Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

October 18, 2024

Fiat Lux

Featured Trade:

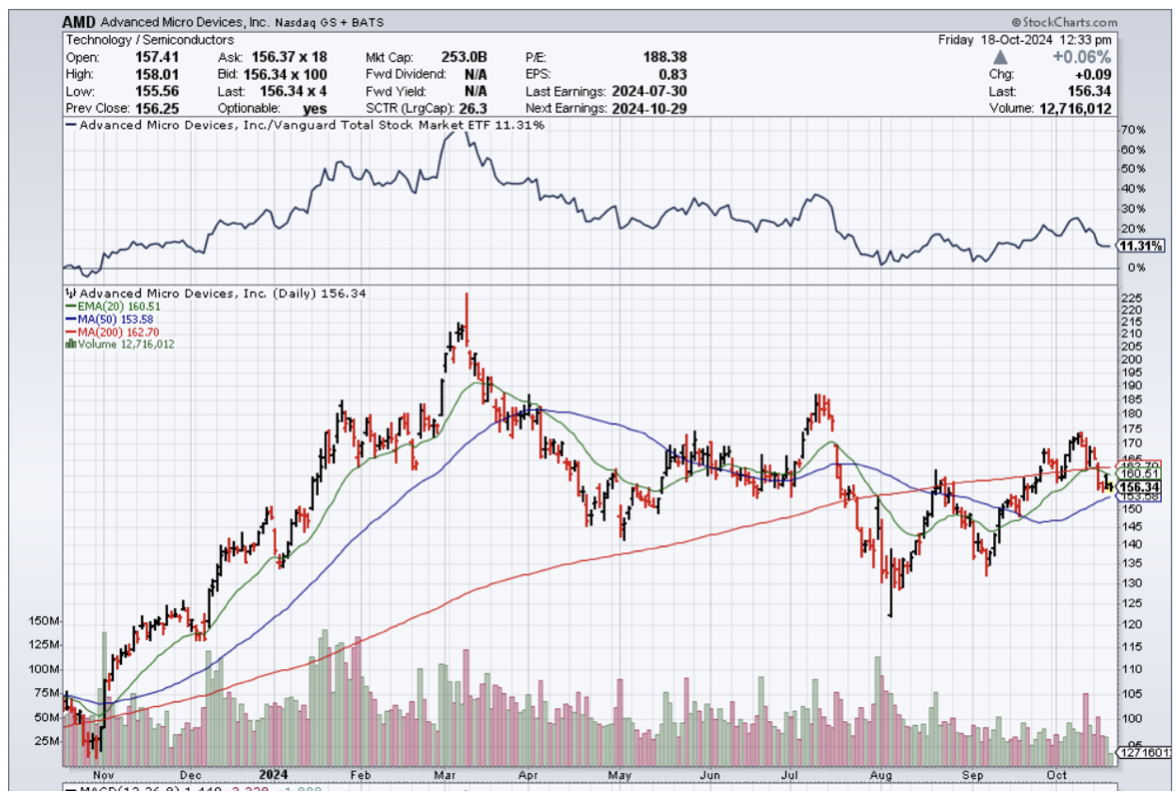

(AMD GAINING MARKET SHARE)

(AMD), (NVDA)

If you thought that AI chips had reached the high water mark, then you are entirely wrong.

