Mad Hedge Technology Alerts!

Modern tech has an unseen dark side to it.

Coders relish the opaqueness surrounding the industry infatuated with developing the next big thing to take Silicon Valley by storm.

There is nothing opaque about the Mad Hedge Technology Letter.

I grind out recommendations and you follow them. Period. End of story.

To put it mildly, the letter has gotten off to a flying start since its inception in February 2018, and there is no looking back, only looking forward.

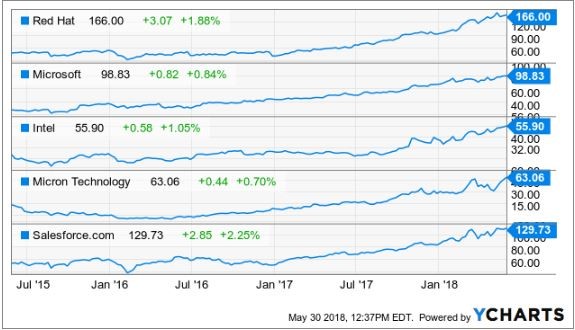

Micron (MU), Red Hat (RHT), Microsoft (MSFT), and Intel (INTC), just to name a few, have been solid recommendations standing up to all the nonsense and mayhem permeating throughout the periodically irrational markets.

Have you noticed lately when you open up the morning paper while sipping on a steaming mug of Blue Bottle Coffee, that almost every story is about technology?

It's not a mistake. I swear.

Technology is permeating into the nooks and crannies of our society and the leaders of this movement are laughing all the way to the bank.

One of those aforementioned pioneers is no other than local lad, Salesforce CEO and perennial Facebook basher Marc Benioff.

I recommended Salesforce at $110 and it was one of the first positions in the Mad Hedge Technology portfolio.

You can't blame me.

I saw this stock pick from a million miles away and I will explain why.

Salesforce set ambitious targets that nobody thought were realistic at the time.

How high in the sky does Benioff want to build his castles?

By 2022, Marc Benioff set out sales targets of a colossal $20 billion per year.

Then Benioff gushed that Salesforce would pass the $40 billion mark, done and dusted by 2028 and $60 billion by 2034.

Remember that tech CEOs are incentivized to forecast ludicrous sales targets because it lures in the unknowledgeable investor.

Unknowledgeable or pure genius, it does not matter, Salesforce is an emphatic buy.

Salesforce is the ultimate growth stock.

In 2016, annual revenue came in at $6.67 billion, which is about the same size as a middle level semiconductor company.

They followed that up with $8.38 billion in 2017, demonstrating the parabolic shaped trajectory of the company.

At the end of fiscal year 2017, Salesforce announced that it expects revenue of around $12.60 billion in 2019.

The latest earnings report, Benioff disclosed full year guidance of $13.13 billion.

This puts Salesforce in the running to achieve its lofty aspirations.

Apparently, the castles Benioff is building aren't in the sky after all.

Theoretically, if Benioff expands the business into a $16 billion to $16.5 billion business by 2019, Salesforce will have a more than likely chance to pass the $20 billion mark by the end of 2020, a full two years than initially thought.

Salesforce will have ample wiggle room on the way to $20 billion if it is 2022 for which it aims.

Why am I rambling on about revenue?

It's the only metric that Salesforce investors value.

The company registered two straight years of less than $200 million in profits then followed it up with a less than stellar 2016 where it lost almost $50 million.

Don't expect any dividends from this neck of the woods anytime soon especially after acquiring MuleSoft, an integration software company, for $6.5 billion last quarter.

This purchase will add another $315 million of annual revenue to Salesforce's quest of eclipsing its future sales targets. This was after MuleSoft made $296.5 million in 2017 before it became a part of Marc Benioff's stable.

Benioff has proved a shrewd dealmaker, taking advantage of cheap capital to add suitable parts to his business.

Since 2016, Benioff has snapped more than 50 niche software companies that he rebrands as Salesforce products and sells them as add-on products.

This is further evidence that any funds available will be allocated toward reinvestment into products and services deeming any future dividend inconceivable, especially with the elevated revenue targets to surpass.

As for the business. Do we still need to talk about it?

Rip-roaring growth was seen across the board with total revenue increasing 25%.

Investors should stay away from any cloud company that is growing less than 20%.

