Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

November 25, 2024

Fiat Lux

Featured Trade:

(TECH STOCKS COULD ENTER A RENAISSANCE)

(NVDA), (TSLA), ($COMPQ)

The consensus of AI and robotics only taking “blue-collar” jobs is now steadily morphing into a new type of rhetoric.

It was once seen that heavy labor, like Amazon’s robots hauling away heavy items in a warehouse, was the widespread case for robots and AI.

However, I’ve been talking to many industry experts who have privately confided that it could be white-collar jobs that receive the most dramatic cuts.

Think about it, can AI and a robot really do the same job as an HVAC repairman or even a plumber?

If tech is able to solve that level of complexity, then the sky is the limit for tech, but I don’t believe we are anywhere near that yet. It is more likely that people typing simple code into computers will be swapped out for an algorithm, which would be an easy one-to-one switch. Jobs that don’t require a physical presence will always be first in line to be cut.

AI has proven that it operates with limited common sense or street smarts, and in some jobs, these 2 skills are essential to performing well.

By analyzing over 24,000 AI-related patents filed between 2015 and 2022, the researchers were able to identify which occupations might be most affected by emerging AI technologies.

Surprisingly, some of the occupations with the highest scores were white-collar jobs requiring advanced education and specialized skills. Topping the list were cardiovascular technologists and technicians, sound engineering technicians, and nuclear medicine technologists. Other jobs at high risk of automation included air traffic controllers, magnetic resonance imaging (MRI) technologists, and even neurologists.

In the information technology sector, 47% of software developers’ tasks and 40% of computer programmers’ tasks were found to align closely with recent AI patents. These patents focused on automating programming tasks and developing workflows, suggesting that even highly skilled tech jobs may not be immune to AI’s influence.

The least likely to be impacted by AI in the near future tended to be blue-collar jobs requiring physical labor or manual dexterity, such as pile driver operators, dredge operators, and aircraft cargo handling supervisors.

Just looking at the new increases in amount of robots suggests that job replacement is coming thick and fast.

Slightly more than 10% of South Korea's workforce has been replaced with robots.

The country has increased its use of robots by 5% each year since 2018.

China, with 470 robots per 10,000 employees, has overtaken Germany and Japan and landed in third place behind Singapore.

The United States ranked 10th with 295 robots per 10,000 employees.

North America's robot density is 197 units per 10,000 employees – up 4.2%.

America has lost around half a million jobs to robots so far, but I believe this concept isn’t linear, and we won’t be able to just extrapolate our current trends into the future.

Once it rains, it will really pour.

It is no coincidence that software companies are firing software engineers in large groups. Silicon Valley has really trimmed the fat off the boat, taking the cue from Elon Musk firing 80% of Twitter and functioning meaningfully better.

I come back to this concept of tech companies operating with algorithms powered by AI with a few “managers” and executives.

We aren’t a few days or months from this coming to fruition, but we are years.

The complete overhaul in staff numbers would mean that tech stocks would enjoy a renaissance and rise 5X to 10X from today’s levels to the joy of shareholders.

American society has never held such a high portion of its wealth in tech stocks, and that will continue as tech stocks get bid up and tech companies doing anything under the sun to massage the stock higher.

The top groups of tech companies ($COMPQ) are still growing around 4X more than the other listed companies, but that doesn’t mean they are sure-fire buy-and-hold stocks today.

In fact, there is a legitimate case that the gap between tech and the rest will narrow as we roll into 2025, making tech stocks marginally unattractive if a full-fledged rotation occurs.

I am not downplaying tech, but sometimes the sector needs a little breather or sideways correction.

