Mad Hedge Technology Alerts!

Dr. Doom Nouriel Roubini needs to lay off the fear porn – I’m not taking the bait this time. Sorry Roubs!

Roubini is sounding the alarm bells on humanoid robots, but I think it is more of a case of fear-mongering than anything else.

After all, like most economists, Roubini isn’t a trader, he is an academic who sits behind the scenes and goes after those juicy sound bites that the media need to publish stories.

He wasn’t taking profits in great tech trades like when I captured profits on Netflix just the other day.

His idea goes like this…

He thinks the big breakthrough right now is the evolution of humanoid robots that essentially follow individual workers on the factory floor, on a construction site, even a chef in a restaurant, or a housekeeper. It's terrifying, but it's happening in the next literally year or two.

For this level of transformation in one year, I believe the percentage chance of this coming to fruition is less than 2%.

My understanding of the humanoids is that the software will take 10 years to figure out the nuances.

Roubini — known as Dr. Doom for his bleak economic forecasts — said human jobs would be lost to humanoids.

Instead, an LLM (large language mode) learns about everything in the world, the entire internet follows your job, my job or anybody else's job in a few months, then learns everything that a construction worker, factory worker, or any other service worker can do, and then can replace them. And I think that it's going to be a revolution — it's going to affect blue-collar jobs like we've never, ever seen before.

The humanoid robot market could reach $7 trillion by 2050, Citi research recently found. Those robots — such as Tesla's (TSLA) Optimus — may be able to do everything from cleaning your home to folding your laundry. The robots could create job loss as routine tasks get automated.

There is a higher likelihood that this humanoid from Tesla will be used as staging to convince investors to buy more tech stocks.

Tech companies have a huge problem on their hands and there hasn’t been a lot of great brain activity to find a real solution.

Venture capitalists have been lamenting the lack of real innovation in tech products like Mark Andreessen and Peter Thiel.

The humanoid is here to get investors to buy more tech stocks in companies that aren’t innovating.

Tech companies are cutting staff to beat earnings and that isn’t a sign for top-notch growth.

Investors need to separate the fluff from reality.

The reality is that big tech companies still make enormous amounts of profit but have failed miserably in finding something new.

Apple CEO Tim Cook is still figuring out what next to do after selling the iPhone to Chinese people.

The humanoid operating on AI software might give tech stocks an extra 6-month cushion before investors pull the rug.

Enjoy the bull market while it lasts. I executed a bullish trade in Dell which is part of the AI story.

AI stocks will go higher and humanoid stocks will too – not because they will make money, but because investors still buy the hype.

Mad Hedge Technology Letter

January 22, 2025

Fiat Lux

Featured Trade:

(A.I. BUBBLE CONTINUES TO INFLATE)

(ORCL). (ARM), (NVDA)

Expect a half a trillion dollar investment into data centers.

This should propel AI stocks higher and the new administration understands the last leg the tech market is standing on is the AI bubble.

It is debatable to say if these tech stocks are in a bubble, but they aren’t cheap and today’s announcement puts fuel in the fire forcing stock prices to go nowhere but up.

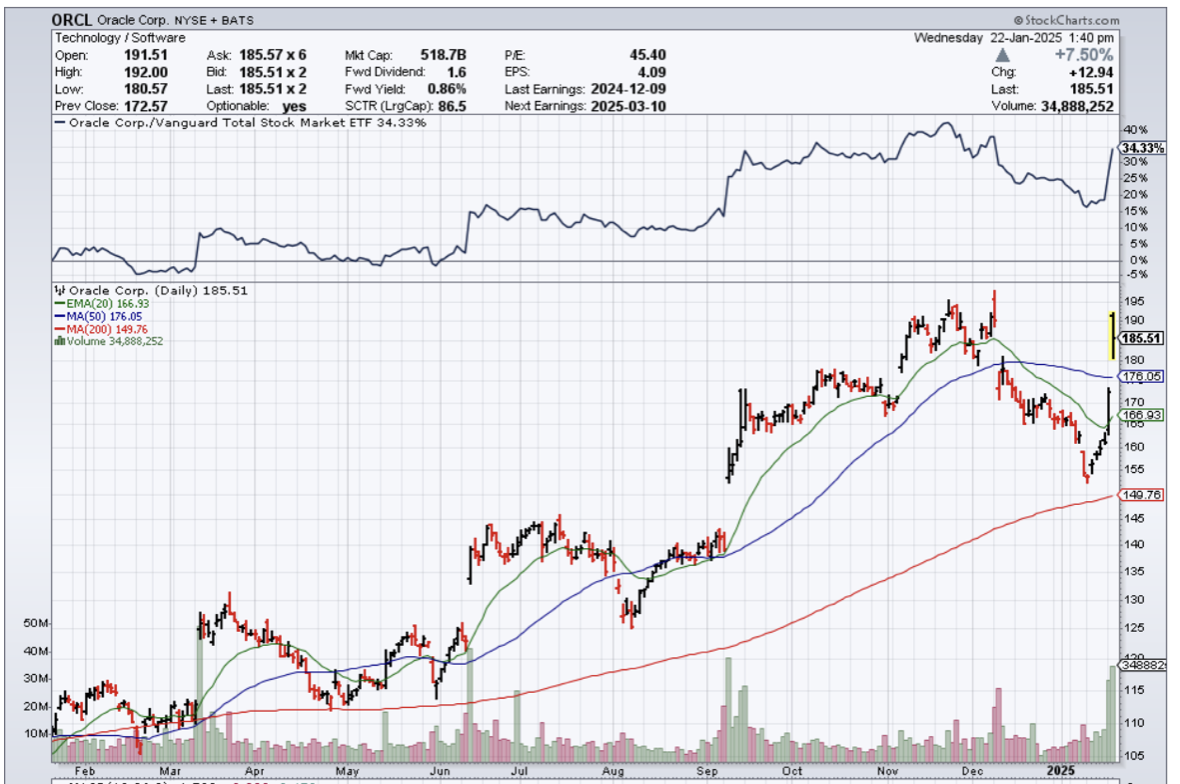

OpenAI says that it will team up with Japanese conglomerate SoftBank and with Oracle to build multiple data centers for AI in the U.S.

