Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

June 4, 2021

Fiat Lux

Featured Trade:

(RIDING THE COATTAILS OF ELLIOT MANAGEMENT)

(DBX), (TWTR), (EBAY), (CRM), (BOX)

Renowned Vulture Fund Elliott Management is at it again, looking to feast on the frail like the predator fund it is.

It was recently announced they own a large stake in cloud provider Dropbox (DBX) and has been holding private discussions with the file-sharing service provider for some time.

The hedge fund owns a stake of more than 10% which is valued at more than $800 million, the source said, declining to reveal the exact size of the investment.

Dropbox currently has a market cap of around $11 billion.

This is a cloud company that allows users to store documents, videos, and photos online, listed its shares in March 2018 at $21 a share.

Elliott has previously gotten their way at other tech companies like Twitter (TWTR) and eBay (EBAY).

Now Elliott Management is assumed to own the second biggest holding in Dropbox after CEO Drew Houston.

Elliot’s previous 13-F filing form has shown they are scooping up shares of Dropbox.

Dropbox shares also gained in March on news of a potential takeover that never came to fruition, and it smells a lot like that was Elliot.

I have heard other analysts mention Dropbox as a short-listed acquisition candidate for a handful of big players.

An acquisition looked close especially after Salesforce (CRM) announced the purchase of Slack Technologies and it’s logical that Dropbox could have been a retaliation purchase for a bigger tech company looking to keep pace with Salesforce's acquisitive thirst.

Elliot Management overtook Vanguard Group Inc. as the largest shareholder outside of Houston. Vanguard had a stake just below 10% as of March 31, according to Bloomberg.

The hedge fund has not made it clear whether it is seeking board seats on Dropbox’s board or other changes at the company.

But I will tell you there is a standard playbook that Elliot loves to roll out each time they buy into a tech company.

These changes almost always revolve around switching management and squeezing out more efficiencies in operations.

They even threatened Founder and CEO of Twitter Jack Dorsey to become more attuned to revenue acceleration so he could keep his job.

There are those who want to play the moral compass card out there, but I can say that almost any tech company Elliot Management has bought into experience a significant boost in asset appreciation 3-6 months after the acquisition.

Elliot is hyper-targeted in what they do, and they usually seek out management who has become too comfortable in their routine.

I believe they do not go after tech companies if they feel they cannot boost the underlying stock shares by 30% within a year.

They have a brilliant track record and any tech investor who doesn’t want to overcomplicate tech investing buys the same tech companies Elliot acquires.

Why?

Because changes are in the pipeline and every management or board seat change is usually met with a 5-7% surge in share price.

What’s not to like about that?

Then there are many up days on the operational front from cutting costs, and forcing through other changes that are first and foremost beneficial for the stakeholders of the company.

Other vulture fund specialists do this too like Starboard Value when they launched a proxy fight earlier this year at Box (BOX), where it has nominated four directors for the three seats that are coming available this year.

To play it simple, buy into Dropbox on the next dip and hold onto shares for the first part of the turnaround.

Once the pace of changes starts to plateau, by then, you should already have a decent-sized profit and can dump the shares.

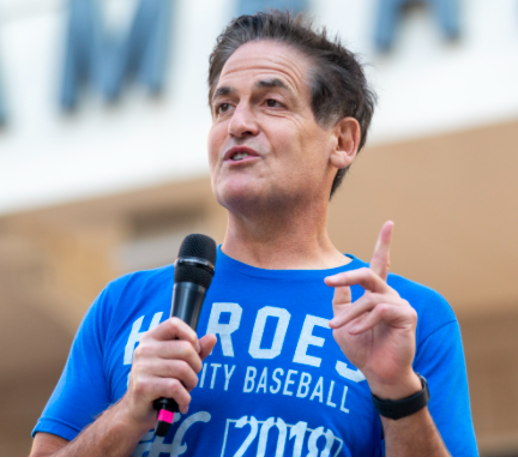

“When I was first getting started, I told myself that there's two people in the world when it came to technology: There's the people who created it and there's everybody else.” – Said Tech Investor and Owner of an NBA Franchise Mark Cuban