot team.

Ultimately, the real new world of higher interest rates and high inflation environment means that your father’s tech playbook must be thrown out the window.

It’s quite evident that we are in the midst of a paradigm shift and new leaders during this shift will emerge.

History shows us that tech leaders of old have a habit of falling behind because they are too set in their ways to adapt to a world with new rules.

It might be so that at some point in the not-so-near future, we might need to set the search default to Bing.

How ironic?

“Bad times are incredibly good for Palantir.” – Said CEO of Palantir Alex Karp