Market intelligence firm International Data Corporation (IDC) voted Salesforce as the No. 1 client relationship management (CRM) platform for the fifth consecutive year.

It is the industry leader in sales, marketing, service, and increased market share in 2017, more than its closest competitors.

Larry Ellison must be tearing his hair out as Oracle's (ORCL) share price has been excommunicated to purgatory indefinitely.

Oracle is a company that I have been pounding on the tables to stay away from.

The Mad Hedge Technology Letter seldom recommends legacy companies that are still legacy companies.

Driving past his former estate, emanating from a sparkling perch in Incline Village overlooking Lake Tahoe, my neighbor gives me the goose bumps.

The property was later sold for $20.35 million. All told, Larry has around $100 million invested in real estate dotted around Incline Village. I sarcastically mentioned to him last time we bumped into each other to call me immediately when his $90 million estate in Kyoto, Japan, hits the market.

Oracle's position in the pecking order is a telltale sign of the inability to land the creme de la creme government contracts that ostensibly fall into Amazon (AMZN), Alphabet (GOOGL), and Microsoft's lap.

And it's not surprising that Larry is spending more time tending to his vast array of glittering luxury properties around the world rather than running Oracle.

Oracle is like a deer caught in the headlights and Marc Benioff is at the wheel.

On the Forbes 500 rankings, Salesforce has moved up almost 200 spots.

This position will rise as Salesforce is under contract booking a further $20.4 billion of commitments driven by its subscription services offering cloud products.

On the domestic contract front, it was much of the same for Salesforce, which inked premium deals with the U.S. Department of Agriculture, Kering, and sports apparel giant Adidas.

International companies such as Philips and Santander UK are expanding their relationships with Salesforce. A firm nod of approval.

Salesforce has been voted in the top three of most innovative companies for the past eight years by reputable Forbes magazine. The list was started in 2011, and it has never dropped out of the top three.

The gobs of innovation are the main logic behind the top five financial institutions expanding their relationship with Salesforce by an extra 70%.

Once companies start using the CRM platform, they become mesmerized with the premium add-ons that help companies run more efficiently.

Benioff has been a huge proponent of artificial intelligence (A.I.) and is an outsized catalyst to product enhancement gains.

Salesforce has taken Einstein, it's A.I. platform, and allowed all the applications to run through it.

The integration of Einstein has resulted in more than 2 billion correct predictions per day paying homage to the quality of A.I. engineering on display.

Instead of hiring a whole team of in-house data scientists, Salesforce is A.I. functionality by the bucket full and it is easy to use on its platform.

In some cases, incorporating Salesforce's A.I. into the business has bolstered other companies' top line by 15%.

Often, Salesforce's A.I. tools are declarative meaning the technology can identify solutions without a fixed formula.

Benioff has choreographed his strategy perfectly.

He is betting the ranch on unlocking data from legacy companies that migrate to his platform.

MuleSoft will help in this process of extracting value, then A.I. will supercharge the data, which is being unlocked.

What does this mean for Salesforce?

Higher revenue and more clients leading to accelerated growth. The share price has powered on north of $130, and after I recommended it at $110, I am convinced this stock will surge higher.

Salesforce is an absolute no-brainer buy on the dip.

Growth Means Shiny New Office Buildings

_________________________________________________________________________________________________

Quote of the Day

"If we become leaders in Artificial Intelligence, we will share this know-how with the entire world, the same way we share our nuclear technologies today." - said current President of Russia, Vladimir Vladimirovich Putin.

Mad Hedge Technology Letter

May 30, 2018

Fiat Lux

Featured Trade:

(WHICH UNICORN WILL EAT YOUR LUNCH?),

(UBER), (AIRBNB)

Hold onto your hats or you might get swept up.

Avoid the projectiles while you're at it.

There are no imminent tsunami warnings. But something else is happening in the world that you might want to know about.

Disruption.

The pace of disruption is accelerating beyond all recognition.

CEOs are here today and gone tomorrow, exiting through the revolving door of companies devoured by disruption.

Are we on the verge of the rise of the robots?

I wouldn't go that far ... yet.

But the truth is that disruption is redefining the world as we know it.

The latest stage of modern disruption came to us by way of smartphone apps.

This application created clear-cut platforms allowing companies to penetrate deep into the smartphone ecosystem where most of the youth are hanging out with consequences galore.

