Mad Hedge Technology Alerts!

Tech investors want nothing to do with an aggressive Federal Reserve, but that’s what we have.

I don’t choose this and neither do many others out there.

We have been spoilt in a world with low inflation, global peace, low energy, and high liquidity which was the perfect scenario for tech stocks.

The reverse has happened almost overnight and now it’s that much harder to earn your crust of bread in the tech world.

Gone are the days of buying Facebook for peanuts then going for a sauna and a nap. It’s not that easy right now.

Tech stocks don’t go up in a straight line anymore – there will be many zigs and zags along the way moving forward.

Tech stocks aren’t immune to these exogenous stocks and as anointed growth companies, they inherently need to borrow capital and grow more than the cost of it.

That endeavor is stretched to the limit as bond yield explodes to the upside with this latest rate rise.

Raising interest rates by 0.75% for the third consecutive time this afternoon was the consensus, but in fact, there was a 25% chance of a full 1% rate rise. We avoided that bullet.

Tech stock doves were hoping US Federal Reserve Governor Jerome Powell would save them, by initiating a pivot to save the stock market, but no do this time around.

It underscores that Powell is adamant about continuing this inflation battle even if I do believe it’s too little too late.

The central bank’s new benchmark borrowing rate is now between 3.0% to 3.25%, up from the current range of 2.25% to 2.5%. This would bring the fed funds rate to its highest level since 2008.

Tech stock reacts most sensitively to the change in Fed Funds rates which is why we have seen CEO and Founder of Meta (META) or Facebook Mark Zuckerberg lose $71 billion of his net wealth this year.

Not only is the macroenvironment squarely against him, but his flagship product Facebook is losing steam, and his new product the Metaverse has garnered tepid reviews from outsiders.

How long does the Fed intend to increase rates?

The updated consensus for the Fed Funds Rate shows it at 4-4.25% by the end of 2022, another hike to 4.25-4.5% at end of 2023, and one more cut in 2024 and two more in 2025.

The answer is quite a while longer.

In the meantime, this will initiate a “reverse wealth effect” and tech stocks are the biggest losers, and the US dollar is an unmitigated winner.

Delaying lower Fed Funds rates means delaying the reversal in tech stocks which need lower rates to explode higher and without it, they are quite ordinary.

Signaling higher rates for longer is designed to tame inflation, but there are so many unintended consequences for US tech stocks.

The most important themes to be concerned about are revenue and financing.

The .75% increase in rates will mean that tech stocks will produce lower annual revenue because financing costs will be higher.

This is already at a time when general costs have exploded higher such as an uncontrollable wage spiral, supply chain bottlenecks, health care costs, transportation costs, and energy costs.

It’s a great deal harder to keep the numbers down enough to profit which basically means gross margins will compress further from today.

Tech stocks will come back because they always do. They are the profit engine of corporate America, and that will never change.

I see great tech companies like Apple (AAPL) installing the framework so they can maximize on the next move up when the bull market reignites.

They are doing this by moving iPhone production to India and other tablet production to Vietnam to get out of lockdown China.

Now is the time to reset before tech bounces back and it’s painful to see tech get slaughtered, but this is a necessary evil after a wonderful bull run from 2012 to November 2021.

US FED GOVERNOR GIVES NO LOVE TO TECH STOCKS

Mad Hedge Technology Letter

September 19, 2022

Fiat Lux

Featured Trade:

(READING THE TECH TEA LEAVES)

(GOOGL), (FDX), (META), (SNAP)

Logistics company FedEx, although not a tech company, offers a fascinating insight into the health of the economy and the current state of the tech world.

Unfortunately for tech readers, the shipping company rang the alarm on the rapidly deteriorating state of the economy in August.

It’s my job to tell you how it will shake out for tech stocks.

FedEx’s earnings report disappointed signaling that tech stocks too, could be on the chopping block. I would agree with that too.

This debunks the myth of the “soft landing” that the US Central Bank likes to refer to with their challenge of high inflation. I believe the soft landing is priced into tech stocks, but not a hard landing yet.

The result is possibly more downside price action to tech stocks.

CEO Raj Subramaniam painted a gloomy picture of what to expect in terms of lower volumes.

FedEx could be the canary in the coal mine signaling ugly earnings for other large tech companies that do business around the world.

The tech companies that come to mind are Apple, Google, Facebook or Meta (META), and Snapchat (SNAP).

Raj is not the only executive who is spooking the tech market.

CEO of Alphabet or Google Sundar Pichai had his own gloomy opinion that adds insult to injury to the already negative sentiment prevailing in trader sentiment.

He said he feels “very uncertain” about the macroeconomic backdrop, and he is one of the few who has deep insight into the different layers of this complicated US economy.

