Mad Hedge Technology Alerts!

Flatten the curve!

No, I am not talking about that 2020 thing, I am talking about the CEO of Amazon Andy Jassy’s vendetta to remove the middle manager tier out of the company he runs.

Flatten the curve so there is no more middle manager and everyone is on the same level with higher-ups rejoicing with the entry levels.

Everything sounds ideal, right?

So why buy this company’s stock?

Why do it?

Easy answer – the stock price goes higher.

Jassy’s campaign to gut the bloat out including the higher earners of Amazon is ringing alarm bells within the employee ecosystem at Amazon.

Amazon is probably the worst FANG company to search for a job at this point. I would never recommend it to a friend.

The thing about Jeff Bezos, he paid his employees well and promised promotions and lots of other perks.

Jassy is promising the inverse and employee morale has fallen off a cliff then mixed into the fact that workers now go back to the office 5 days per week when the standard at other tech companies is a hybrid 3 days per week in-office requirement.

Tried and Tested Amazon's career paths are drying up faster than the Salt Lake in Utah.

Managers fear replacement by lower-paid people with less experience and half a brain.

Jassy has even coined a new term “horizontal development” which he wants workers to understand as a fake promotion.

Jassy even codified his philosophy into a published 1,400-word manifesto for change on Amazon’s corporate blog — where investors could read it — and appears to have targeted an entire layer of middle managers.

Jassy is pressuring HR to hire from a pool of recent college graduates to fill positions while finding reasons to remove more senior workers.

Jassy’s cost-cutting has helped increase profits in each of the past six quarters, and the shares have surged 42% in the last 12 months.

Targeting middle managers rather than front-line workers has become more common recently in corporate America because these people tend to have higher salaries and usually don’t contribute directly to a project by coding or negotiating deals.

Like 2024, I do believe Amazon has a great chance at defying the tech malaise by pushing the financials over the line.

The stock will be rewarded by a higher share price.

Let’s be straight, Amazon isn’t reinventing the wheel.

There is no big new shiny thing to hang their hat on.

But much like Tim Cook came in for Steven Jobs, Jassy has come in for Jeff Bezos to operate the hell out of Amazon and search for nickels in the corner of every couch.

Sadly, that is what has come of Silicon Valley and the “most innovative” place in the world.

The truth is that Silicon Valley isn’t innovating like it used to aside from a few people like the guy who figured out how to re-use rockets.

However, Amazon and Silicon Valley don’t need to offer something new when there is little competition besides the Chinese (which are taking over the iPhone and EV business).

Unluckily for China, it’s harder for the Chinese to replace a foreign e-commerce and logistics company while easier to rip off a smartphone.

Buy the dip in Amazon in 2025.

Mad Hedge Technology Letter

February 3, 2025

Fiat Lux

Featured Trade:

(TARIFFS COME FOR TECH STOCKS)

(NVDA), (META)

Tech stocks have felt the full effect of the volatile nature of the new federal government in charge in Washington.

Tech stocks aren’t looking too pretty today.

The new admin levied a 25% tariff on goods from Mexico only to give the Mexicans a 1-month reprieve.

Like a game of high-stakes poker, but Trump is wielding the American economy at the poker table with reckless abandon.

Tech stocks whipsawed and most stocks opened up in the red, however, a stock like Meta was able to ride out the instability by surging at the open.

Not all tech stocks are created equal.

If many investors thought Trump wouldn’t follow through with his sabre-rattling, then think again.

He is hell-bent on going full throttle and pushing allies to the brink whether they can tolerate it or not.

The surge in interest rates because of the perception of higher inflation and higher geopolitical risk was the reason tech stocks were jolted at the beginning of this week.

Indeed, tech stocks are in for a sideways correction if American government policy becomes constantly aggressive and brutal.

Tech stocks will have a narrow path to go higher, but not like the prior 10 years when stocks were cheered higher by almost everyone.

Trump said this will boost US manufacturing.

The tariffs will grow the US economy, protect jobs, and raise tax revenue, he argues.

Canada’s Trudeau declared retaliatory 25% tariffs on $107 billion dollars worth of US goods on Saturday.

Mexican President Claudia Sheinbaum has directed the Secretary of Economy to impose a plan including "tariff and non-tariff measures in defense of Mexico's interests".

Together, China, Mexico, and Canada accounted for more than 40% of imports into the US last year.

