Mad Hedge Technology Alerts!

Up to my elbows in the market for the past 50 years, I have seen my share of paradigm shifts transforming the world and markets with it.

The Supreme Court delivered another momentous decision overturning the 1992 decision to ban sports betting in most states.

The aftermath is decisively pro-business with a profusion of domestic and international winners that can bask in the glow of a future windfall swelling the industry coffers to the tune of $150 billion per year.

The estimated amount of illicit sports gambling activity that goes unreported is $150 billion, and that will migrate to official channels, but I bet the sum is vastly higher.

Sports betting is as American as apple pie.

This is highly evident each year with the NCAA men's basketball tournament sucking in eyeballs resulting in more than $5 billion in lost worker productivity.

The annual Super Bowl is practically an institution in this country as well as quarterback Tom Brady's starting spot on Super Bowl Sunday.

Not only is this ruling pro-business, but the verdict is another overwhelming win for technology and the state of Nevada.

Nevada was one of the few states to receive an exemption from the 1992 ruling, and its sports betting books have developed uninterrupted for the past 26 years.

The 26-year head start will mirror Amazon's seven-year head start in the cloud catapulting existing operations to the top of the food chain.

Sports team owners from all the major sports leagues are jumping with joy as the team valuations of each franchise received another boost with fresh capital pouring in like an overflowing dam.

This development effectively creates a digital sports industry operating parallel to the official leagues and will have business synergies galore.

Sports leagues are about to welcome a new tidal wave of viewer interest that seeks to capitalize on the new synergies.

Options derivative contracts on sports games could be another product down the road for this budding industry.

The two best tech companies in position to take the court ruling and turn it into material business are the leading fantasy sports providers DraftKings and FanDuel, which are both private companies.

In 2016, these two companies attempted a merger that would have given the company a 90% monopolistic market share and more than 5 million customers.

The following year, the Supreme Court blocked the merger as DraftKings continued to grow in excess of 8 million users.

Fantasy sports and the entire e-sports genre is experiencing skyrocketing popularity with youth (physical) sports participation falling off a cliff.

New York-based FanDuel and Boston-based DraftKings have a wide-reaching digital footprint in fantasy sports that is supported by rich tech architecture.

The abundance of tech capabilities will make the crossover into sport wagering seamless.

NumberFire, a sports big data company, was bought up by FanDuel in 2015, and has close to 1 million subscribers parsing through its analytics.

The sports big data movement was christened by Bill James who coined the study of statistics in baseball as sabermetrics. That was the platform used by the Oakland Athletics' General Manager Billy Beane that later developed into a movie and book called Moneyball written by Michael Lewis starring Brad Pitt.

FanDuel was able to poach an entire team of sports tech developers when Zynga 365 Sports went bust after a few sports titles failed to stick and FanDuel picked up 38 of the 42 leftover developers in 2015.

DraftKings has pounced its increasing headcount from 425 to 700 at its Boston headquarters taking advantage of the new legislation to ramp up the required staff.

Plundering talent across the pond, too, leaving no stone unturned is a statement of intent.

DraftKings anointed Sean Hurley, who cut his teeth as head of U.K. B2B sports betting technology supplier Amelco and niche online sports book Whale Global, as its new head of sportsbook.

Tapping the U.K. for sports tech talent makes sense.

The U.K. legalized sports betting in 1961. The Brits bet more than $20 billion last year.

There is an affluence of sports betting tech know-how for hire in Europe. American companies would be naive not to pursue staff reinforcements at a time when companies are fortifying talent levels.

Thus, opening up an extensive market full of sports-crazed fans gives U.K. firms a tasty new opportunity to pursue with existing foundations in place.

Upon the announcement, online sports book outfit 888 Holdings (LSE:888) exploded 15% on the London Stock Exchange.

It's subsidiary 888sport was the first foreign company to receive a license to operate by the Nevada Gaming Commission in 2013.

Paddy Power Betfair (LSE:PPB), based in Dublin, is another company poised to benefit and has launched a takeover bid for FanDuel to seize further gains in market share.

Discussions are ongoing.

This all comes after buying U.S. headquartered Draft, a fantasy sports rival, for $48 million.

There are obvious synergies between fantasy sports and sports betting as they both process ample amounts of data that help set the odds for each game.

