Mad Hedge Technology Alerts!

Sometimes, the best way to become successful at investing in technology stocks is to avoid the black swan or the big disaster.

I hate to say it, but investment risk has never been higher as we migrate our lives to the internet to extract what we need from personal to business affairs.

One question that keeps getting rehashed that I thought I might take time to address is the rise of the TikTok influencer-adviser.

According to a brief Google search, TikTok, known in China as Douyin, is a video-sharing social networking service owned by Chinese company ByteDance.

The social media platform is used to make a variety of short-form videos from genres like dance, comedy, and education that have a duration from three seconds to one minute.

Unfortunately, for serious retail investors lately, content has migrated into high-stakes themes like financial education and financial advising, giving rise to content that is produced by video creators to get a piece of the financial industry.

Naturally, this has brought down the quality of the financial content on the internet to historic lows simply because most of the content is marginal at best.

These promulgators often preach about their status as “trading gurus” and often leverage the hype of digital currencies to claim they are fully invested in “crypto assets” and urge anyone reading to become one of their new “cult followers.”

They are also usually paid to market a “bulletproof” financial app or certain crypto asset to avid followers without properly disclosing that they are being paid for the advertisement.

This behavior is being encouraged by the TikTok algorithms, who order this type of misleading content at the top of searches simply because it gets more hits being a click-bait type of content.

The more outlandish the videos become, gloating about get-rich-quick schemes and 1,000% daily returns, the higher up in the search queries they usually populate when filtered through TikTok algorithms.

These accounts are known as financial “influencers” and post 100s of such videos every month featuring fraudulent success or minimizing the difficulty of profiting through trading and a mix or mash of everything in between.

Even some proclaim to have unlocked the holy grail of trading and “guarantee” 100% returns or your money back.

Another speaking point they like to touch on is how video watchers can “also” afford wealthy lifestyles without having to work, at least in the traditional way.

To dumb down the travails of investing and trading to something easier than pouring a glass of water is a lie.

Many of these novice investors are duped into paying for exorbitant services that are nothing more than promotional buzz offering hyped-up marketing language as specific trading advice.

Unfortunately, US regulators have turned a blind eye to what is happening on this nefarious Chinese platform, and imitators are spawned daily and are certainly incentivized to do so.

While I must admit that regulating this type of behavior on TikTok is incredibly messy, to leave this unchecked will result in massive fraud for the little guy that I try to help.

I will say the main reason for ignoring these TikTok “influencers” is because there is even worse cybercrime taking place out there, and the content these influencers are peddling is straddling the gray areas of the law.

The digital migration during Covid has created a tsunami of fresh cybercrime that is really making the TikTok gurus look like choir boys.

Here are some statistics to stew over, according to Gartner research.

- 88% of organizations worldwide experienced spear-phishing attempts in 2023.

- 68% of business leaders feel their cybersecurity risks are increasing in 2023.

- On average, only 5% of companies’ folders are properly protected in 2023.

- Data breaches exposed 36 billion records in the first half of 2023.

- 86% of breaches were financially motivated, and 10% were motivated by espionage in 2023.

- 45% of breaches featured hacking, 17% involved malware, and 22% involved phishing in 2023.

When digital professionals went remote, this also increased the risk of cybercriminals wreaking havoc by isolating their targets.

In the grand scheme of the internet, the TikTok trading “gurus” are small fish to fry when hackers are attempting to topple state of federal governments and Fortune 500 companies, yet that doesn’t make it okay.

The Financial Conduct Authority (FCA) is already looking into trading scams and considering ramping up its capacity to monitor those TikTok creators and others who are flogging trading signals, managed investment services, or other fraudulent services.

But it’s not enough, and readers need to understand the heightened risks of diving feet-first into these TikTok polar vortexes where you just get whipped around unknowingly.

Pre-emptively protect your portfolio by avoiding these TikTok trading gurus is the order of the day.

Stay vigilant and happy trading, and just know there is no holy grail of trading.

It’s hard work earning your crust of bread.

BUYER BEWARE

Mad Hedge Technology Letter

December 18, 2024

Fiat Lux

Featured Trade:

(UNLOCKING THE FUTURE OF TECH)

