Mad Hedge Technology Alerts!

A torpedo has just hit the world of digital content.

The cost of digital content is about to skyrocket as Washington D.C., plans to levy a 100% tariff on movies produced outside the states.

Actually, this is one of Hollywood’s dirty little secrets and a big way they cut costs by outsourcing film production to Eastern Europe or Southeast Asia.

Budapest, Hungary, has become a major hub for studios to geoarbitrage production, and a massive studio has sprouted up in this part of Europe.

Millions of expenses have been saved by not making movies in the United States, and so much has been outsourced that the administration has created a new tariff to get the movie business back in the United States.

I would not say this is anything like a national security threat, even to the point that I would say that Hollywood is more or less socially irrelevant in 2025.

However, corporate entertainment content still moves the needle even if people don’t watch it anymore.

It also keeps people employed, and this is a specific attempt to force whoever is making these movies to return to the United States instead of hiring cheaper Hungarians to make our movies.

Imposing a 100% tariff on all films produced abroad that are then sent into the United States will negate most of the cost savings.

A bombshell like this will hurt employment in the industry, causing companies to fire staff much like tech has been doing for the past few years.

Movie and TV production has been exiting Hollywood for years, heading to locations with tax incentives that make filming cheaper.

Governments around the world have increased credits and cash rebates to attract productions and capture a greater share of the $248 billion that will be spent globally in 2025 to produce content.

All major media companies, including Walt Disney (DIS), Netflix (NFLX), and Universal Pictures, film overseas to increase profits.

Film and television production has fallen by nearly 40% over the last decade in Hollywood’s home city of Los Angeles, because of the outrageous cost of doing business in the state of California.

The January wildfires accelerated concerns that producers may look outside Los Angeles, and that camera operators, costume designers, sound technicians, and other behind-the-scenes workers may move out of town rather than try to rebuild in their neighborhoods.

Ultimately, this tariff is devastating to digital content.

This is also on the heels of China limiting Hollywood to only 10 movie imports into China per year.

The city of Los Angeles is about to face a rash of job losses as digital content companies will turn to AI to fill out the rest of the production.

Much less content will be made if these large budget productions of over $20 million cannot be outsourced to cheaper global south employees.

In general, the cost of creating digital content will increase and be painful for the average content maker.

Who does this favor?

Those individual YouTubers who go around filming on a selfie stick while simultaneously editing their own content.

Any digital content company masquerading as a global Titanic will need to shrink accordingly and get leaner.

Americans will need to think twice whether to develop production outside of the United States with this new steep cost.

Companies that will be hurt from this are Netflix, Disney, Amazon, and Comcast.

If these executives don’t pay the tariffs, they could even find themselves locked up in Alcatraz.

Who would have thought that a few days ago?

Mad Hedge Technology Letter

May 2, 2025

Fiat Lux

Featured Trade:

(CHINESE CHIP MAKERS CLOSER THAN YOU THINK)

(NVDA), (HUAWEI)

Just the other day, CEO of Nvidia told the media, “China is not behind...This is a country with great capabilities. 50% of the world's best AI researchers are Chinese.”

So it’s not a surprise that Huawei is about to debut a new AI chip and will continue to foray into higher value-added products and stand toe-to-toe with the United States for technological supremacy.

Remember Huawei?

They were brutally banned from installing the best American chip technology, but like a boomerang, they have come back with even more ferocious ambition.

The Huawei chip called the Ascend 910D is still at an early developmental stage, and a series of tests will be needed to assess the chip’s performance.

Huawei hopes that the latest iteration of its Ascend AI processors will be more powerful than Nvidia’s H100.

Huawei has emerged as China’s champion in a technology field where the U.S. remains ahead. The Shenzhen-based company has developed some of the country’s most promising substitutes for Nvidia’s AI chips. It is part of Beijing’s effort to groom a self-sufficient semiconductor industry.

This year, Huawei is poised to ship more than 800,000 Ascend 910B and 910C chips to customers, including state-owned telecommunications carriers and private AI developers such as TikTok parent ByteDance.