Online sports betting is another industry that is waiting for Artificial Intelligence (A.I.) to enhance the betting products, creating a plethora of new business opportunities.

British firms use the same in-game add-on product strategy that is popular with e-gaming franchises such as Fortnite.

In-game bets allow gamblers to wager on specific events within a game such as the first scorer of a soccer match or the first player to receive a yellow card.

Niche betting has proved hugely popular.

Paddy Power has already made inroads in America with a horseracing and greyhound racing TV channel and sportsbook called TVG and an online casino in the state of New Jersey.

Cross-border talent poaching will heat up as premium dollars are up for grabs favoring the first movers that can retain business.

The last clear-cut U.K. winner is William Hill (LSE:WMH), which already has an outsized presence in America by way of its purchase of three Nevadan sports books: Lucky, Leroy's, and Club Cal Neva, for a grand total of $53 million.

The deal gave William Hill an 11% market share of sports book revenues in Nevada. The British bookmaker's sports book can be seen dotted all over Las Vegas and Reno thoroughfares.

CEO of William Hill, Philip Bowcock chimed in saying America will benefit with an injection of "100,000 new jobs" stateside, and consumer safety will increase with the need to bet under the table swept into the dustbin of history.

The U.S.-based fantasy sports powerhouses, U.K.-based sports betting sites, and the State of Nevada are the unwavering victors.

The last stratum of indirect winners are the companies that manufacture sports betting equipment.

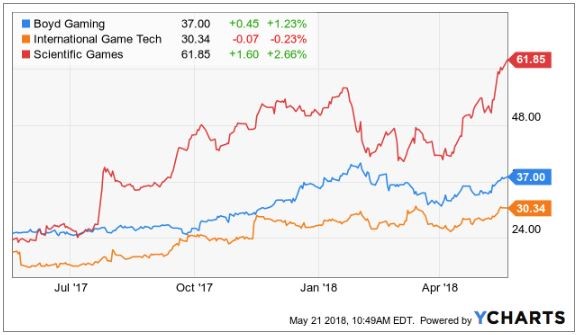

No doubt that states will likely set up brick-and-mortar sports betting establishments. Companies such as Boyd Gaming (BYD), Scientific Games Corporation (SGMS), and International Game Technology (IGT) could see a nice revenue bump stemming from the equipment they manufacture.

_________________________________________________________________________________________________

Quote of the Day

"Cybersecurity is not only a question of developing defensive technologies but offensive technologies, as well," said President of the United States Donald J. Trump.

Mad Hedge Technology Letter

May 21, 2018

Fiat Lux

Featured Trade:

(HERE'S THE BIGGEST TECHNOLOGY CONTRACT IN HISTORY)

(AMZN), (MSFT), (ORCL), (IBM), (GOOGL)

The return of the Jedi is coming.

Luke Skywalker and Obi-Wan Kenobi will enter the cloud and use the force.

Not the Jedi of the famous George Lucas films, but JEDI - Joint Enterprise Defense Infrastructure commissioned by the Department of Defense.

This large contract is up for grabs.

Rumor has it that Amazon is in the driver's seat to become the government's right-hand man.

The purpose of this broad-based upgrade is to enhance communication channels among military branches by loading up operations into the cloud.

Artificial Intelligence (A.I.) and machine learning will be integrated as well.

One task slated for modernization includes the heaps of documents waiting to be translated from Arabic, Farsi, Chinese and other foreign languages into English.

A.I. will organize which documents have priority over others as well as aiding in raw translation. This will save the Department of Defense's overworked linguists thousands of hours in brute translation work.

As it stands, the government is grappling with an overlapping fractious system with legacy software up to 20 years old.

These legacy systems of yore are poor at keeping out the cyber criminals looking for a smash-and-data grab.

One instance where massive inefficiencies rear its ugly head is in the Department of Agriculture.

This department has 22 chief information officers that require seven more personal assistants inflating the IT budget.

The government could become the best turnaround story in the tech industry in years.

This turnaround could eventually become bigger than Microsoft and Cisco, which are the poster children for extreme cosmetic surgery in Silicon Valley.

