Mad Hedge Technology Alerts!

People want a better life.

And the Internet has connected the outermost populations giving them a feed into the biggest transformation ever to grace mankind.

The applications of the Internet are countless and promise to deliver huge gains in productivity while lifting entire populations out of poverty.

The next leap of digital migration will see the remaining 3 billion of unconnected users connected offering new markets for our tech behemoths.

Every day that passes by, not only does the value of technology companies rise, but the level of expertise increases at a hyper-accelerated pace.

The Mad Hedge Technology Letter diligently chronicles the never-ending paradigm shifts in the industry.

Yes, indeed, it's a sellers' market for anything closely resembling tech.

Recent stories are legion.

The Long Island Iced Tea Corp. beverage company rebranded itself as Long Blockchain and saw shares shoot up 289% on the basis the company might "diversify."

The human capital fueling the outperforming tech sector is like the blood that pumps through the arteries.

Now, governments are getting in on the act, crafting policies that attempt to lure in top tech talent.

Digital nomads are frequently typecast as tech-savvy Millennials remotely working via an Internet connection while living as an expatriate.

However, they come in all shapes and sizes and that is the main point.

The Baltic nation of Estonia has been one of the leading lights in tech innovation, rolling out Skype before Facebook and Twitter existed.

Skype was entirely comprised of local Estonian developers who achieved this in the early 2000s.

Quite a feat for such a small nation.

This charming Baltic country is stepping up its game by announcing a new visa targeted at digital nomads.

In January 2019, Estonia will roll out a revolutionary visa allowing digital nomads to work in Estonia all year round. This visa also includes 90 days of travel in the Schengen Area of mainland Europe.

This visa isn't targeted at EU citizens who already reap the benefits of working all over the European Union.

Estonia is on a mission to amass as many tech-savvy workers from far-flung places around the world, incorporating them into Estonian life, and boosting the level of innovation in a country that prides itself as a start-up hub.

And more importantly jacking up the volume of tech workers.

These digital nomads create communities that harness an enormous flow of tech know-how. Usually their friends are fellow like-minded digital nomads that roll in packs with each other.

Tallinn, Estonia has rapidly turned into a top 10 digital stronghold attracting hordes of digital nomads.

If technical issues arise, help is usually just a shout across a coffee shop and presto!

Everything is fixed.

The message is that simple.

Estonia does not care where you are from, how many sugars you drink with your tea, or how you style your hair in the morning.

The concern there is if you know how to use a computer well or not. Plain and simple.

The global talent shortage is dire, and this is just the beginning.

Try hiring an experienced artificial intelligence engineer on the cheap, and headhunters will just hang up and delete your contact information. Better to think of 10 figures.

In fact, something must give because visa policies are entirely based on legacy systems of yore.

The world has moved on and visa policies should reflect it.

Expect more exotic visa policies pinpointed exactly toward the type of immigrants that nations want as part of their national policy.

With the advent of low-cost carriers such as airBaltic, Spirit Airlines, and Norwegian Air, taking a flight halfway across the world is only a $200 proposition thanks to wonders of deflation and competition.

And the further creation of private short-term rental app Airbnb has allowed digital nomads a pipeline of private housing to tap into when they jet set across the globe.

The common denominator that denotes a perfect location for a digital nomad is cost.

Locations such as Copenhagen and Monaco are places of cultural beauty but pricey for a digital nomad to operate from as the wallet turns lighter consumed by the additional marginal cost of housing and hooking up a decent Internet connection.

Estonia and the rest of the Baltic countries are affordable and boast great digital infrastructure.

After the collapse of the Iron Curtain, these post-Soviet republics stumbled.

Jaded by generations of relying on the Soviet infrastructure, adapting to independence meant building everything from scratch.

Without the Soviet infrastructure, which was all they knew, developing a thriving country out of the ashes of the Soviet implosion was agonizing.

