Mad Hedge Technology Alerts!

“We could have a couple of negative quarters” – uttered Federal Reserve Bank of Philadelphia President Patrick Harker.

We badly needed to hear that, because the jargon we’ve been offered so far from federal representatives has not been honest enough.

Ironically enough, saying the truth could offer relief to the Nasdaq index as pricing in a recession moves us along, but that doesn’t mean we are out of the woods yet.

Harker also said it is possible the U.S. economy might see a modest contraction in growth, but he expects the job market to remain strong.

Let me translate that for you.

Harker expects a soft recession, and he feels that it is increasingly priced into stocks.

However, the Nasdaq isn’t priced for a hard recession today, which could be the potential driving force for another dip in the index.

Adding some validation to a possible leg lower is that one of the biggest dip buyers out there, Blackrock (BLK), has said that it is not buying the dip in stocks, as valuations haven’t really improved.

Maybe they are targeting more single-family homes!

To get a real reversal of momentum, we will need not only big stocks like Apple to participate, but also the big buyers.

Don’t look at the Saudi’s either, they are busy earnings $2 billion a day selling oil.

From behind the scenes talks, there is still the hush hush feeling that positioning indicates that we are in for a sharp V-shaped rebound.

How do I know this?

Tech earnings still have a highly optimistic tinge to them, and lower inflation is built into earnings’ calculations.

Don’t forget that many garden-variety tech CFOs built low inflation into their 2nd half of the year revenue models.

Inflation, according to them, is supposed to subside triggering earnings’ beats around the pantheon of great tech companies.

This is what is supposed to happen if consensus plays out.

It rarely does.

Adding fuel to the fire is a proposed federal gas tax holiday by the current administration which is extraordinarily inflationary even if it does help marginal tech companies like Uber (UBER) and Lyft (LYFT) in the short run.

A tax holiday will destroy oil capacity by disincentivizing oil companies in capital investments.

Supply will also crash by encouraging gas hoarding by clever consumers and CEOs hellbent on taking advantage of this brief tax holiday.

The 800-pound gorilla in the room is clearly China.

Imagine if the Communists finally start to peel back their dystopian arbitrary lockdowns and what that will do for rampant inflation.

Pork prices will rise 25% and more importantly oil prices will revisit the peak we had from the on set of the military event East of Poland.

All of this matters for tech companies that consummate contracts for chips, parts, pay salaries to inflationary traumatized coders and build computers.

The conundrum here is that CFOs and CEOs might be guilty of being too positive in regard to the economic cycle.

Consensus estimates (IBES data by Refinitiv) still show very healthy levels of earnings growth. S&P 500 earnings per share for 2022 remain at +10.8%, but the expectations for 2023 continue to reflect a probably optimistic +8.1% growth, with revenues up 4%.

This is ridiculously overly optimistic and isn’t in tune to the realities on the ground.

It is highly plausible we will experience another bear market rally in tech only to be reminded by upcoming earnings’ revisions that there’s still multiple contractions that needs to be rammed down our throat.

Tech stocks will be the most volatile during this period and traders looking for the best bang for a buck should look at smaller positions but in higher beta names like Tuttle Capital Short Innovation ETF (SARK) for the post-bear market rally and ARK Innovation ETF (ARKK) for the current bear market rally.

It’ll be interesting to see if stocks like Apple (AAPL) can eclipse their previous bear market rally peak of $151.

Apple stands at $138, and I presume with these lower gas prices, it should eke out at least $145 before another acid test.

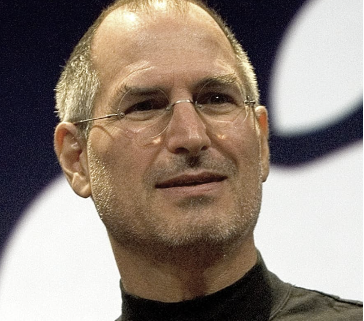

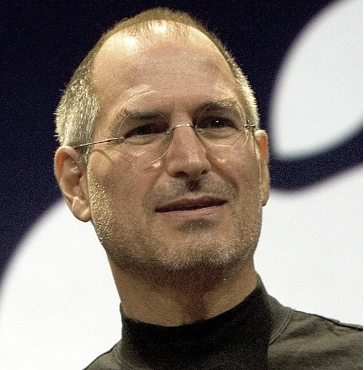

“If you really look closely, most overnight successes took a long time.” – Said Co-Founder and Former CEO of Apple Steve Jobs

When the sushi hits the fan – the sushi really does hit the fan.

We are at the beginning of a massive tech reckoning, and many will shed a tear because of the new changes.

The lavish era of artificially rock-bottom-priced interest rates that fueled an unconscionable tech bubble has now reached an end.

There wasn’t even a main street parade for the closing.

Many fortunes were christened over the past 13 years, mostly by the "Who’s Who" of Silicon Valley as founders and CEOs.

This meant that wild speculation was the flavor of the day which was a force that delivered the equity markets astronomically high tech valuations that we have never seen before.

Those likely won’t be back any time soon.

Many investors haven’t adjusted to the new normal yet.

Similar to 2009, the founders & executives that run VC-backed companies have been quick to figure it out.

They understand that the cost of capital is now exorbitantly high and that high cash burn rates are now impossible.

These artisanal tech companies with zero killer technology like Uber, Lyft, and Peloton are more or less screwed in this new environment.

Even though the executives and founders get what is going on, the same can’t be said on the field of play.

Tech employees who may have enjoyed higher than average success aren’t prepared to enter this new era where accountability and costs matter.

When I talk about employees, I am referring to the ones working in technology in the Bay Area.

Up until now, tech employees have been used to pretty much naming their benefits and compensation package and companies fighting over them.

A rude awakening meets them as tech companies who once showered stock options on new employees now wait in horror as that same method of payment is demonstrably less attractive to future employees with low stock prices.

Most employees have only experienced this amusement park-like setting in the Bay Area, which is what led to many employees dictating the work-from-home situation.

Unfortunately, they might now have to come into the office or get fired.

In many ways, this is not their fault. Excess capital led to excessive showering of employee benefits and heightened expectations.

Unfortunately, you can't ignore the fact that if your company isn't cash flow positive & capital is now expensive, you are living on borrowed time.

During the arbitrary societal lockdown, many companies experimented with remote workers, most from outside of the Bay Area.

Based on anecdotal conversations, this trend is likely to continue post-pandemic. This means the Bay Area employee is now competing with a broader set of alternatives.

In today's world, positive cash-flow matters & surviving requires outmaneuvering competitors.

You need teammates that are ready to grit it out and not whine like an adolescent teenager.

Sadly, we may have conditioned a contingent of employees in a way that is incongruent with this mindset.

As we enter the cusp of layoffs, the guy at the bottom is clearly hurt the most or the last one in is usually the first out.

There is nobody to blame for this situation.

The low rates encouraged that type of poor behavior because they could get away with it.

When everybody is making money, most companies don’t clamp down and top employees can’t get away with a lot.

Tech firms like Teledoc (TDOC) and DocuSign (DOCU) are in real trouble if the capital markets only offer them 10% cost of capital for the next few years.

As the greater economy looks to reset, the goalposts have narrowed in the technology sector and the firms considered “successful” from here on out will have a checkmark next to profitability.

Growth at all costs has now been substituted with survive at all costs in Silicon Valley, so get used to it.