The unfolding of the sharing economy has been nothing short of breathtaking.

Take Uber.

Uber was so disruptive that its former CEO, Travis Kalanick, disrupted himself out of a job at Uber.

That is quite disruptive.

First, look at its business model.

Uber does not actually create intrinsic value.

It does not create something you can eat, sleep on, or imbibe.

Uber is a vanilla app that brings together a marketplace for riders and ride givers effectively becoming a de facto broker.

Brokers have been around since the advent of time.

This type of technology lacks quality, and half the undergraduate computer engineers in university could fabricate something similar with ease.

Disrupters formulate a plan, scavenge for weak points, identify backdoor entrances, then wreak havoc to the guts of the system.

At an auction late last year in 2017, New York City taxi medallions were going for a derisory $186,000, precipitously lower than the $1.3 million in 2014. A spate of taxi driver suicides ensued.

The 86%-plus drop in value is directly correlated to Uber's advancement into the taxi industry.

It's that simple.

Taxi drivers have been left holding the bag and in big-time debt crying their eyeballs out.

Buy low and sell high. I guess taxi drivers didn't get the message.

The initial point of attack was to render the taxi medallion utterly useless.

To find drivers of its own, Uber subcontracted regular people as drivers.

Genius! Another problem solved.

In one fell swoop, the Uber app made every adult with a driver's license a taxi driver anywhere in the world.

Ka-ching!

New York City capped the total amount of medallions in circulation at 13,587.

The flood of new drivers crushed the price of taxi fares around the world bettering the lives of the average Joe.

Uber also figured it would be cheaper to allow drivers to use their own private car, shedding the costs to maintain, finance, and service one of the highest inputs of taxi business models.

Uber and the rest of the tech industry benefit from being the least regulated industry in the world.

The lack of regulation was a golden ticket to test the rules of the road.

That is exactly what unfolded.

Management even approved an app inside the Uber app bent on skirting the challenges of secret strings organized by police enforcement.

The app, called Greyball, reaffirmed the company ethos of pushing regulation to the brink of no return.

Any emerging tech company not pushing the borders of regulation should not be in technology.

Everything reverts back to the fact that emerging tech is held in check by one metric - growth.

Growth solves anything in the eyes of tech investors.

Yes, it's unfair that Walmart and traditional media companies don't get the same free pass, but life is unfair.

Uber had incentive to break all the rules because surpassing growth targets would lure in additional financing.

The outperforming growth is the main logic justifying an investment in a cash-burning enterprise.

People don't like losing money but people with deep pockets will wait it out if they know there is a golden prize at the end of the road.

The administration has grossly failed to regulate technology, even after the Cambridge Analytica scandal came to light.

This all bodes well for technology companies.

Europe is the hotbed for global data regulation. Large tech companies have been astutely planning for the new General Data Protection Regulation (GDPR) rules to take effect.

The companies that do not create anything proprietary are at serious risk of being passed over in the history books.

Therefore, the aggressive tactics "broker apps" adopt are completely justified, and it is paying off in spades as the 2019 IPO approaches.

That upcoming momentous day will enrich many people associated with Uber and in hindsight, management might acknowledge that its initial wild ways were worth the price of the mild rebuke.

The underlying problem is tech disruption, and the success of it has many unintended consequences - particularly social upheaval and job losses.

Myanmar born "Kenny" Chow's body was found floating face down in the river around the Brooklyn Bridge after his family said he disappeared a few days ago.

This was the fifth New York taxi driver suicide in the past five months.

Chow had taken out high-interest loans to pocket his $700,000 New York City medallion and his precarious financial situation, brought upon by the success of Uber, led him to leap to his death.

Sadly, the thirst to grow means taking away other people's livelihood and even their option to live.

We know the pace of change is in full gear. However, the amount of people being economically and socially displaced is a worrying sign that public opinion cannot absorb the accelerating pace of disruption.

More regulation? Probably not.

Chow isn't the first person to lose a job because of technology and won't be the last.

Enter the hotel industry.

Accommodation-sharing app Airbnb was the end for hotels as we knew them.

Airbnb is the Uber of short-term rentals, matching renters with private home owners. They earn revenue by the servicing fee incurred for the brokering.