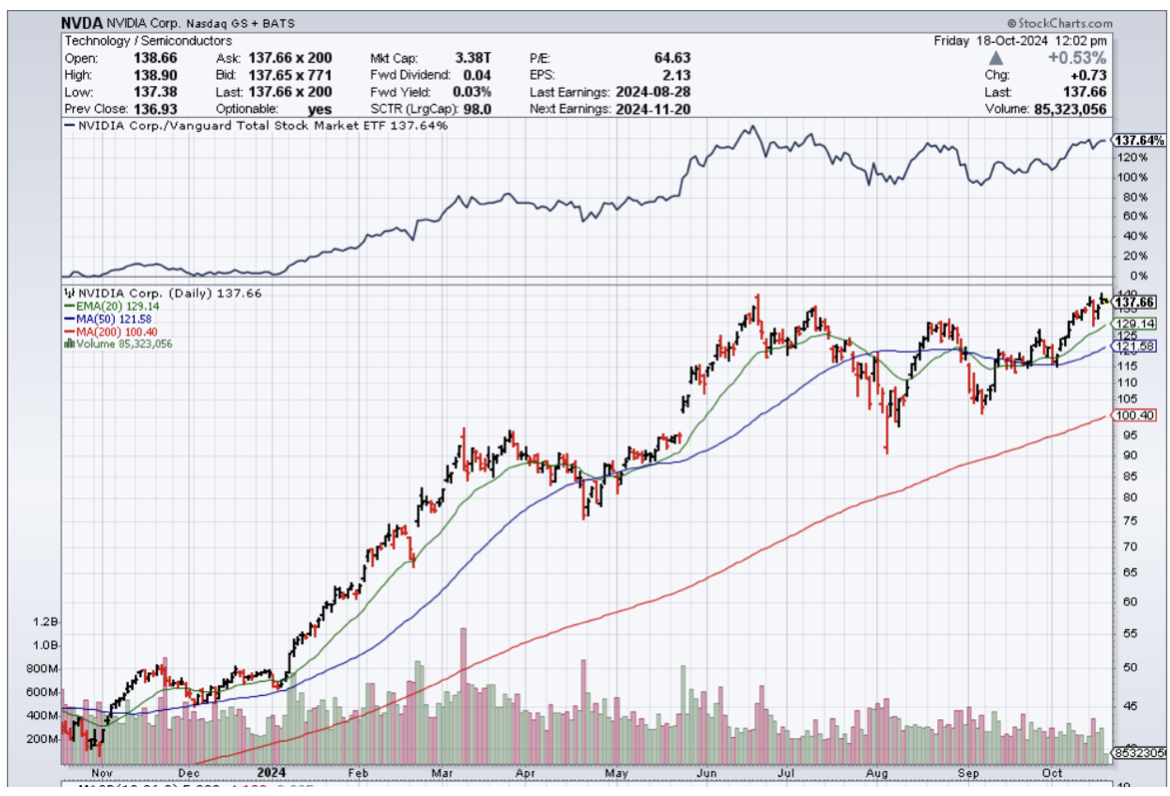

Nvidia has been one of the only games in town, and that is a strong sign of a first-mover advantage.

In fact, the ecosystem could benefit if several chip companies could rise to the occasion to infuse that extra bit of supply.

Nvidia is on record, saying they can’t meet demand.

Well, we have finally reached the next phase of the AI chip story, and that is the next company stepping up to the plate.

AMD (AMD) has been working furiously to get into the AI GPU game, and it appears as if their harvest is just around the corner.

For the past 18 months, Nvidia (NVDA) has dominated the GPU industry with a ball-busting market share of up to 98%.

Nvidia's H100 GPU set the benchmark for AI training and AI inference.

The H100 is still a sizzling product today, and Nvidia continues to struggle with supply constraints because demand is so high from leading AI companies like OpenAI, Amazon, Microsoft, and more.

Those supply challenges have opened the door for competitors like Advanced Micro Devices to swoop out of nowhere. The company announced its own data center GPU called the MI300X at the end of 2023, which was specifically designed to compete with the H100. So far, it has lured in some of Nvidia's top customers, including Microsoft, Oracle, and Meta Platforms.

AMD forecasts the MI300 series will propel its GPU revenue to a record $4.5 billion in 2024 - an estimate that has already been raised twice.

Nvidia still is the champion - it started shipping its new H200 GPU earlier this year, which is capable of performing AI inference at nearly twice the speed of the H100.

Nvidia is now focused on its latest Blackwell chip architecture, which paves the way for the biggest leap in performance so far. The new GB200 NVL72 system is capable of performing AI inference at a whopping 30x the pace of the equivalent H100 system.

AMD is preparing to ship another new GPU next year called the MI350X, offering a staggering leap in performance of 35x compared to CDNA 3 chips like the original MI300X.

Advanced Micro Devices has explicitly said the MI350X will compete directly with Nvidia's Blackwell chips.

Nvidia plans to ramp up shipments of Blackwell GPUs during its fiscal 2025 fourth quarter.

A 114% increase year over year in data center revenue is what it looks like on the balance sheet for AMD.

Developing artificial intelligence (AI) software wouldn't be possible without data centers and the powerful graphics processing chips (GPUs) inside them.

This is where we stand – at the beginning of an AI-induced supercycle in technology stocks.

AMD is clearly the 2nd horse in the race that will pick up market share on Nvidia.

This could easily turn into a duopoly of GPU chip companies, and readers would be ignorant to not apply this knowledge a trading regimen.

Wait for a substantial dip to buy into AMD shares.

You’ll regret it if you don’t, especially long-term.

“A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful.” – Said American Investor Warren Buffett