Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

November 18, 2024

Fiat Lux

Featured Trade:

(SPOTIFY WORTH A LOOK)

(SPOT), (META), (PINS)

If new research from Pew Research is anything close to accurate, there appears to be a massive shift underway that has major ramifications for the online media landscape.

Pew Research discovered that 40% of young adults rely on social media influencers without formal journalism training.

Gone are the days when journalists needed to cut their teeth doing coverage on the ground.

This phenomenon has reversed with social media influencers and podcasters dishing out the real media from the comfort of their home.

Yes, this has been happening for a while, but the data suggests we are on the cusp of the legacy media becoming the minority.

The evolving landscape was most notably taken advantage of the richest man in the world, Elon Musk, who used X.com to propel him into politics.

Most social media users relying on news influencers say the information they offer is unique and sometimes more helpful than what they’d find elsewhere and less likely to be fake.

Social media news is also reliant on ad revenue to stay afloat, so in that sense, it could be beholden to advertiser demands on viewpoint and ideology. The legacy media has the same ongoing problem with advertisers, and I believe there is no perfect model.

Yet, the direct connection of social media profiles to audience has grown and will remain attractive moving forward.

According to the survey, traditional journalism is dead, and 40% of young adults under 30 rely on these news influencers to stay updated on current events and politics.

While X, formerly Twitter, is the most popular platform for news influencers, video app TikTok and Google’s YouTube are home to the largest share of news influencers who monetize their content and have no formal background in journalism. Of the news influencers on TikTok, 84% haven’t worked in journalism, and roughly three-quarters of those influencers try to make money off their news analysis, whether by asking for tips, peddling merchandise, or touting separate subscriptions to additional exclusive material, Pew found.

The Pew report analyzed hundreds of news influencer accounts with more than 100,000 followers; surveyed more than 10,600 US adults about their news consumption habits; and reviewed content from more than 100,000 posts across Facebook, Instagram, TikTok, X, and YouTube from July and August.

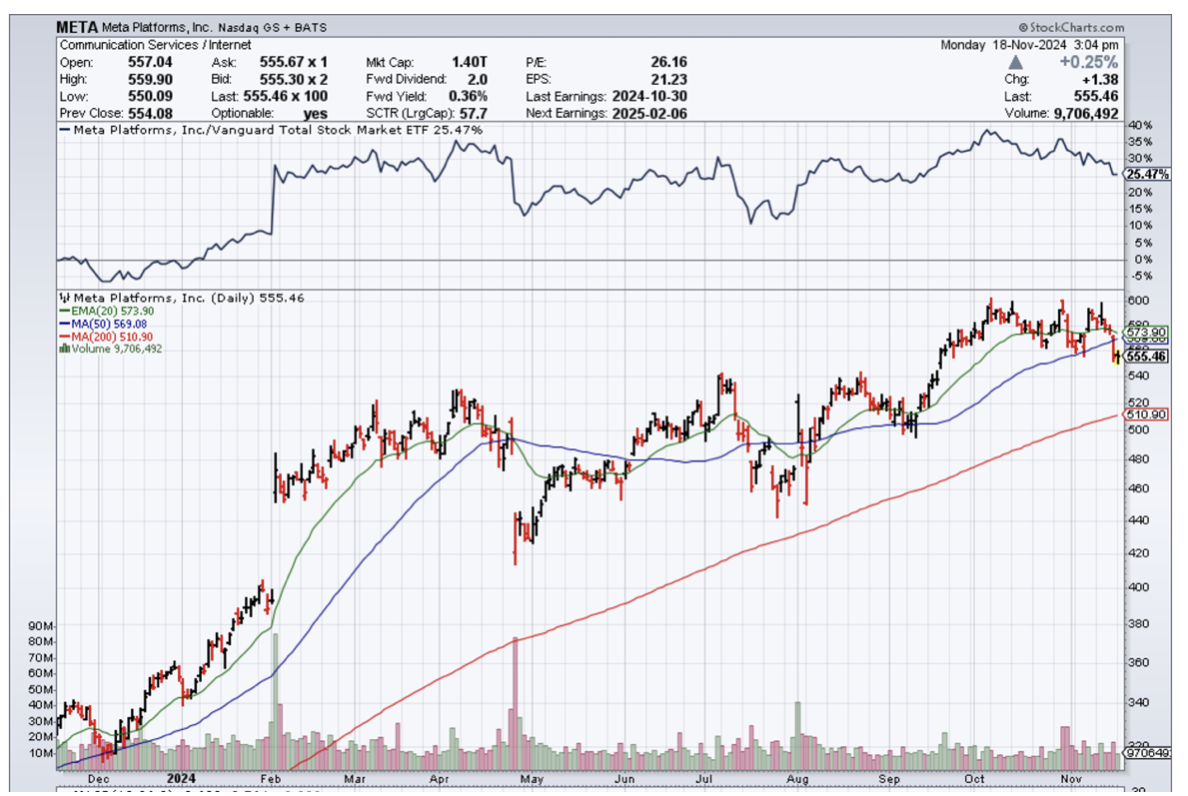

One of the reasons traders cannot short META stock is because of this cash cow business tied to social media.