These countries that hug the border of Russia bet the farm on creating a digital infrastructure and invested the little they had into enhancing connectivity.

It's no shocker the Baltic countries of today boast a faster average Internet connection than America today.

In general, antiquated government systems are mired in bureaucracy and operate rudimentary systems straight from the history books.

Many governments suffer from the short-termism of the highest leaders doing everything possible to improve narrow interests irrespective of the big picture and usually solely focused on reelection.

This problem is echoed in America with the government digital infrastructure 20 to 30 years behind.

It is only now that Washington is reaching out to Silicon Valley to upgrade its dinosaur systems of yore.

Estonia is also grappling with aging demographics as with many of the Western powers and must lure 440,000 people just to maintain the current population of 1.3 million people.

Many of these Baltic countries lose huge swaths of youth that migrate to higher wage countries in Western Europe.

Expectedly, they never come back unless just visiting relatives in effect crushing the local birth rate.

The brain drain has also spilled over to low-income countries in Central and Eastern Europe such as Moldova, Poland, and the Ukraine.

Young people want a better life standard and will move across the universe 10 times over to find it.

Many of these Baltic countries have lasting ethnic tensions - a holdover from Soviet times - because of the substantial leftover minority of Russian-speaking Russians dotted around the Baltics.

The digital nomad visa is seen as a strong pivot to the West, attempting to shake off the Soviet heritage and Russian people.

Baltic countries do not want to be the next land grab for Russian President Vladimir Putin. Creating a powerful tech industry would be a key victory for the pro-West government.

Ethnic Russians still make up about 20% to 30% of the Baltic countries' population and live in the face of locals who view them as unfortunate riffraff.

Sometimes, the progressive policies have backfired.

Latvian banks have been a recipient of a massive witch hunt.

Washington has accused Latvian banks of being a facade for laundering Russian capital.

These negative headlines indeed will exacerbate ethnic tension.

Placing an army of digital nomads along the Russian border effectively acts as a deterrent and real army.

Since the aggregated value of digital nomads grows by the day, businesses will have incentives to keep the nomads along the border innovating and profiting from the global digital migration that is taking place as I write this.

The Estonian government has been bold and in some ways is acting with a start-up mentality itself.

This young, audacious government looks to scale up as fast as possible. Visionary policy is seen as the solution to maneuvering around long-lasting problems.

These pro-growth tech policies could invigorate local youth causing them to stay at home rather than flee to greener pastures.

This lifeline might slow down the 60% of local Estonians who dream of moving to a place where they can live better.

Rebranding itself as the digital nomad epicenter is a risky move that most governments wouldn't dare to do.

It's easy to ignore the brain drain in the Baltics while I am living in the Bay Area.

Silicon Valley has been drawing in the cream of the crop for years.

Developers want to stay in California because of the high standard of living, which is even nicer on a developer's salary.

No doubt the Bay Area has poached its share of Baltic working professionals.

However, this Estonian policy starts with the low-hanging fruit as the biggest names in the industry will gravitate toward the oodles of venture capital and large pool of talent. Unfortunately, that place is not the Baltics.

You must learn how to crawl before you can walk. If this visa experiment takes off, it could be a game changer while nudging the Baltics closer into the West's orbit of influence and raising income levels.

A win-win situation.

As for John Thomas. I won't be taking a $200 flight to Estonia to work in a coffee shop.

I prefer Incline Village, Nevada, and Zermatt, Switzerland, as my favorite digital nomad hangouts.

If it's not broke, don't fix it.

See you there in the summer!

On My Way to Switzerland

Chiang Mai, Thailand - Another Digital Nomad Stronghold

_________________________________________________________________________________________________

Quote of the Day

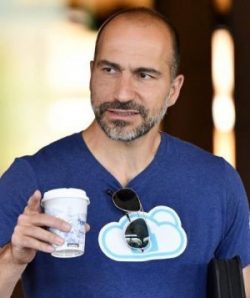

"As tech leaders we have to admit that we are hugely disconnected with our nation. I don't like it but have to recognize this issue," - said current CEO of Uber Dara Khosrowshahi in 2016.

