Mad Hedge Technology Alerts!

Tech stocks ($COMPQ) won’t be down for too long. It’s been a while since we were caught by a right hook to the jaw, but it still hurts nonetheless.

The myriad of weakness was triggered by weakening employment numbers suggesting the internals of the US economy are falling apart.

Some of the big names are down, but that doesn’t mean they are down and out.

In fact, big tech didn’t fare that badly during earnings even though lots of little software companies were crushed.

It is true that forecasts have been substantially weak as enterprise spending is reigned in and belts tightened.

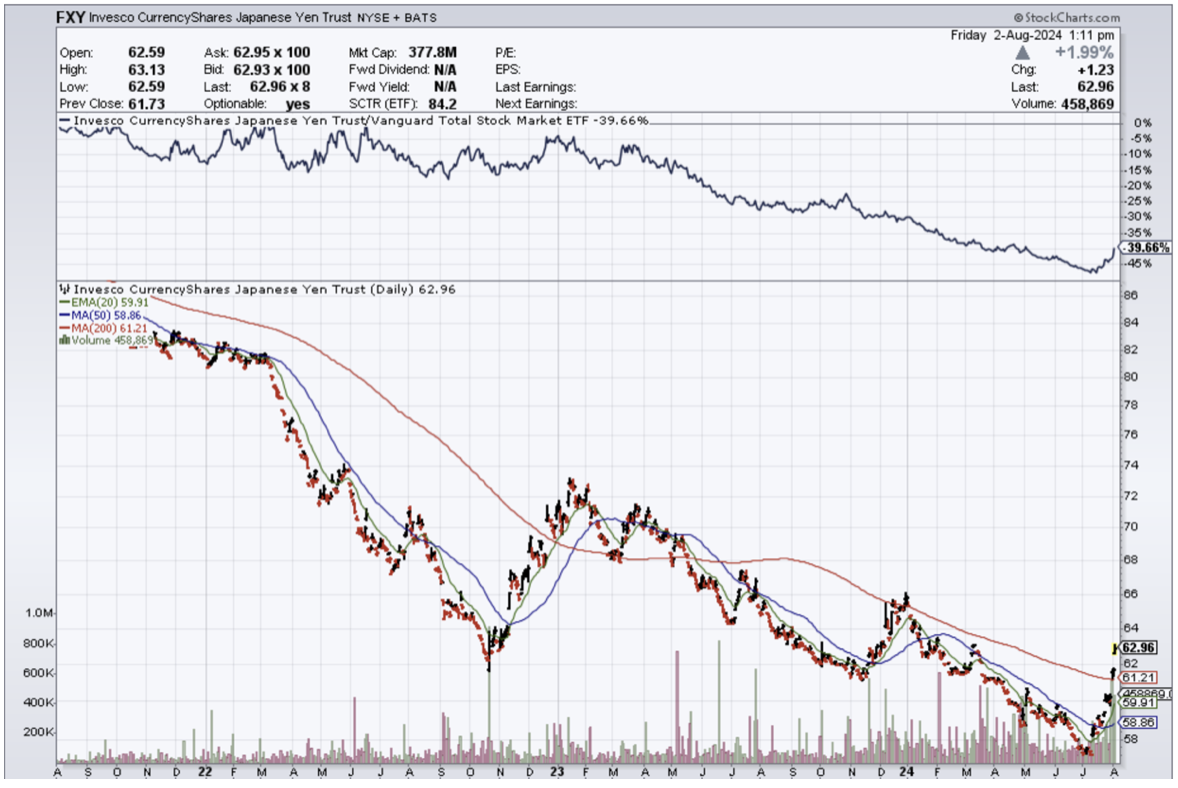

Then to really cap it off, the Japanese yen (FXY) strengthening via an unexpected interest rate hike by the Bank of Japan, sparked an unwind that really gutted tech stocks in the short-term.

Much of the liquid capital used to bid up tech stocks originated from Japanese banks who lent in Yen only for private funds to buy tech stocks in dollars.

That trade has gotten clobbered in the past few weeks.

There is a strong chance that the Bank of Japan could be out of bullets for now and this isn’t the death of tech.

We are just resting.

The unemployment rate cooling and tech stocks selling off finally means that bad news is bad news.

That translates into a manifestation of an upcoming recession or at least tech investors firmly believe so.

New signs of a cooling labor market are stoking fears that the Federal Reserve may have waited too long to start lowering interest rates.

We are in full-blown risk-off mode.

The US economy added 114,000 nonfarm payroll jobs in July, fewer than the 175,000 expected by economists. The unemployment rate rose to 4.3% — its highest level since October 2021.

Fed chair Jerome Powell said Wednesday that a cut in September was “on the table.”

Powell also said "the question really is one of are we worried about a sharper downturn in the labor market. The answer is we are watching carefully for that."

I still believe we will experience some sort of bounce back from tech stocks.

There is no way we go from soft landing to hard landing in a matter of three days.

What does this do for tech stocks?

With data points of this magnitude, it’s normal for a sharp rotation to occur.

The thing we have here is that we are at all-time highs so the profit-taking can become very vicious and hasty.

But if you want to ask me if the tech rally is over, no, it isn’t but we will need to go into consolidation mode to absorb poor revenue guidance.

The dip will be bigger than a mini-dip so as investors, we need to allow this underperformance to work itself through the system before we are off to the races again.

In the end, lower rates are the most advantageous for tech stocks, but conditions need to stabilize for tech stocks to reap those benefits.

“Rule No. 1: Never lose money.” – Said American Investor Warren Buffett

Mad Hedge Technology Letter

July 31, 2024

Fiat Lux

Featured Trade:

(CONSOLIDATION TIME)

(MSFT), (PINS), (NVDA)