Mad Hedge Technology Alerts!

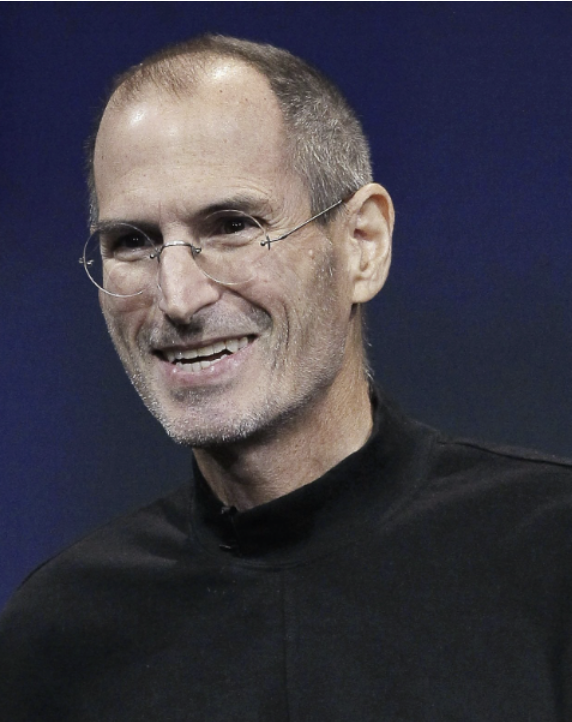

“It doesn't make sense to hire smart people and tell them what to do. We hire smart people so they can tell us what to do.” – Said Apple Co-Founder Steve Jobs

Mad Hedge Technology Letter

July 19, 2024

Fiat Lux

Featured Trade:

(FOLLOW THE CELL TOWERS IN TECH)

(CCI)

I will explain to everyone why the digital revolution is becoming supercharged in the blink of an eye.

Market valuations reflect the state of expected future cash flows in a company.

Under this assumption, some could argue that most big tech companies with staying power are almost a good buy at any price.

No-brainers would include a list of Microsoft, Amazon, Apple, and Netflix.

The global health scare and the carnage associated with it have brought forward revenue and expertise from the tech industry and infused the global economy with more cash.

When you mix that with the Fed playing nice, it sets up conditions for heavy buying in an industry that is going to be king of the global economy anyway.

Tech has been rampant in the first half of 2024 and the brief selloffs we get are only because we are running too hot too fast.

Doing business as we know it has been fast-forwarded by 15 years.

The change took place in a blistering 4 weeks.

The clearest signal of who is really calling the shots in the equity market is looking at which companies are dragging it up.

Technology is shouldering the responsibility of the equity market by outperforming the broader market with many software companies’ share prices higher than before the crisis.

For every Amazon or Microsoft, there is also a Macy’s or JC Pennys showing that this is really a stock pickers market.

We have not only learned that tech companies are critical to our functioning as a society, but that large tech companies will be even more central than ever before.

We are setting up for the Golden Age of tech who are earmarked to capture even more of the broader equity market.

I do agree that currently, the network effect is working in overdrive like a positive force multiplier. The US economy is riding high again, and this cannot be emphasized enough with the US economy printing growth quarter after quarter.

Digital revenue streams will effectively be pumped into every nook and crevice of the digital economy because of current modifications to the business environment.

Tech is destroying literally every sub-sector as we speak.

Take a look at commercial real estate and hotel operators; they have had to fight against the triple whammy of office sharing WeWork, short-term hotel platform Airbnb, and the coronavirus - a lethal three-part cocktail of malicious forces to the “traditional” model.

Any deep-pocketed investors should be cherry-picking every quality cell tower play possible because they are one of the various supercharged sub-sectors of tech.

Obviously, there are other no-brainers like semiconductor chips and certain software companies.

Any long-term investor with a pulse should buy Crown Castle International Corp. (REIT) (CCI) on any and all dips.

They are the largest owner of cell towers owning over 40,000 in the U.S. and the data will flow through these towers juicing the wider economy.