The joint venture, called the Stargate Project, will begin with a large data center project in Texas and eventually expand to other states. The companies expect to commit $100 billion to Stargate initially and pour up to $500 billion into the venture over the next four years.

SoftBank chief Masayoshi Son, OpenAI CEO Sam Altman, and Oracle co-founder Larry Ellison were in attendance.

Microsoft is also involved in Stargate as a tech partner. So are Arm and Nvidia.

The data centers could house chips designed by OpenAI someday. The company is said to be aggressively building out a team of chip designers and engineers, and working with semiconductor firms Broadcom and TSMC to create an AI chip for running models that could arrive as soon as 2026.

Abilene, Texas will be Stargate’s first site, and OpenAI says that Stargate, by 2029, could scale up to 20 data center installations.

Microsoft, which recently announced it is on track to spend $80 billion on AI data centers showing it’s an industry-wide trend.

It’s clear to everyone and also investors that propping up the AI tech world is a must because the drop in shares would be devastating to not only the retail holders but also to corporate America.

Much of the recent inflation has been paid by stock appreciation and history has shown that the current US president highlights accelerating stock prices as a barometer of US economic health.

The interesting part of this is building a slew of data centers doesn’t translate into revenue one-to-one.

The jury is still out there whether there will be a revenue windfall out of it.

At the very minimum, we know that data centers will make the price of electricity higher for everyone because they guzzle energy non-stop.

The revenue accrued will need to be higher than the cost of electricity or this is just another massive transfer from retail consumers to the corporate tech world.

Ironically, Elon Musk tweeted that the money isn’t available right now leading the investor to believe this is more about keeping the AI bubble alive than anything else.

Rumor has it that Musk doesn’t really like OpenAI CEO Sam Altman who took OpenAI from non-profit to for-profit and harvesting a multi-billion dollar payday.

Until now, kicking potential revenue creation can down the road is the order of the day, and as long as investors can buy this idea that AI data centers will mean higher revenue opportunities, then shareholders will still pile into this bubble until they don’t.

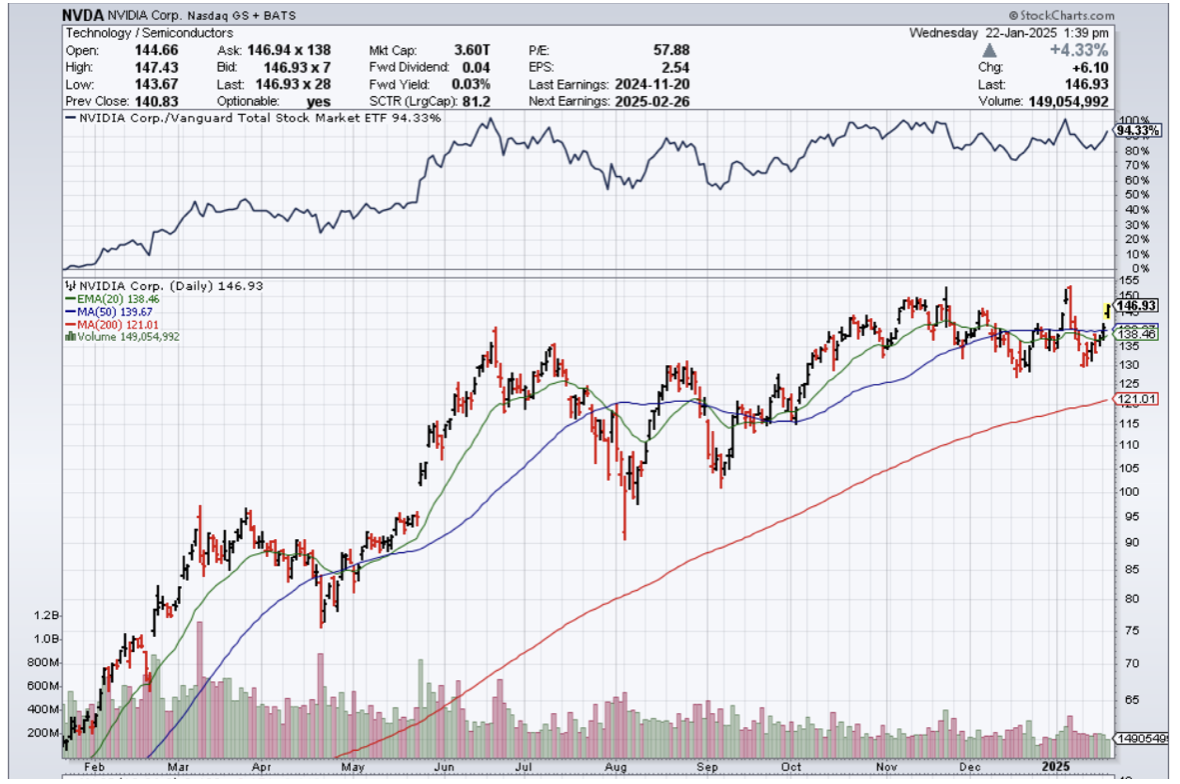

That is why stocks like Nvidia, Oracle, and ARM are seeing double digit gains in just one day.

Buy these three companies on the dip until the AI bubble pops.