Mad Hedge Technology Alerts!

“Life's tragedy is that we get old too soon and wise too late.” – Said Benjamin Franklin

Mad Hedge Technology Letter

August 14, 2024

Fiat Lux

Featured Trade:

(POSITIVE SIGNAL FOR THE TECH RALLY)

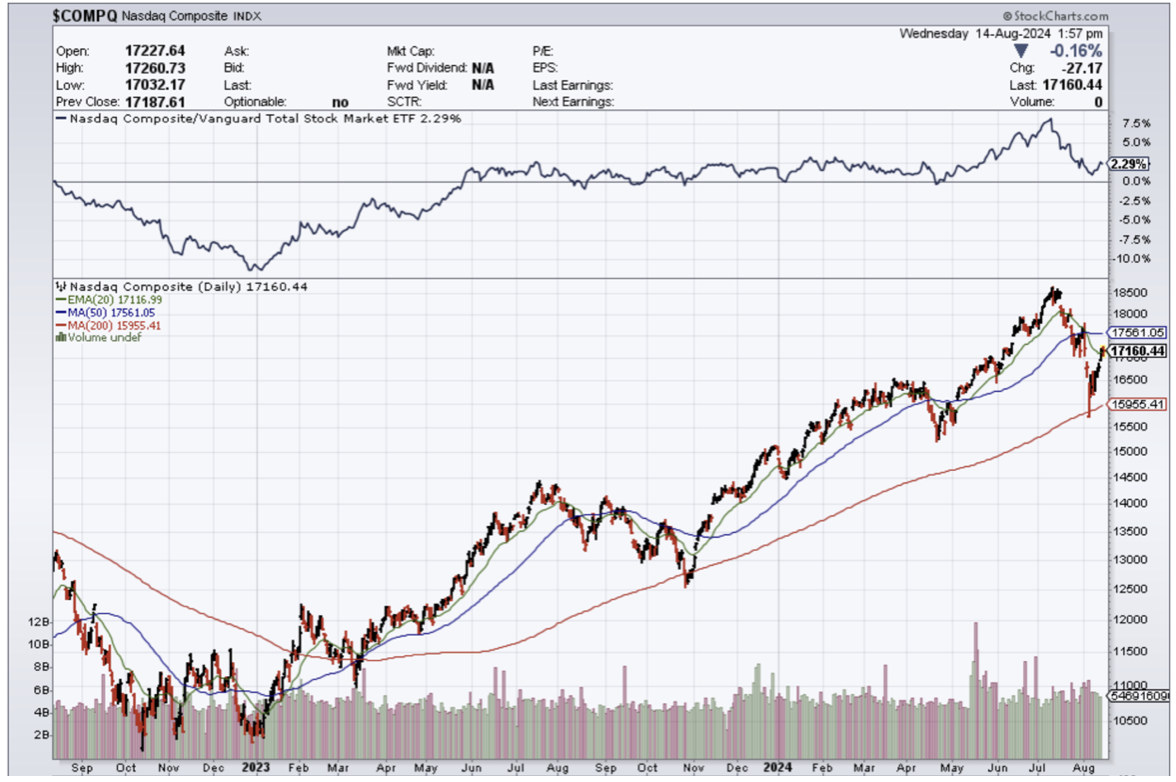

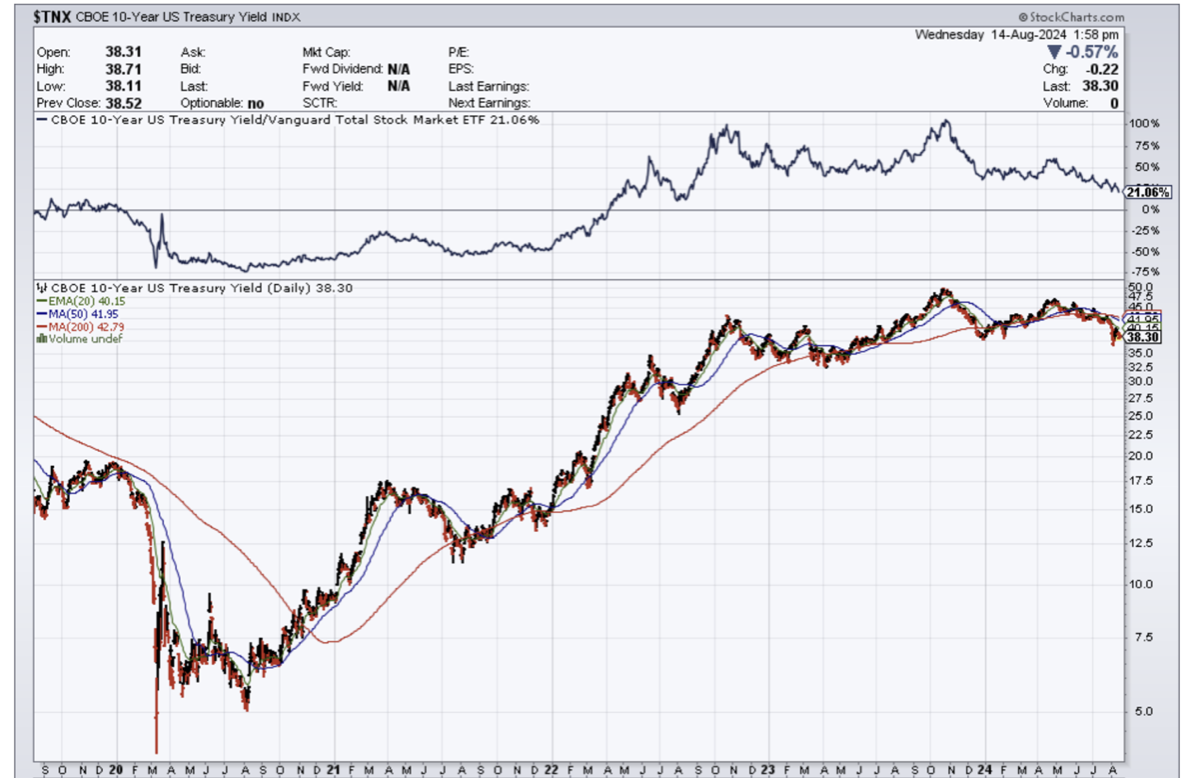

($COMPQ), ($TNX)

We received highly bullish news from the fiscal policy side today.

Conditions are everything in the short-term which is why macro events sometimes steal the whole show by destroying or propping up market sentiment.

Scare events can shock investors and become the impetus to take profits to protect capital.

Fortunately, the data from the CPI index has most likely given the green light for the US Central Bank to officially initiate its easing cycle next month.

My guess is that Fed Governor Jerome Powell cuts by 25 basis points and it could turn out to be a hawkish cut.

This is massively bullish for tech stocks ($COMPQ) leading up to the next earnings report in October.

This sets the backdrop for tech stocks to motor towards the upper left in upcoming months.

Lower rates ($TNX) translate into lower costs of capital for tech stocks to borrow money for paying stuff like salaries, software, and hardware.

The high-rate environment has translated into a dearth of companies going public and has stifled the creative juices at the formative stages of Silicon Valley.

That last jobs report offered new signs of a cooling labor market, which stoked fears that the Fed may have waited too long to start lowering interest rates after keeping them at a 23-year high for the last year.