Despite manufacturing bottlenecks, Huawei and several Chinese chip firms have already been able to deliver some products comparable to Nvidia chips and are inching closer to Nvidia’s level of expertise.

Old versions of Huawei chips have struggled to live up to their hype. The 910C was marketed to clients as comparable to Nvidia’s H100, but engineers who have used the two chips said Huawei’s performance fell short of its rival.

Huawei faces challenges in producing such chips at a significant scale. It has been cut off from the world’s largest chip foundry, Taiwan Semiconductor Manufacturing. China’s closest alternative, Semiconductor Manufacturing International, is blocked from purchasing the most advanced chip-making equipment.

Even though Chinese chips have been overhyped and fail to deliver, I do believe it is only a matter of time before they reach the same level of Nvidia.

If you remember what the first Chinese smartphones looked like, and compare them to what they are now, and you will understand that once the weight of the government supports these goals, many of them are met.

Just look at another example like EVs, Chinese EVs are some of the top EV products in the world, and they produce them for just a fraction of a Western-made EV.

This trend is here to stay, and with the Chinese government subsidizing the operation to push it over the line, many Western countries will have a hard time beating the Chinese on price and performance.

Silicon Valley innovation has slowed down considerably, and one of the obvious side effects is the Chinese catching up on the latest cutting-edge tech.