The government burns $90 billion per year servicing IT operations, and JEDI is slated to offer an attractive sum of $100 billion over 10 years to a private company.

Not only will the Department of Defense modernize, but every part of the government will adopt new technologies.

Security is a priority for this administration after its legitimacy was questioned due to alleged nefarious Russian involvement.

The Committee on Foreign Investment in the United States (CFIUS) has buckled down rejecting a myriad of attempted foreign takeovers of cutting-edge tech companies stressing the need to properly harness local tech companies' ingenuity to the benefit of the country.

These new opportunities do not affect the already $1 billion per quarter that Alphabet (GOOGL) takes in from government servicing.

The $1 billion contract was given to Alphabet to develop the Algorithmic Warfare Cross-Functional Team industrially working on Project Maven.

Project Maven is the Department of Defense's attempt to integrate A.I. and machine learning into motion detector technology applied to surveillance drones using the Google cloud.

Project Maven received an additional boost to its objectives with an additional $100 million cash injection recently underlining the government's efforts to make warfare more efficient and less expensive.

Amazon Web Services (AWS) has also carved out a nice $5 billion per quarter business thanks to the power brokers in Washington.

Another side deal consummated recently has thrust Microsoft into the frame as well.

Microsoft (MSFT) agreed with the Office of the Director of National Intelligence to service 17 intelligence agencies with the Microsoft Azure cloud platform.

The deal was reported to be valued at "hundreds of million" of dollars.

Another separate deal agreed by both parties has Microsoft migrating another 3.4 million users and 4 million devices from the Department of Defense into the cloud.

All told, Microsoft has pulled in more than $1.3 billion of orders from the government in the past five years.

Bill Gates's old company was rewarded certification to supply the government with computers, operating systems, Microsoft Office, and the cloud services bolstering their credentials to potentially extract more government business.

The administration has adopted a winner takes all approach to the JEDI contract preferring one cloud provider to maintain the infrastructure.

Companies are scratching and clawing to get within a shout of winning this valuable revenue stream that could extrapolate down the road.

JEDI accounts for just 20% of the cloud possibilities for the tech companies in the government system.

The further 80% of digitization will happen down the road.

Firms are up in arms about the single platform solution and believe branching out to multiple platforms will come in use if part of the operation goes down.

Hybrid solutions are the norm for 80% of Fortune 500 companies.

As it is, International Business Machines Corp. (IBM), Oracle (ORCL), Alphabet, Amazon (AMZN), and Microsoft have been adamant that they are the best candidates for the job.

Amazon has been on a one-man mission mobilizing its all-star team of lobbyists to gain an edge.

Amazon has been part of the government's purse strings for quite some time.

It was awarded a $600 million contract in 2013.

Secretary of Defense James Mattis spoke about the relationship with Amazon in glowing terms characterizing Amazon's performance as "impressive" in terms of securing data and functionality.

The positive Amazon feedback has given AWS a head start. It hopes to capitalize on the biggest transfer of data to the cloud in modern history.

Once completed, departments will at last be able to access files from different branches on the same platform. This process is currently done manually.

Quickening the pace of modernization is a prerogative for the new administration.

President Donald Trump signed an executive order to spur on the process of getting rid of the decaying system.

Son-in-law Jared Kushner has also been an advocate of the agonizing overhaul.

This bold initiative ties in well with enhancing cybersecurity inside Washington at a time when hackers have penetrated legacy systems with ease.

Getting the White House up and running will improve the operation of the government. From an investor's point of view, it will add materially to the bottom line of companies that start to win more contracts.

This underscores the reliance of our government and economy on the large cap tech companies that are single-handedly propping up the current bull market.

The White House will wake up one day and understand that technology innovation is more powerful than ever, and even the mayhem inside the White House can't stop the digitization of politics.

Going forward Amazon and Microsoft should get a healthy boost to their overflowing coffers. Legacy companies such as IBM and Oracle could be punished by the government as well as investors for being legacy companies, which could lead the government to pass over IBM and Oracle.

Yes Mr. President ... An Upgrade Is Needed

_________________________________________________________________________________________________

Quote of the Day

"What would I do? I'd shut it down and give the money back to the shareholders." - said Michael Dell in 1997, the founder of Dell Technologies, when asked what he would do if he was in charge of Apple.