A milder inflation reading released Wednesday removes one of the last hurdles the Federal Reserve needed to clear before cutting rates in September.

The Consumer Price Index (CPI) increased 2.9% over the prior year in July, down from June's 3% annual gain in prices. On a "core" basis, which strips out the more volatile costs of food and gas, prices in July climbed 3.2% over last year — down from 3.3% in June. That was the smallest increase since April 2021.

The new numbers are the latest confirmation that inflation is in fact dropping off a cliff after heating back up during the first quarter of the year, a development that prompted the Fed to warn at one point that rates would likely stay higher for longer.

Fed Chair Jerome Powell made it clear at the end of last month that a cut in September was “on the table” as long as the data supported it. He and other policymakers have said they want to be sure that inflation is in fact moving “sustainably” down to their 2% goal.

Tech stocks have positively correlated with interest yields since 2020, which is counterintuitive.

What this really means is that the growth rate of tech has overpowered the 5% Fed Funds rate which is quite impressive.

That high rate was supposed to pummel tech stocks and that fear-mongering failed to materialize.

No doubt the AI boom delivered a helping hand to tech shares as well.

Tech stocks were one of the few sectors in the public market that remained attractive in the face of aggressive rate hikes.

With the Fed almost to the point of reversing hawkish policy, I do believe it is “all systems go” for tech stocks in the short-term and this removes yet another possible black swan event off the table.

I am bullish on tech shares in the short-term.