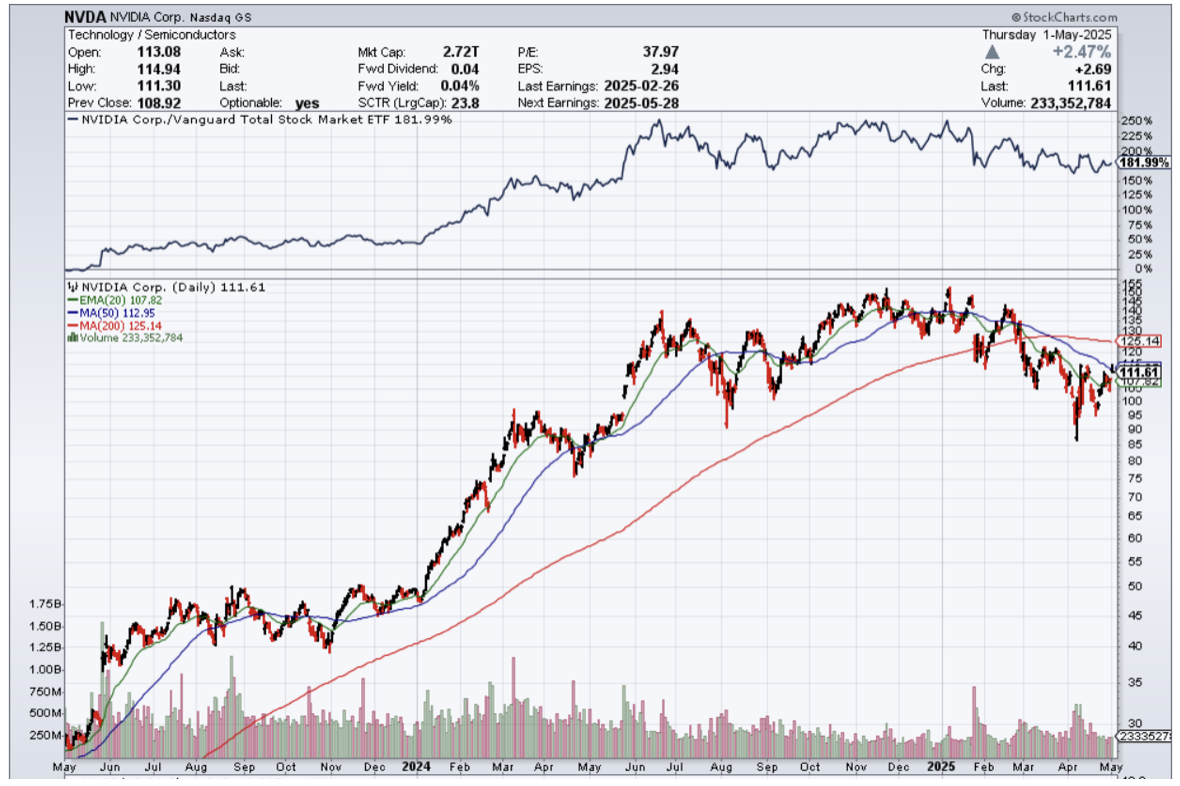

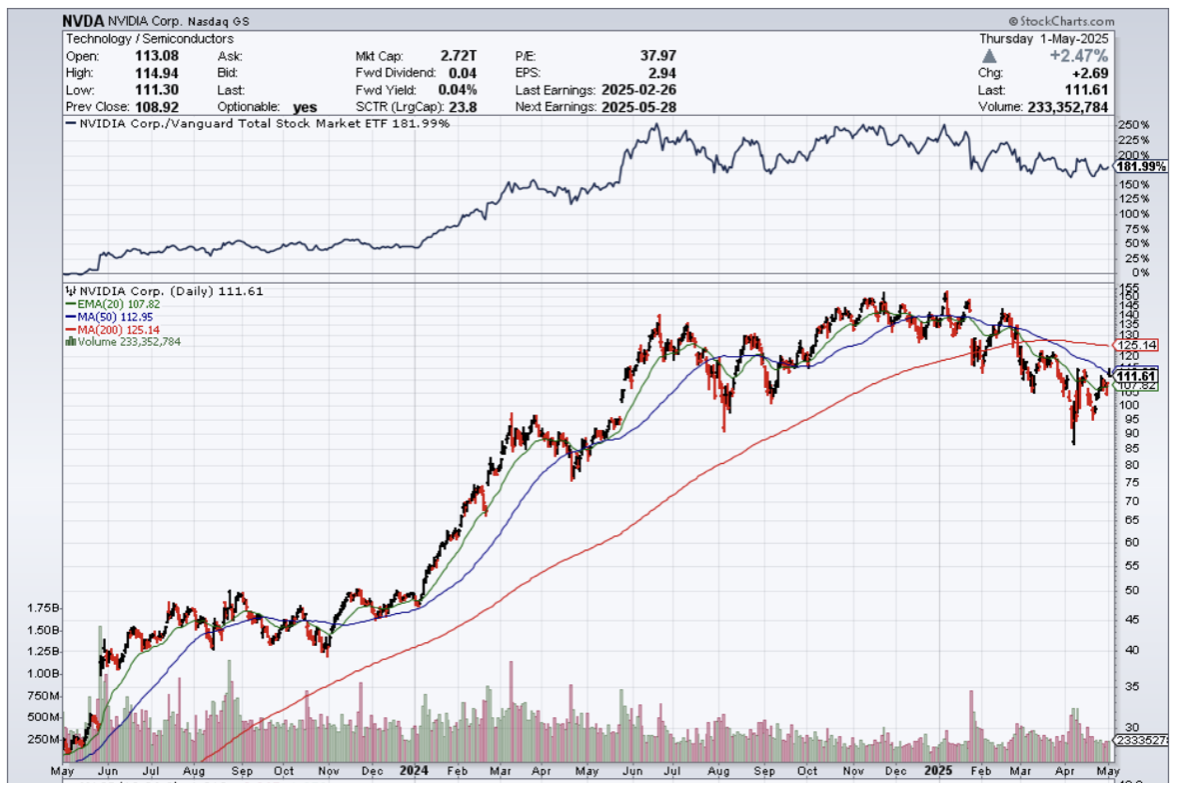

Some of this is reflected in the price of Nvidia’s stock, which has zig-zagged sideways for around the year.

Naturally, some of the stock’s weakness has to do with the volatile foreign trade policies, but a big portion of this is Chinese competition in high-end tech products.

There is a chance that we will continue to see this sideways price action in the stock, and at the very minimum, the era of breakaway growth is over for Nvidia.