Microsoft Hits A Home Run

After the smoke clears, it is obvious to the naked eye that the winner of the Sam Altman firing is Sam Altman and Microsoft.

Sam Altman is the former OpenAI CEO and the face of AI.

The board at OpenAI just gave away the company to Microsoft.

The event is still reverberating around the world and is a shocker for anyone and everyone involved in technology.

It is similar to if Elon Musk is fired by the board of Tesla.

Something of this magnitude has a lot of unintended consequences and from first glance, it appears that the board of directors overplayed their hand.

The only reason why the board got its way is because of the government structure in place that allows the power of management.

The best NFL teams don’t fire their franchise quarterback or lose them for nothing.

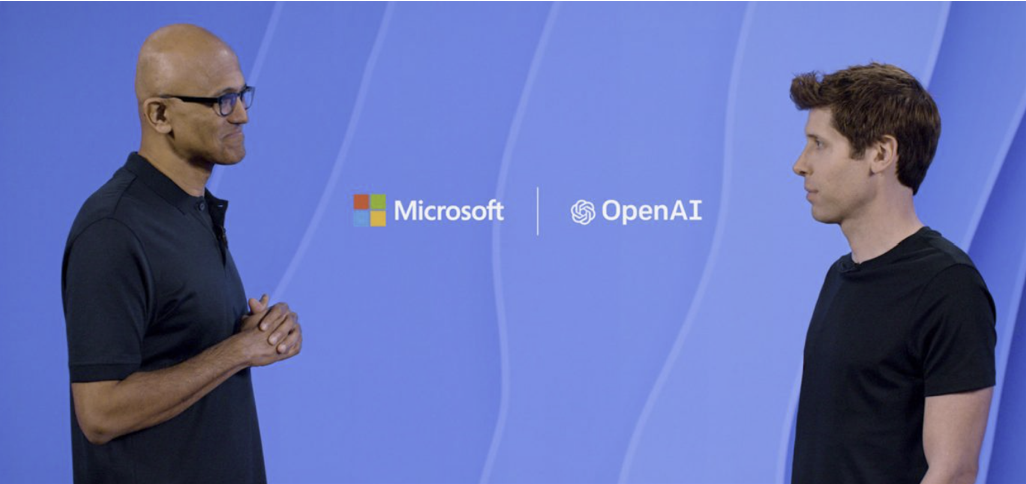

In an ironic twist, OpenAI's biggest investor Microsoft said it is hiring Sam Altman to lead a new advanced artificial-intelligence research team, after his bid to return to OpenAI with the board that fired him declining to agree to the proposed terms of his reinstatement.

OpenAI has been relegated to second-tier status and Altman has been promoted to the big show.

Microsoft Chief Executive Satya Nadella posted on X late Sunday that Altman and Greg Brockman, OpenAI’s president and cofounder who resigned Friday in protest over Altman’s ouster, will lead its team alongside unspecified colleagues.

Altman was blindsided by the firing which shows there was something horribly wrong with the relationship between the board and Altman. It sure smells like a power struggle.

Altman was the key to the company’s close relationship with Microsoft, which became highly dependent on its technology and remains OpenAI’s largest investor with a 49% stake.

Ultimately, Altman’s insistence that the current board resigns was rebuffed.

It would have made no sense for him to go back for anything less than that plus a big salary hike.

Among all the investors, Microsoft might be the most deeply intertwined in the fate of OpenAI, and the startup’s turmoil has been a liability.

Beyond being OpenAI’s largest backer, Microsoft has reoriented its business around the startup’s AI software.

The first takeaway is that this is great for Microsoft’s stock because of the boost it will deliver to its AI business.

MSFT shares would have sold off by 10% if Altman left completely.

MSFT now has the best of breed working directly for them after becoming frustrated by the lack of insight into OpenAI.

A lack of a board seat made the transparency even blurrier.

Opportunistically, expect a mass exodus of OpenAI’s best to join Microsoft’s new AI division.

Most of the employees are already demanding for the board to resign and this situation is on the verge of erupting into a toxic mess.

Poaching is the oldest game in town and MSFT will aggressively look to add to its staff. OpenAI will be a shell of its former self soon because MSFT has the resources to pull it off. Everyone jumping ship will be granted a massive pay rise and restricted stock.

Even if MSFT needs to write down its initial AI investment into OpenAI, it pales in comparison to the potential and bottom-line boost that Altman could muster for the Washington company.

Free agents of this caliber don’t usually jump ship for free and this is a major coup for Microsoft, Altman, and anyone else that follows him to MSFT.

Half the value of OpenAI is wrapped up in Altman himself.

He is now tasked to bring what he did from OpenAI and then develop it, and this time around he has unlimited resources to deploy.

This is another win for the Magnificent 7.

I am highly bullish on MSFT.

MSFT HITS A HOME RUN WITH ALTMAN