Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

August 30, 2024

Fiat Lux

Featured Trade:

(AI SQUEEZES OUT TECH WORK FORCE)

(AI), (NVDA)

Don’t be in denial about artificial intelligence.

The more you fight it – it will fight you back.

It is coming for us and you need to adjust your life accordingly.

That is largely the message I want to convey to readers because the existence of tech companies and how they function has never been changing at such warp speed until today.

Instead of getting all worked up about the hoopla of what it will bring like it is some shiny new Porsche in the garage, we need to get into the weeds to see how it will manifest itself inside the real world.

While the rest of the world still has no idea what artificial intelligence is, tech workers in the Philippines are already living and breathing the new reality every day for better or worse.

The spoiler here is that it is mostly bad for the local workforce in the beautiful island and sovereign nation of the Philippines but positive for the bottom line.

It’s not a shocker that foreign companies don’t like to pay high wages and will even skirt around the low-wage area if they have their way.

Until today, tech workers in the likes of Moldova, Montenegro, and the Philippines were irreplaceable because they represented good value for labor.

Now these workers are getting crushed by the dreaded AI substitute software.

All of the major players in its vast outsourcing industry, which is forecast to cross $38 billion in revenue this year, are rushing to roll out AI tools to stay competitive and defend their business models.

Over the past eight or nine months, most have introduced some form of AI “copilot.” These algorithms mainly work alongside human operators.

Avasant, an outsourcing advisory firm that works extensively in the Philippines, estimates that up to 300,000 business process outsourcing (BPO) jobs could be lost in the country to AI in the next five years.

In February, payments company Klarna Bank announced AI bots were conducting two-thirds of all customer service interactions, equaling the work of 700 full-time agents.

Readers cannot fall asleep at the wheel by downplaying this transition in the business model of tech companies.

This movement to bots has the potential to save many percentage points of expenses on labor.

I don’t know any CEO who is actively ignoring this hard pivot to software.

For every success story, there will also be failures because let's get this straight, not every CEO or COO knows how to implement and harness the powers of AI.

Not all managers are created equally.

I know it sounds cliché to look at big tech but they are the powerbrokers of the AI industry and unsurprisingly are the ones pouring the most capital into this new technology.

The end results are that only a handful of companies will secure the bounty of profits that AI will deliver.

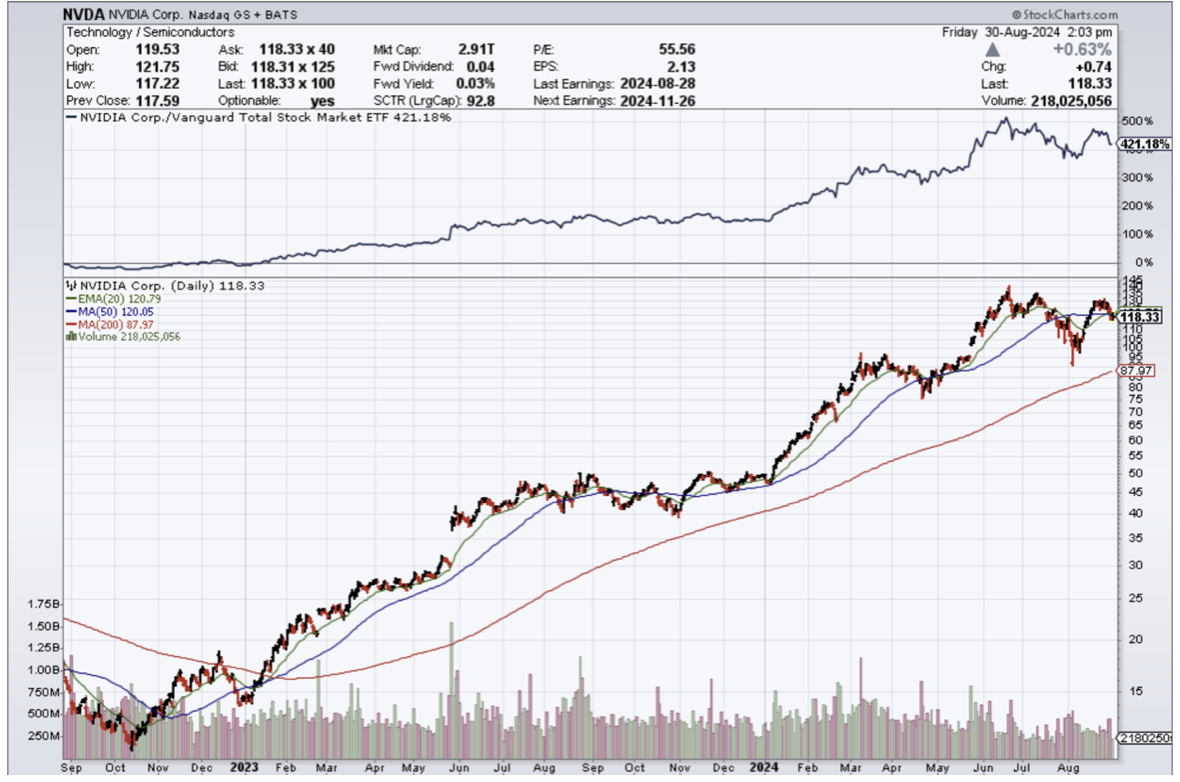

There will be surprises on the way but Nvidia relaying to investors that the AI narrative is still here is just as important as management talking about how great AI is.

The only caveat I would say is that the honeymoon phase of AI is definitely coming to a close.

Now the real tough sledding starts ahead of us.

For the time being, pick up shares in Nvidia on this nice dip.

Mad Hedge Technology Letter

August 28, 2024

Fiat Lux

Featured Trade:

(NOT SUPER BY SUPER MICRO)

(SMCI), (NVDA)