Global Market Comments February 7, 2022 Fiat Lux Featured Trades: (MARKET OUTLOOK FOR THE WEEK AHEAD, or CASH IS KING), (SPY), (TLT), (TBT), (MSFT), (AAPL), (TSLA), (BRKB)

“Cash is king.” That is the sage piece of advice I learned from my father about what to do during stock market corrections. Pop wasn’t a professional investor, but he had been through enough bear markets to know the value of a dollar at a market bottom. This week will go down in history of

Global Market Comments February 4, 2022 Fiat Lux Featured Trades: (FEBRUARY 2 BIWEEKLY STRATEGY WEBINAR Q&A), (PYPL), (PLTR), (BRKB), (MS), (GOOGL), (ROM), (MSFT), (ABNB), (VXX), (X), (FCX), (BHP), (USO), (TSLA), (EDIT), (CRSP)

Below please find subscribers’ Q&A for the February 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, Nevada. Q: Thoughts on Palantir Technologies Inc. (PLTR)? A: Well, we got out of this last summer at $28 because the CEO said he didn’t care what the share price does, and when you say

Global Market Comments February 3, 2022 Fiat Lux Featured Trades: (WATCH OUT FOR THE COMING COPPER SHOCK) (FCX), ($COPPER)

Global Market Comments February 2, 2022 Fiat Lux Featured Trades: (A NOTE ON OPTIONS CALLED AWAY) (TLT)

Global Market Comments February 1, 2022 Fiat Lux Featured Trades: (A NEW THEORY OF THE AMERICAN ECONOMY)

The US economy is currently recovering at double the rate of past recoveries. No one has ever seen anything like this before. Sometimes a trader can turn wildly bullish, not really understanding why. He is just responding the market price action. Often the reasons why don’t become obvious for months, or even years after the

“Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years.” – Said Legendary U.S. Investors Warren Buffet

Global Market Comments January 31, 2022 Fiat Lux Featured Trades: (TESTIMONIAL), (MARKET OUTLOOK FOR THE WEEK AHEAD, or DEATH OF THE FED PUT), (SPY), (TLT), (TBT), (MSFT), (AAPL), (TSLA), (BRKB)

I am Ari, the son of Ed, who had a subscription to your service for the past several years. Unfortunately, my dad passed last week, and we had a beautiful memorial service for him. I spoke of his interest in the stock market and how he also introduced me to the financial markets and the

That great wellspring of your personal wealth for the last 13 years, the Fed put, is no more. No longer can you count on an endless expansion of the money supply to boost the value of your share and real estate portfolios. In fact, since our central bank embarked on an endless effort to restore

Global Market Comments January 28, 2022 Fiat Lux Featured Trades: (GUIDE TO THE MAD HEDGE DAILY POSITION SHEET)

One of the benefits of subscribing to the Diary of a Mad Hedge Fund Trader is that you get a daily accounting of the recommendation we have made, marked to market at the close of each day. The goal is to make you feel like an actual hedge fund trader yourself, which means being held

Global Market Comments January 27, 2022 Fiat Lux Featured Trades: (GUIDE TO THE MAD HEDGE DAILY POSITION SHEET)

Global Market Comments January 26, 2022 Fiat Lux Featured Trades: (TESTIMONIAL) (A REFRESHER COURSE AT SHORT SELLING SCHOOL), (SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA), (VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Global Market Comments January 25, 2022 Fiat Lux Featured Trades: (A REFRESHER COURSE AT SHORT SELLING SCHOOL), (SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA), (VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Global Market Comments January 24, 2022 Fiat Lux Featured Trades: (MARKET OUTLOOK FOR THE WEEK AHEAD, or PARACHUTING WITHOUT A PARACHUTE), (AAPL), (SPY), (MSFT), (TLT), (TBT), (TDOC), (NFLX), (DIS), (VALE), (FCX), (USO), (JPM), (WFC), (BAC), (TSLA), (AMZN), (NVDA)

It has been the worst New Year stock market opening in history. After a two-day fake-out to the upside, stocks rolled over like the Bismarck and never looked up. NASDAQ did its best interpretation of flunking parachute school without a parachute, posting the worst month since 2008. Markets can’t hold on to any rally longer

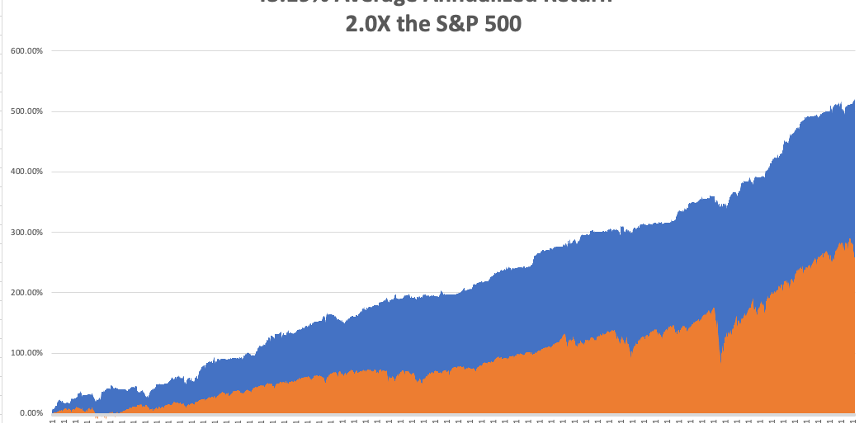

Global Market Comments January 20, 2022 Fiat Lux Featured Trades: (HOW THE MAD HEDGE MARKET TIMING ALGORITHM TRIPLED MY PERFORMANCE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.