The harbinger of doom never came to materialize for the hotel industry, which is enjoying record profits - the likes we have never seen before.

The synchronized economic recovery fueled the demand for hotel rooms located in economic hubs close to urban centers.

As we found out, 90% of business travelers have no desire to stay in other people's houses, and the assortment of services hotels offer is critical for the prototypical business traveler.

The hotel industry saved its bacon while Airbnb is thriving. A win-win situation.

You thought wrong.

Airbnb services are a hit with tech-savvy Millennials, which data reveals as upper-middle class, young, and addicted to wanderlust.

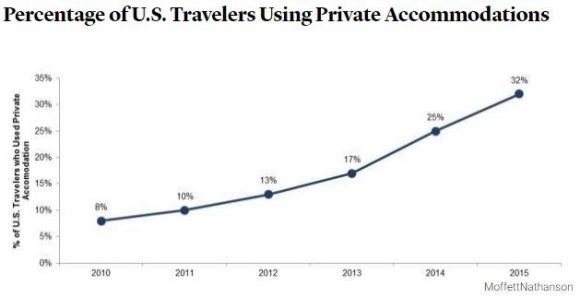

The percentage of American travelers using private housing has more than quadrupled since 2010.

The surge in Airbnb users coincides with an explosion of global tourism led by the bourgeoning Chinese middle-class flooding tourist meccas all over the world.

The app that champions individuals to open up their personal homes is effectively pricing out locals from the dwindling supply of available residential housing.

The problem is most acute in Spain and every other tourist haven.

Madrid currently has 9,000 private units rented out to globe-trotting tourists, a sevenfold rise since 2013.

Of these 9,000 units, 2,000 are illegal and do not possess the necessary permits.

In the port city of Valencia, online-based private housing rose more than 30% since 2016.

To cope with the droves of tourists, the local government is attempting to pass legislation by removing 95% of the housing supply from house-sharing applications, in effect giving local residents back their neighborhoods.

Airbnb is another prime example of the severe lack of regulation that tech revels in, which in turn boosts the pace of technological disruption.

Blame the government. Lawless industries breed marginal behavior. We are all just a function of our environment.

Local neighborhoods are being ravaged by these short-term rentals and entire cities are being turned into massive tourist depots with little afterthought of the local people.

Examples are legion. Venice, Italy; Prague, Czech Republic; Dubrovnik, Croatia; Lisbon, Portugal. And the list goes on and on.

These cities are the victims of their own success and are grappling with hordes of tourists ruining the charm and souls of their beloved cities.

Granted, rapid development of the tourist industry trended toward this result, but the pace of upheaval has accelerated beyond anyone's wildest dreams.

For years, taxi drivers were seen as the first cohort to eventually be swept away with the magic of technology, but it happened too fast for people to accept.

I hope your uncle isn't a taxi driver.

Unfortunately, things are about to get a lot worse as the first stage of disruption transitions to the history books and the next stage is upon us.

The second stage will displace even more people as this unregulated industry sees everything as a zero-sum game.

This stage will incorporate higher grade tech - not just a broker app - that will change the world faster and to a larger degree than anything witnessed today.

And the next stage will incorporate proprietary technology the world has never seen before.

Imminent rollout of self-driving cars hitting the market in 2019 to 2020, will be the first progression for investors to digest.

Followed directly after self-driving will be the broad-based adoption of 5G delivering Internet connection speeds more than 100 times faster than current speeds, stoking a new leg up of commercialization.

As for now, Uber and Airbnb, which both plan to go public in 2019, are eye-opening success stories catapulting them into the top five of global unicorns along with the Uber of China (Didi Chuxing), the Apple of China (Xiaomi), and the Grubhub of China (Meituan-Dianping).

And if you somehow descend on Barcelona during this summer's tourist season, you might want to avoid the tourist protests.

_________________________________________________________________________________________________

Quote of the Day

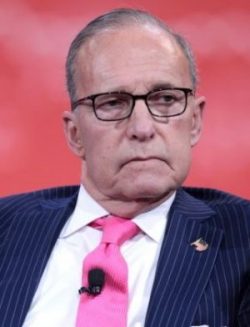

"They counterfeit our goods, steal our intellectual property rights, and hack the computers of our industries and government. Something must be done about it." - said Director of the United States National Economic Council Larry Kudlow when asked about a specific country.