Mad Hedge Technology Alerts!

Mad Hedge Technology Letter

August 9, 2024

Fiat Lux

Featured Trade:

(WARNING SIGNS LITTER THE TECH NARRATIVE)

(ABNB), (BKNG), (EXPE)

It was early.

The real recession doesn’t kick into gear for another quarter or so.

This was just a quick fake-out.

The bond market freaking out and pricing in 1.25% Fed Funds’ cuts was a generous gift to tech stocks.

Why do I say that?

It is a dip in which we can get into tech prices at cheaper prices – probably the last time before the U.S. election.

We are starting to receive confirmation from many earnings reports that the consumer is starting to get cold feet.

The pullback in consumer strength runs the whole gamut from home improvement to restaurant eating.

I cover tech and the weakness is multi-pronged stemming from hardware to software.

The latest to ring the alarm about sluggish consumer spending was the digital accommodation platform Airbnb (ABNB).

Airbnb earned sales of $2.7 billion for the same quarter last year and now they have told investors that for next year they plan to target $2.5 billion of sales.

The culprit blamed by Airbnb management is the American consumer.

Americans are shortening their Airbnb stays and soon they could be sacrificing Airbnb altogether. Although we aren’t at that point yet, US consumers simply can’t stomach this new wave of price increases for the cost of living, and reigning back discretionary travel is this logical item to shave from the budget.

The second quarter continued a trend of decelerating bookings growth for Airbnb. The total value of all bookings through Airbnb grew 11% year over year to $21.2 billion for the three-month period. That's down from 12% booking growth in Q1, 15% growth in the final quarter of 2023, and 17% growth in September-ended third quarter of 2023.

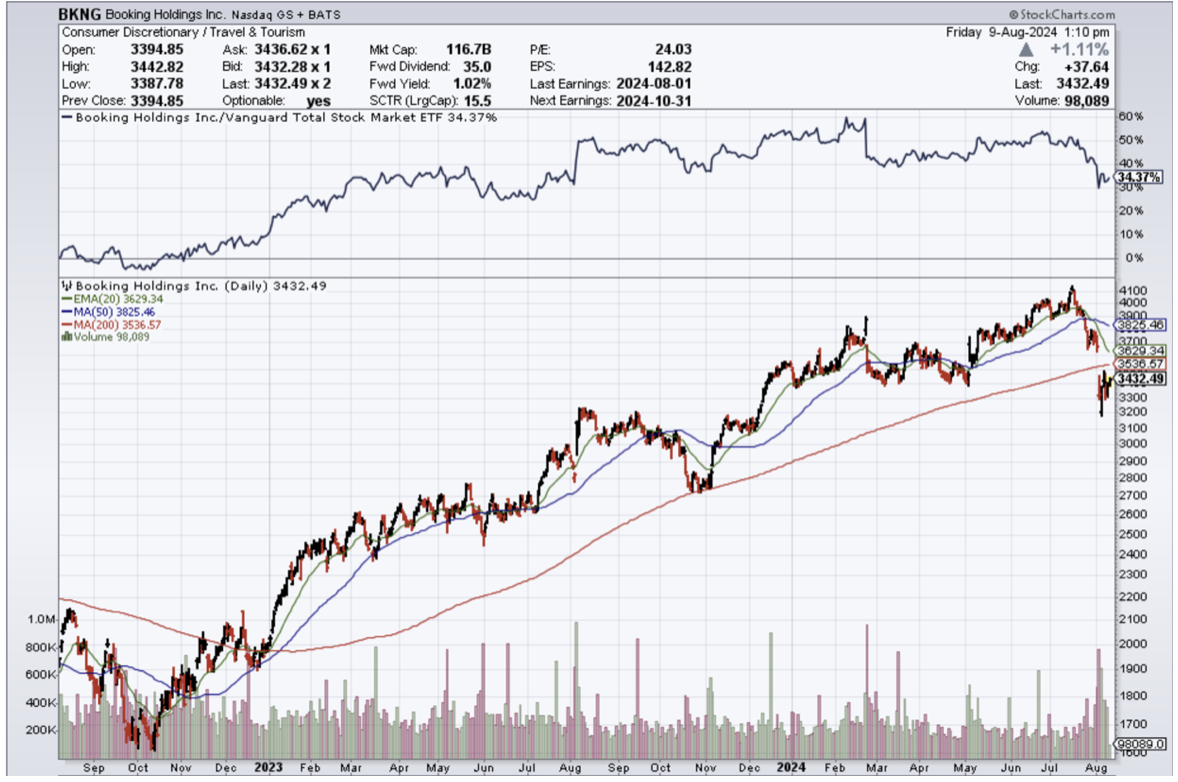

In 2022 and 2023, Airbnb, Booking Holdings (BKNG), and Expedia Group (EXPE) benefited from a bounce-back in travel after the harsh lockdowns prevented many types of travel in 2020 and into 2021. So-called revenge travel powered strong sales growth for the companies. But the picture appears to be shifting.

It is hard to see the US consumer just bouncing back with a V-shaped trajectory and that could affect Airbnb sales.

Reports out of high costs states like Washington and New York peg $150,000 per year in income as “lower middle class.”

There has also been a huge migration shift from wealth moving out of blue states to red states in the hope of maintaining purchasing power through these high inflation times.

The fact of the matter is that $35 trillion in Federal debt is the most important topic for this upcoming U.S. President Election, but this topic has been completely sidelined from the national discourse.

This surely means higher debt down the road and a further deterioration in the US consumer profile.

Tech companies with large moats around their business models will get through these times, but for Airbnb, they don’t have this type of moat because consumers don’t necessarily need to travel. Consumers do need to eat, sleep, and drive a car to work.

They can simply just delay travel for a few years before they reload financially.

It is high time to unload stocks like Airbnb even if they are leaders in the home-sharing sub-sector in tech.

Airbnb shares are down around 32% in the past few months highlighting the need for overly expensive tech stocks to adjust to the new reality.

I do believe there is another leg down in shares before an optimal window to buy on the dip presents itself, but that appears to be around $90-$100 per share.

“Apple doesn't do hobbies as a general rule.” – Said CEO of Apple Tim Cook