Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

March 11, 2022

Fiat Lux

Featured Trade:

(AMAZON MEANS BUSINESS)

(AMZN), (AAPL), (TSLA), (GOOGL)

The blockbuster announcement from Amazon (AMZN) regarding their 20:1 stock split is a big deal, and don’t listen to the charlatans who say otherwise.

Sure, on paper, the business model will be thriving just like it has been since its inception, but this piece of financial manipulation is genius.

Just think about it.

The reason for Amazon to need a stock split in the first place is because the stock has gone from the bottom left to the top right over time.

The best and most successful companies frequently execute stock splits and so even if one wants to spin it as a problem, it’s a problem that I wouldn’t mind having myself.

Splits are often a bullish sign since valuations get so high that the stock may be out of reach for smaller investors trying to stay diversified. Investors who own a stock that splits may not make a lot of money immediately, but they shouldn't sell the stock since the split is likely a positive sign.

Nominally cheap stocks have a massive psychological effect on the average investor.

I also don’t buy the BS about fractional shares, it’s like owning half a car.

Nobody wants that.

Investors also clamor for round numbers.

Would you rather own 5 shares of AMZN or 100 after the stock split?

Human psychology can’t be discounted here and, true to form, stock splits have been the precursor to even higher share prices.

Many companies decide to rinse and repeat and AMZN also unearthed a tidy $10 billion stock buyback plan.

So it’s no shock that this will be Amazon's 4th stock split in its history. The last split came in September 1999.

If shareholders approve of the split, it will begin trading on the new basis on June 6.

Big tech behemoths made hay when the sun was shining during the pandemic, and now they want to make it easy for the simple investors to get back into shares.

Bravo to them.

Other companies of its ilk have also partaken in stock splits like Tesla and Alphabet.

So this isn’t out of left field.

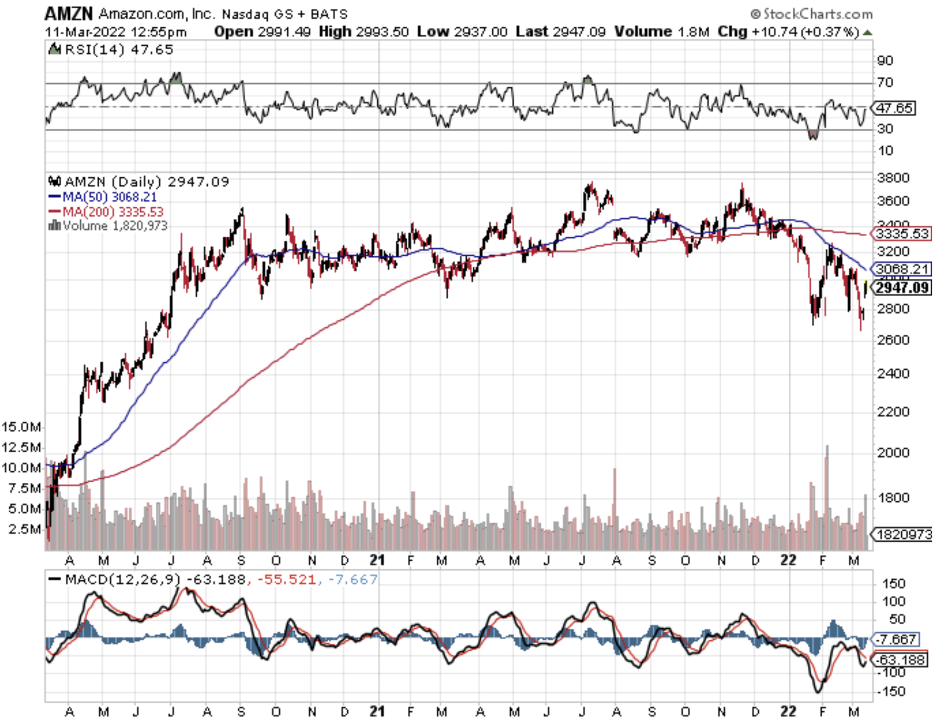

It just so happens that at the time of the stock split announcement, big tech has been the most oversold in the past 5 years.

Apple (AAPL) split its stock 4-for-1 in 2020s. Tesla's (TSLA) 5-for-1 stock split also occurred in 2020. Alphabet's (GOOGL) 20-for-1 stock split was announced in February.

Granted, at a fundamental level, things won’t be different at Amazon.

This doesn’t change the innards of the machine that was built for financial engineering from share buybacks to stock splits and the timing of it is also an important lever as every company tries to max out its genetic makeup.

Amazon shares are down about 9% in the past year, but I would attribute that more to too fast too soon.

Then we were hit by the onslaught of higher interest rate expectations and then the Ukrainian war.

Let’s be honest, the first 3 months of this year have been an absolute blood bath for equities, and AMZN doesn’t trade in a vacuum.

The extra kick in the teeth was the supply chain problem for the ecommerce juggernaut.

AMZN will come back as market sentiment starts to heal itself.

War won’t be a ubiquitous event around the Western world and I view the military escalation as an anomaly.

It’s not like AMZN is operating in Russia as well, or China for that matter.

It’s true that the events of the last few weeks have shined a spotlight on non-Democratic countries as a poor environment for business and in absolute disregard of the rule of law.

AMZN needs to operate in places where the law has teeth, otherwise, delivery packages would get stolen half the time with no recourse.

I feel the timing of the stock split is also indicative of a near short-term bottom in tech stocks.

“Don't chase a girl, let the girl chase you.” – Said Founder of Softbank Masayoshi Son