Most goods from Mexico don’t affect tech stocks such as fruits like avocado, vegetables, tequila, and beer.

Canadian goods such as steel, lumber, grains, and potatoes are also likely to get pricier.

It is expected that the car manufacturing sector could see the brunt of the effects of the tariff.

It’s not like Trump is only going after Mexico and Canada, he also has the U.K. and Europe in his crosshairs.

Do tariffs cause inflation?

In the short term, tariffs will hit consumers in the U.S. with corporations front-running price increases by passing on the higher inputs to the end buyer.

The market also senses higher inflation and interest rate yields will get bid up, which is negative for tech stocks.

It is naïve to think that tech stocks will go up in a straight line like the past 10 years – they certainly will not.

If the government is hell-bent on this type of tactic, global markets will feel the pain.

Even if this doesn’t directly affect tech stocks, the American consumer will not go unscathed.

Interest rates exploding higher will certainly mean tech stocks opening up Monday mornings 3% down.

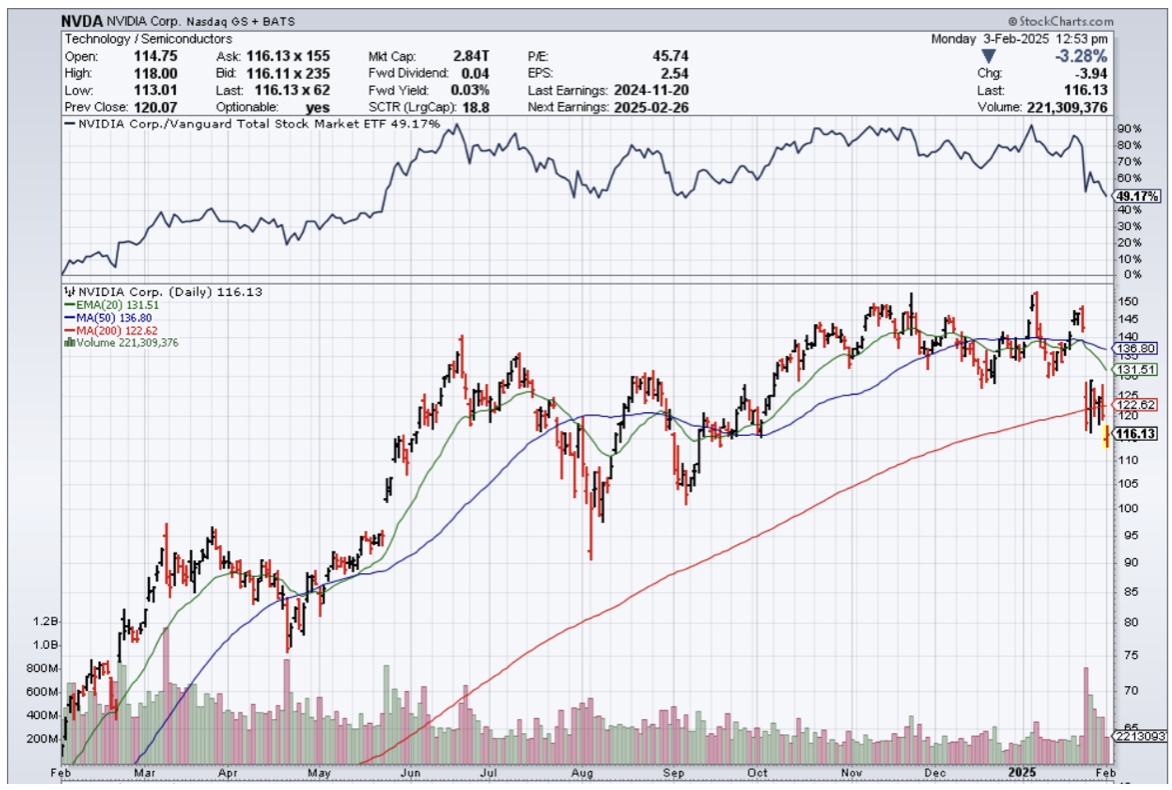

That is not a good starting point for the week and explains why the bellwether Nvidia (NVDA) is down 15% year to date.

Then throw in the chaos from the Deepseek fiasco that threatens the valuations of many AI stocks.

It’ll be tough sledding from here on out and tech investors need to be mindful to not get caved in out of nowhere.