Mad Hedge Technology Alerts!

Popular nostrum has it that earnings will save the stock market.

The strength of corporate America time and time again is on display to show investors how high short-term growth follows through.

Anytime the Nasdaq enters a little rut, earnings bail us out and the next move is usually higher for tech shares.

Well, wait a second, things are different this time.

The bad news now is that confirmation of solid fundamentals during the upcoming earnings season, won’t make the Nasdaq index go higher.

The market is pricing in business as usually for the largest 5 tech stocks which are really the only ones that matter.

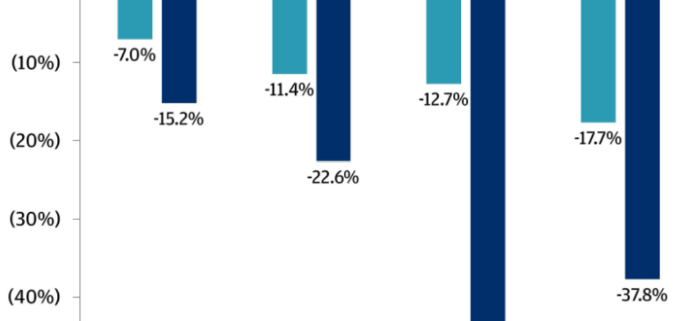

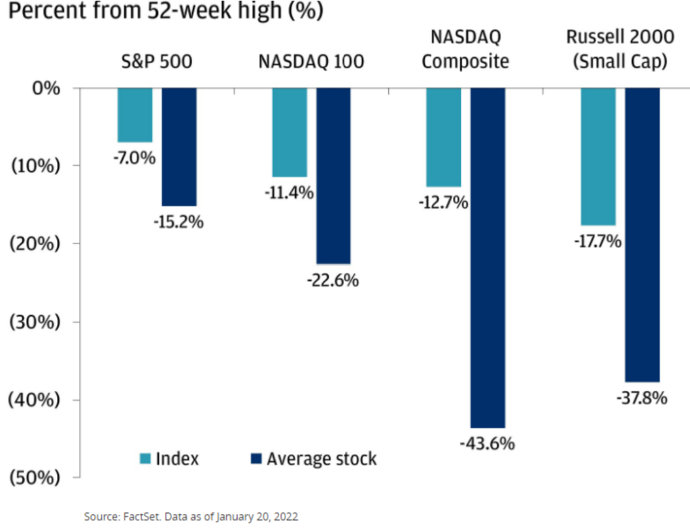

Internally, the rest of tech has been deeply damaged by this January sell-off and we are talking about 8-9% one-day sell-offs for the small cap tech growth and I haven’t even mentioned the peak to trough underperformance which is much worse.

Larger cap Enterprise and Cyber Security stocks still boast solid foundations and are going down less than the meme stocks, shelter-at-home stocks, and the best of the rest tech stocks.

Basically, we need to get through earnings because there is minimal upside for tech stocks as investors peruse through a lack of short-term catalysts.

We are stuck in a ditch where monetary and fiscal policy has been set dead straight against an environment of potentially appreciating tech stocks.

Until that changes, I don’t envision a snappy reversal apart from a dead cat bounce to sell into.

Chasing growth in a low-interest rate environment gave us an overshoot to the upside and now that is all working in reverse.

And for the big FANG stocks outperforming small cap, it just means shares are performing better than tech growth because they command lower volatility due to stronger balance sheets.

Resilience to indiscriminate selling is currency in today’s trading world.

Nothing wrong with growth, but they are what they are, so much so that if you cannot generate profitability now, sell-offs are indicative of their poor strategic position among bigger tech.

The carnage under the hood is stark today with Snap stock cratering after the social media company’s shares were downgraded amid risks to revenue growth and tough competition from rival TikTok.

Snap’s headwinds result from a weakening business profile stemming from IDFA headwinds, difficult [year-over-year comparisons] from stellar growth in 2020-21, and increasing competition from TikTok.

IDFA is a serious thorn in the side for the android-based systems of Google as well as for Facebook.

IDFA is Apple minimizing the reach of data harvesting platforms by turning off their data reach and these modifications by Apple (AAPL) to rules for advertising on mobile apps have forced companies like Snap to lower guidance.

When it reported quarterly earnings last October, Snap revealed that the impact on its advertising business could be long lasting and now we are experiencing that.

The IDFA issues could cut growth rates by half as these social media firms have been unable to remedy its loss of reach in digital advertising.

Snap has the unenviable position to not only be behind Google and Facebook, but they are also the next company to be upended by TikTok that has really come on the last few years.

TikTok has supplanted Snap as the go-to social media platform for teens and young adults.

In a rising interest rate environment, the best of the rest like Snap gets punished for not being the best of class.

Snap shares are down over 200% from its peak and threatening to close in on 300% in the red.

Snap represents the fortunes for the marginal tech stocks that rely on growth and that is not working in 2022.

Although not as loss-making as other tech growth, SNAP has been fairly pigeonholed as the tech you don’t want to own now.

It’s a dangerous position to fill in times of the VIX spiking to 30.

The problems don’t stop there with TikTok really threatening Snap’s position and the momentum signaling that Snap is prepared for a deeper slowdown than initially expected.

Snap’s foothold is strongest in the 13-34-year-old range in the U.S., Canada, the U.K., France, Australia, and the Netherlands, but TikTok’s audience is the most similar to Snap’s which means it puts both Snap’s user face time spent and ad dollars at risk.

From a monetary standpoint, digital advertisers will start to play off ad competition between TikTok and Snap, resulting in discounted ad revenue per unit which will narrow margins moving forward.

Not being able to command the prior ad premium is a stinging blow to Snap who thought they were in the driving seat to the third position behind Google and Facebook, but it shows that being a tech minnow is a harrowing experience and fending off toxicity is part of the playbook just to survive.

Head to higher waters in this volatile environment.

“Strip malls are history.” – Said CEO and Founder of Amazon Jeff Bezos

Mad Hedge Technology Letter

January 21, 2022

Fiat Lux

Featured Trade:

(FIVE TECH STOCKS TO LAP UP AT THE BOTTOM)

(MSFT), (TSLA), (GOOGL), (AAPL), (AMZN)