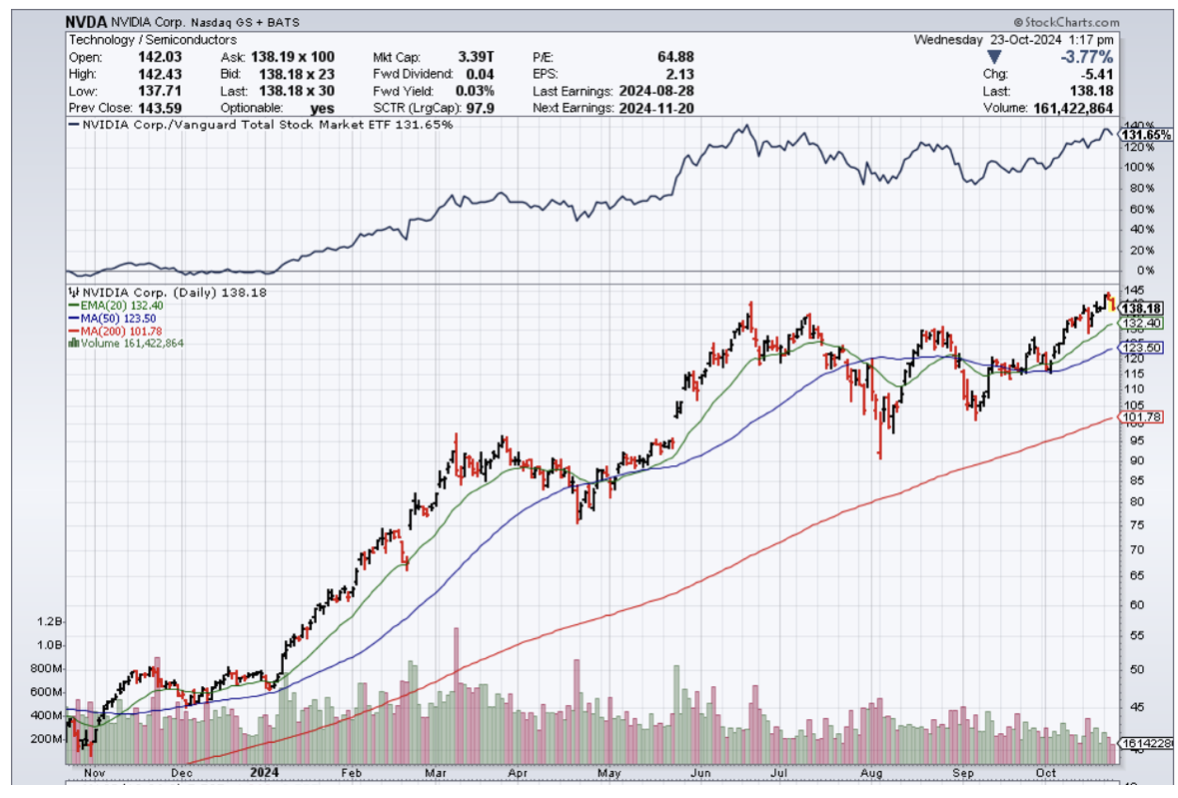

Much of the over performance in 2024 has been breathtaking with the gem of the group Nvidia (NVDA).

I am not saying that there will be a non-tech Nvidia-like firm sprouting up from nothing in 2025, but the rate of stock acceleration could face some resistance in the tech sector.

That is why it is important not to chase big gains and wait for stocks to come to you as investors book profits to close the year.

There will be moments where you wish you waited.

Remember, much of tech’s success has already been priced into the stock, and looking out, they will need to deliver another bounty of alpha for shareholders to bid up the price even more.

That is certainly what Nvidia is doing as they impress and then reestablish a new higher goal.

The rally isn’t over, but readers will need to pick their spots.

Since peaking on July 10, big tech stocks have fallen 2%. That lags every major sector in the S&P 500, with the utilities, real estate, financial, and industrial groups jumping more than 10% and the broader index gaining 3.1% over the same span.

Microsoft faces concerns about its prospects in AI. Apple has seen early signs of tepid demand for its newest iPhones, although long-term optimism helped send the stock to a record last week. Amazon investors are worried about heavy capital spending eating into profits. And Alphabet has regulatory uncertainty as the US Justice Department investigates it for monopoly practices.

In the third quarter, Microsoft, Alphabet, Amazon, and Meta Platforms are projected to have poured $56 billion into capital expenditures, up 52% from the same period a year ago.

This is getting expensive, and investors want to know if the expenses are becoming too burdensome to the point that it doesn’t make economic sense.

Raising concerns about future profit margins was never a concern, but it suddenly is for tech investors looking down the road.

Top-line gains are starting to get offset by surging AI-related capital spending.

The reason for the optimism is fairly simple. For all the concerns, they continue to offer above-average profit growth, exposure to AI, strong capital returns, and less risk than other stock market sectors.

They are still attractive businesses with established business models, but at what price?

This earnings season will finally be the acid test to whether investors co-sign management’s vision to grow earnings in 2025.

The path is certainly much harder than in years past, and the goalpost continues to shrink.

Opportunities will present themselves as many companies might need a short-term haircut after earnings.

I still like the tech sector, but I would like it more if the expensive prices were reigned in.

For companies like Nvidia or Tesla, I don’t believe that will be possible, but the tier after that should offer optimal chances to pocket some high-quality names at better prices.