Mad Hedge Technology Letter

June 4, 2018

Fiat Lux

Featured Trade:

(THE INNOVATOR'S DILEMMA),

(UBER), (WMT), (SNAP), (MSFT), (GOOGL), (AAPL), (GM), (IBM)

I must confess, innovation can't be taught.

You are innovative, or you aren't. Don't pretend otherwise.

Innovation drives companies to outperform.

The economic environment becomes more cutthroat by the day rendering complacent companies obsolete.

Top-quality innovation leading to outstanding entrepreneurship is a well-traversed theme transcending industries across the American economic landscape.

The reservoir of innovation in 2018 is primarily flowing from one narrow source - the tech sector.

This is the primary motive for many adjacent industries to incorporate tech expertise into existing and commonly ancient legacy systems.

Tech promises laggards a ride atop the gravy chain.

In many instances, these companies are grappling with existential threats from all directions.

The best example is Walmart (WMT), which effectively mutated into the next FANG with its majority stake in Indian e-commerce juggernaut Flipkart. This deal followed its purchase of Jet.com in 2016, which was its first foothold in the e-commerce world.

Traditional companies are becoming tech companies because of the ability to innovate all leads through the fingertips of talented coders.

When all roads lead to Rome, you will have to go through Rome.

The hunger for innovation has had major implications to the financial side of technology.

The story picks up from a recent report disclosing the 2017 remuneration of co-founder and CEO of Instagram competitor Snapchat (SNAP) Evan Spiegel.

The $637.8 million he received in 2017 was the third-highest annual compensation ever to be collected by a CEO.

Snapchat has tanked following its 2017 IPO and the main reason is Facebook is stealing its lunch and leaving Snap the crumbs on which to nibble.

Instagram, using a cunning strategy of cloning Snap's best features, single-handedly bludgeoned Snap's share price cutting it by half after the successfully launched IPO.

Snap has been an unequivocal sell on the rallies stock since the inception of the Mad Hedge Technology Letter and the disastrous redesign did no favors either.

My first risk off recommendation was Snapchat and at the time it was trading at $19. To revisit the story, please click here.

Microsoft (MSFT) is a great stock because it posts accelerated revenue and earnings, while Snapchat is a terrible company because it produces accelerated losses and lousy user growth.

A company almost 100 times smaller than Microsoft should not be struggling to grow.

It's a failure of epic proportions.

Small companies expand briskly because the law of numbers is leveraged in their favor and the tiniest bump of additional business has a larger effect on the bottom line.

As it stands, Snapchat lost $373 million in 2015, and followed that up with a disastrous $514 million loss in 2016, and a gigantic $3.45 billion loss in 2017.

Losses accelerated by 800% but annual revenue only doubled last year.

It was no shocker that the poor relative performance resulted in the sacking of 100 Snapchat developers.

Smart people would assume an annual salary of this magnitude (Spiegel's) would be the result of excellent performance.

Why else would a CEO get a lavish payout?

I'll explain.

The demand for tech knows no bounds.

In this environment, venture capitalists will pay up for brilliant ideas.

The problem is that brilliant ideas don't grow on trees.

The few cutting-edge ideas have stacks of money thrown at them.

In this sellers' market, founders can cherry-pick the best financing deal that will enrich them the quickest and empower them the most.

Multiple offers have become the norm just as with the Silicon Valley housing market.

The consequences are the premium for these brilliant ideas keeps rising and investors keep paying higher prices without a second thought.

Therefore, founders and CEOs are opting for the financial packages that offer them bulletproof voting shares, allowing the innovators to control operations to the very last detail.