Instagram and Facebook are still great businesses, even if they aren’t growing like they used to.

TikTok is a private company, and so is X.com, and there are no stock opportunities there.

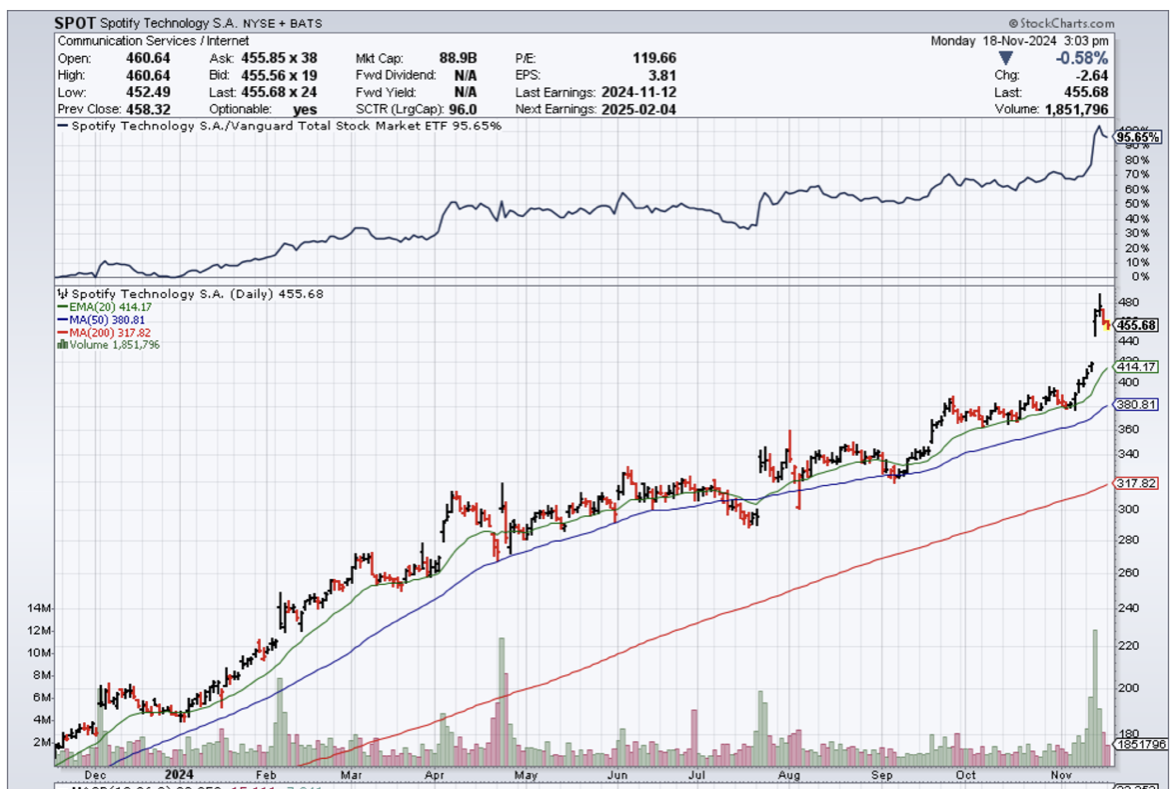

However, I would suggest readers take a look at Pinterest (PINS) and Spotify (SPOT).

PINS is still growing almost 20% per year, and I do believe the stock has an upside with the recent involvement of venture capitalists.

SPOT is in the podcast industry and has a locked-in quasi-monopoly in this sub-sector.

Podcasts and their popularity have exploded in the past few years, highlighted by SPOT signing podcaster Joe Rogan to a monster $100 million contract.

Legacy media has also followed up the election with terrible audience numbers, suggesting that the existing viewer base has decided to move on or temporarily pause participation.

META, PINS, and SPOT should be serious buy-the-dips candidates moving forward as the pivot to alternative media goes from a drip to a waterfall. As I am rereading this newsletter, the AP just fired 8% of its staff, citing “fast- changing conditions in the media industry.”