He also warned that layoffs could be in the cards as the company seeks to boost its efficiency by 20% while staving off fierce economic headwinds and antitrust investigations.

A large element of such downbeat forecasts by executives is the roaring price hikes from everything like diapers to salami.

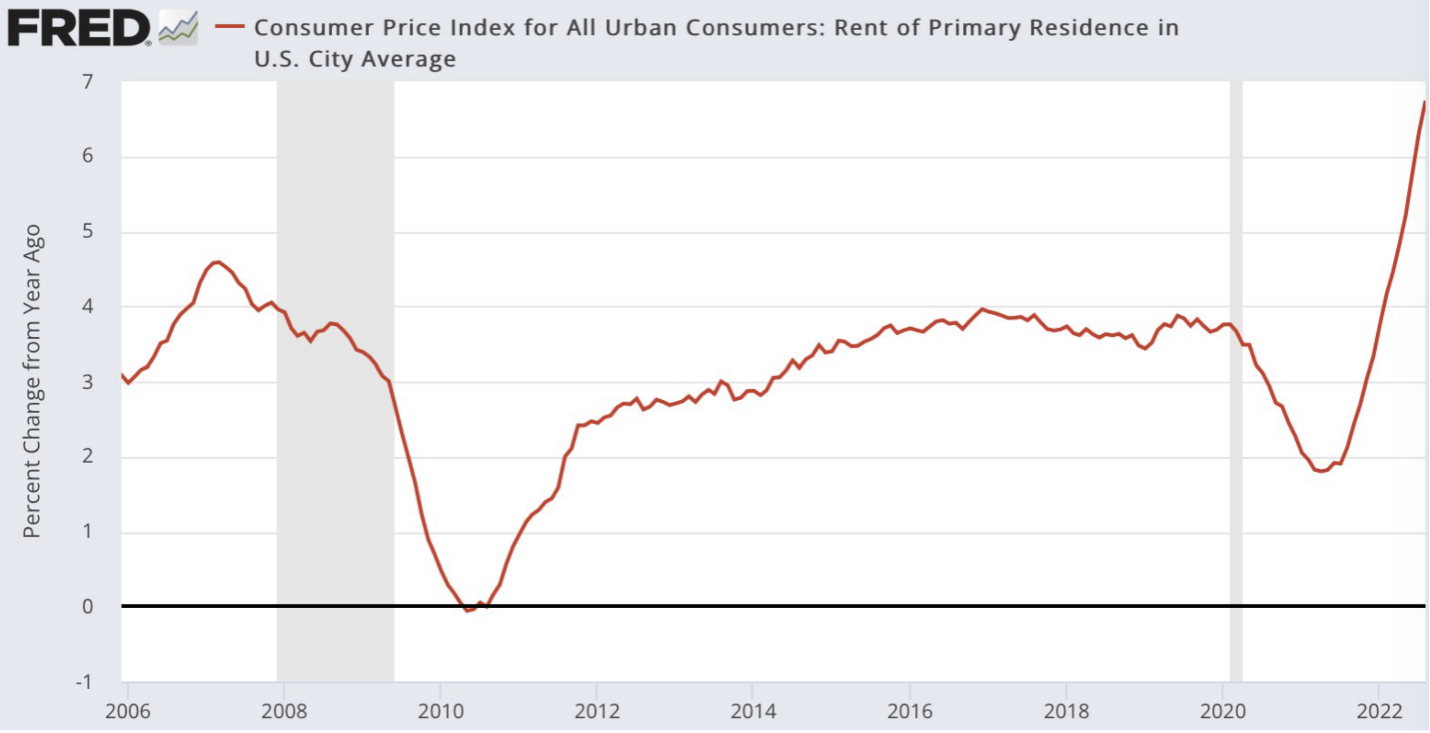

The one ironic tidbit that I took away from the last inflation report was that the recent explosion in inflation has been in rental housing.

If this is the case, then high-income individuals, who mostly own rental real estate, are passing on inflationary costs to their tenants who are strapped with a worse financial profile.

This means that high-income individuals still harness the resources to spend, spend, spend.

Why not go lease a new Maserati or Aston Martin?

If that’s the case, we could see this group pick up the slack and power spending all the way until Christmas which is a net negative for tech stocks because it delays the Fed pivot.

Warnings from Subramaniam and Pichai indeed have weight to them, but keep in mind that these businesses are optimized for scale and reflect the general situation of Americans, not just rich people.

High net worth individuals reloading the consumer bazookas don’t move the needle for the entire US economy, but they do have enough gunpowder to trigger another bout of inflation or rental increases to build on the already high inflation existing in US prices.

Short-term traders should focus on selling rallies in poor tech stocks as upside momentum cannot be sustained in the face of anticipated interest rate rises.