Mad Hedge Technology Alerts!

Millennials usually stick with the stocks that they know.

That’s all fine until it takes a bite out of their wallet.

Some of these decisions based on the products that represent this generation have been stock market disasters of late.

Sadly, many Millennials were too young to catch the ride up for Tesla.

Many older generations got into the stock at $20, $40 and $100 and rode the elevator up with an ultra low-cost basis.

I can’t say the same for Millennials as many came of age and finally had the money to splurge for shares after the stock had plateaued.

This was a cringe-worthy lesson that just because a company has a great product doesn’t always mean the stock is just as great.

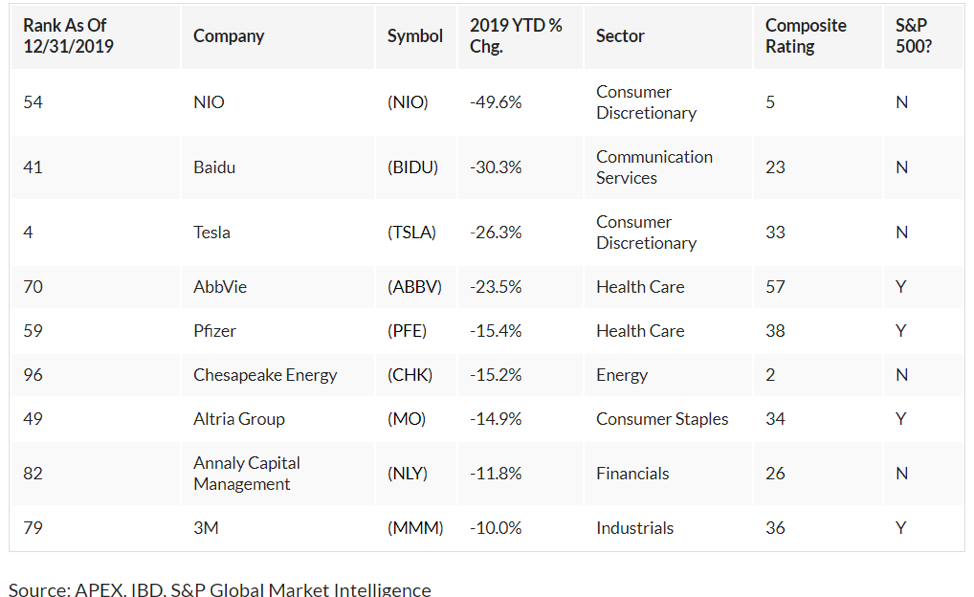

Electric Vehicles (EV) are front and center of the Millennial consciousness and that also meant that many scooped up NIO which is the Chinese version of Tesla.

After peaking at $10 in March, the stock is now trading at $3.

Many Chinese IPOs that go public in New York are of a pump-and-dump mentality as they shower the public with losses.

In fact, many Chinese IPOs only have the goal of going public without the goal of doing much more after that.

NIO has yet to be found out completely, but the Chinese economy is hurting and the Chinese consumer has reigned back the purse strings as times become lean.

As we head into a global slow down, electric car companies that lose boatloads of money will be in the firing line for value revaluations.

In fact, I would urge any reader to steer clear of any Chinese company traded on the public markets because of opaque financials that are intentionally obfuscated.

Baidu is another favorite of the Millennial generation pigeonholed as the “Google search of China.”

That moniker is an impressive catchphrase but it doesn’t do much to rejuvenate the large loss in market share that Baidu has ceded to Alibaba and WeChat platforms.

Baidu has lost its mojo and is bleeding usership and it will be hard to reverse it as Baidu never evolved with the changing trends of Chinese consumers.

Baidu peaked in April 2018, at $250 and is now trading at less than $108 and the slide isn’t over yet as Baidu has no adequate response to the domination of the other Chinese tech behemoths.

Yes, many tech trends have legs and are secular shifts that have major ramifications to the global economy.

But the devil is in the details and peels back the layers to be aware of developments such as CEO of Tesla Elon Musk building an American Gigafactory in Shanghai at the worse time in economic history as a legitimate canary in the coal mine.

As robust as the Chinese consumer has been, the latest contagion of African swine flu that culled a major amount of Chinese pigs has raised the price of pork by over 45%.

Chinese consumers are hyper-aware of these economic developments in the year of the pig.

After a massive ride up in Chinese tech shares and electric car story that took many investors breath away, we are at the beginning of a meaningful revaluation that will change the narrative moving forward.

Timing is everything in this game.

“I don't care about revenue.” – Said Founder of Alibaba Jack Ma

Mad Hedge Technology Letter

September 16, 2019

Fiat Lux

Featured Trade:

(GILLETTE’S MARKETING FLUB)

(PG)