The founders are responsible for leading innovation, and investors are offering glorious pay terms for this innovation because it can't be substituted. Low-quality tech has less of a premium because the technology can easily be rebranded and substituted.

Technology from the ground up is slowly being automated away leaving runaway valuations the norm.

Giving the keys to the Ferrari makes sense as tech companies formulate long-term strategies based on scale. And securing job security without the threat of an activist takeover offers peace of mind for CEOs who are focused on the daily grind.

Knowing their baby won't get stolen from the carriage goes a long way in tech land.

Venture capitalists are reticent about following through with proper governance because they do not want to alienate the innovators who could choose to stop innovating.

These investors also know that tech is the least regulated industry in the world, so it's better to turn a blind eye to cunning growth strategies that push the border of regulation.

The competition to fund these emerging tech companies is borderline criminal.

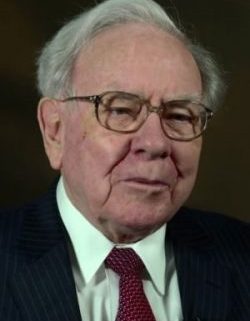

Uber declined a $3 billion investment by no other than the Oracle of Omaha Warren Buffett.

Buffett described himself as a "great admirer" of Uber CEO Dara Khosrowshahi.

Uber is one of the most unlikely Warren Buffett investments because it doesn't create anything and burns cash faster than a Kardashian.

Buffett's faith in Uber underscores the reliance on tech to fuel the stock market to new heights.

Buffett also admitted mistakes on missing out on Alphabet (GOOGL) and Apple (AAPL).

Rightly so.

Then add in the mix of SoftBank's $100 billion vision fund that just announced an upcoming sequel with another $100 billion vision fund.

Where is all this money flowing into?

Of the tech companies that went through an IPO last year backed by venture capitalist money, 67% relinquished superior voting rights to key founders, a rise of 54% since 2010.

Compare that to non-tech companies that only allow 10% to 15% of CEOs to institute a voting structure that will put them in charge indefinitely.

In many instances, the persona of these ultra-famous tech CEOs has taken on a life of its own.

Elon Musk, CEO of Tesla, is the most prominent example of a celebrity tech innovator milking every possible penny from his shareholders and is not shy about flaunting it.

News has it that Musk needs to go back to the well for another stage of financing later this year.

Don't worry, the money will be there in this climate.

Buffett's rejection was due to losing out to SoftBank, which beat out Buffett to invest in Uber.

SoftBank just announced a $3.35 billion investment into GM's (GM) autonomous driving unit called Cruise enhancing the best big data portfolio in the world.

At this pace, CEO of SoftBank Masayoshi Son will have a piece of every major big data company in the world.

This all bodes well for tech equities as the insatiable hunt for emerging, innovative tech spills over into daily equity market driving up the prices for all the top innovating public companies such as Salesforce, Amazon, Microsoft and Netflix.

Buffett, down on his luck after being shafted by Uber, picked up more Apple shares.

He sold all his IBM (IBM) shares after reading the Mad Hedge Technology Letter advising him to stay away from legacy companies.

Smart move, Warren. You can pick up the tab for our next lunch date.

If you have a few billion to throw around, expect multiple offers over the asking price for any high-grade tech innovation.

The going rate is shooting through the roof and you might NEVER be able to sack the founder.

Caveat emptor.

_________________________________________________________________________________________________

Quote of the Day

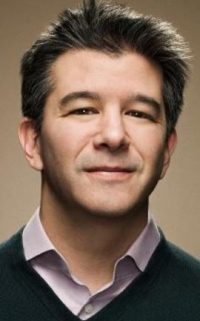

"We knew that Lyft was going to raise a ton of money. And we went (to their investors): 'Just so you know, we're going to be fund-raising after this, so before you decide whether you want to invest in them, just make sure you know that we are going to be fund-raising immediately after.' " - said former CEO and founder of Uber Travis Kalanick when asked how he copes with competition.