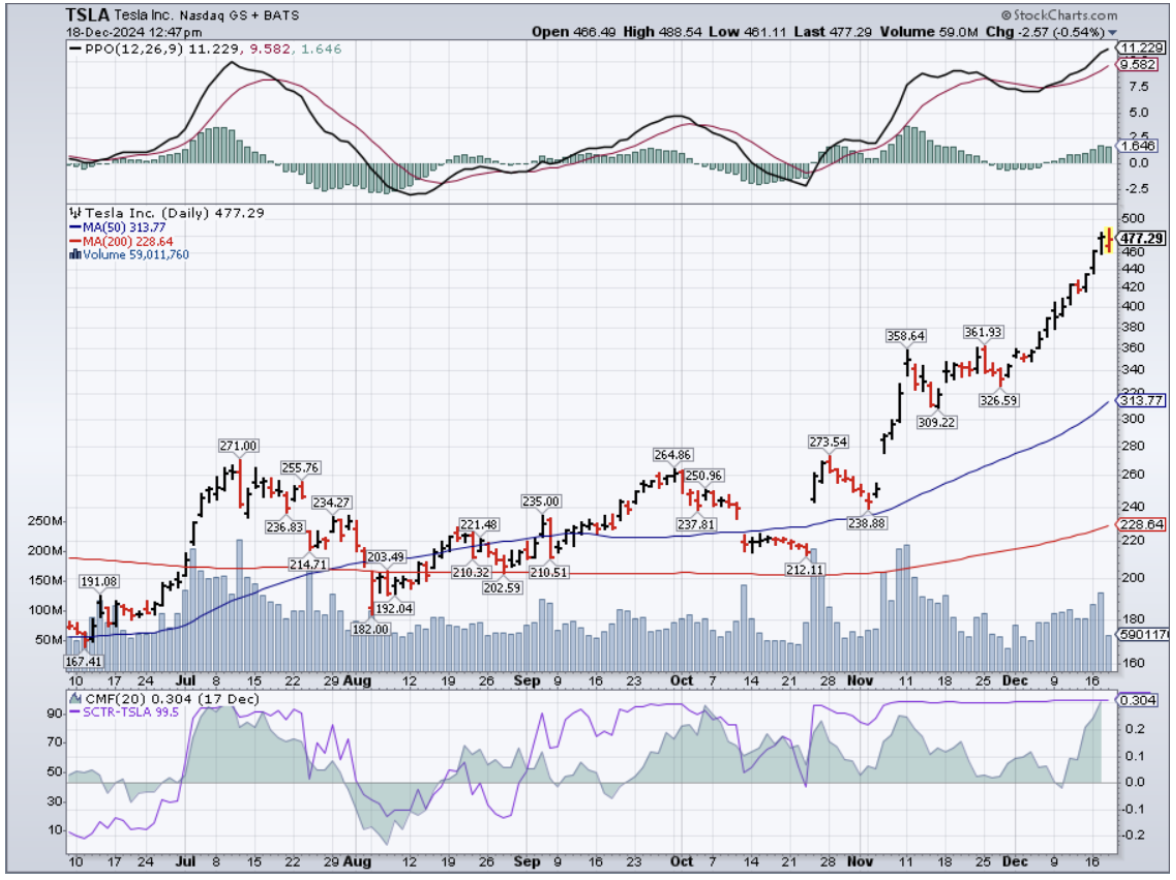

(TSLA), (NVDA), (AMZN)

Unshackling the restraints on human labor – that is where tech is headed.

I’m talking about AI.

Robots aren’t able to perform complicated tasks, and that is the holy grail of AI.

If headway is made just on this one issue, then the sky is the limit.

Profits are then unlimited, and the world will change into something we could have never imagined.

If stakes weren’t high enough, the next explosive leg up in tech shares is now centered on this concept.

There is only so much balance sheet maneuvering can add to the bottom line.

Magnificent 7 stocks who are experts are juicing up the balance sheet will gradually run out of levers to pull.

Technology stocks demand that management move the needle along because the alternative is that the company will get left behind.

When the Department of Defense commenced its robotics challenge in 2015, the stated goal was to develop ground robots that can aid in disaster recovery with the help of human operators.

Nearly a decade later, generative AI is accelerating that learning curve, pushing human-like machines to pick up new tasks in real-time.

And in June, Tesla (TSLA) presented an updated version of its Optimus robot at Tesla’s Investor Day and showed it roaming a factory floor. CEO Elon Musk touted the robot’s potential, saying it had the ability to push the company’s market cap to $25 trillion.

Humanoids that can adapt to existing environments have long been seen as the ultimate test if they can work alongside humans in spaces built for them.

Nvidia (NVDA) is driving rapid development through an ecosystem built specifically for humanoids. It combines high-powered chips that process data at high speeds with a digital world that allows users to train robots on skills applied in the real world.

Nvidia has already unveiled “NIM Microservices,” a visual training ground that allows generative AI models to visually interpret their surroundings in 3D.

Nvidia’s ecosystem now enables robots to train using text and speech input in addition to live demonstrations.

Humanoids have already begun taking their first steps into reality. Musk has said two Optimus robots are working at Tesla’s Fremont factory, and he expects a few thousand to be deployed by next year. Amazon (AMZN) has partnered with Oregon-based Agility to utilize its Digit robot at a test facility. Apptronik is working with Mercedes-Benz to integrate Apollo into its manufacturing line.

The goal is to adapt humanoid for the future, which will allow them to operate beyond industrial use. They could become as ubiquitous if companies are able to scale and bring costs down to $10,000 per machine.

Technology is still in the stage of calculating how they bring the expenses under control.

It is not very cost-effective if a company needs to spend 5 times the actual cost of running the AI division on retrofitting the environment for a humanoid and resetting the language models for different tasks.

Much of these technical aspects are being worked out, and these companies are inching their way closer to a day when companies might be able to work fully without a human worker or alongside a minimum amount of workers.

Tesla is a company long-term that needs to be looked at, and this assumption is solely based on their robotics and humanoid business. It is highly plausible that Elon Musk is at peace with sacrificing his EV business in the medium time as long as moving up the value chain to become the leader of what is next, which is looking more like robotics using AI.

Musk is skating to where the puck is next, and that is where the future will be.