Global Market Comments November 4, 2021 Fiat Lux Featured Trade: (WHY THE REAL ESTATE BOOM HAS A DECADE TO RUN), (DHI), (LEN), (PHM), (ITB)

Global Market Comments November 3, 2021 Fiat Lux Featured Trade: (TESTIMONIAL), (DECODING THE GREENBACK), (WHAT ABOUT ASSET ALLOCATION?)

I watched John Thomas for a year before jumping in, and I should have done it earlier when he phenomenally traded that awful year, 2011, that whipsawed so many investors including myself. He again outperformed the market in 2012, 2013, 2014, 2015 and so far he has shown amazing skill once more in navigating treacherous

Asset allocation is the one question that I get every day, which I absolutely cannot answer. The reason is simple: no two investors are alike. The answer varies whether you are young or old, have $1,000 in the bank or $1 billion, are a sophisticated investor or an average Joe, in the top or the

Global Market Comments November 2, 2021 Fiat Lux Featured Trade: (THE CROOKS ARE GETTING SMARTER) (ROM), (THO)

Global Market Comments November 1, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or LET THE GAMES BEGIN!) (MS), (GS), (BLK), (JPM), (BAC), (TLT), (TSLA), (AAPL), (MSFT), (GOOGL), (AMZN), (ROM)

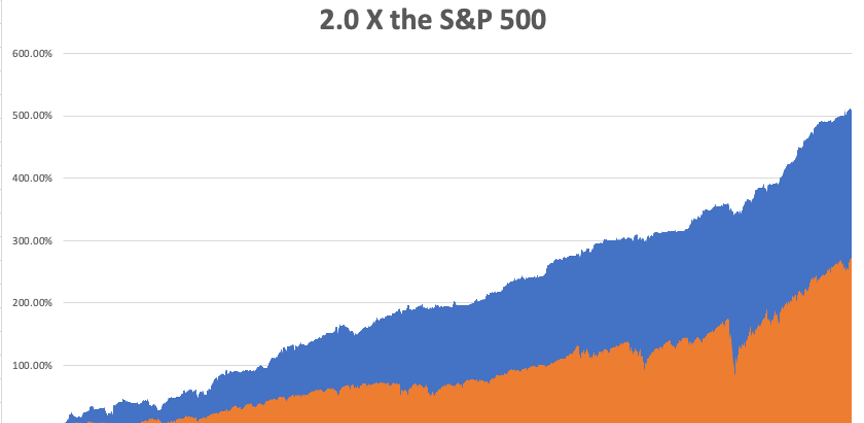

Welcome to the first day of November, when the seasonals swing from negative to positive. The hard six months are over. The next six should be like shooting fish in a barrel. At least that’s what happened in the past. The period from November 1 to May 31 has delivered the highest stock returns for

Global Market Comments October 29, 2021 Fiat Lux Featured Trade: (WHICH IS THE CHEAPEST US STATE?)

Global Market Comments October 28, 2021 Fiat Lux Featured Trade: (WHAT THE HECK IS ESG INVESTING?), (TSLA), (MO)

Global Market Comments October 27, 2021 Fiat Lux Featured Trade: (A NEW THEORY OF TESLA, or WHY I’M RAISING MY TARGET TO $10,000), (TSLA)

Global Market Comments October 26, 2021 Fiat Lux Featured Trade: (CHINA’S COMING DEMOGRAPHIC NIGHTMARE)

Global Market Comments October 25, 2021 Fiat Lux Featured Trade: (TESTIMONIAL), (MARKET OUTLOOK FOR THE WEEK AHEAD, or TAKING A BREAK) (MS), (GS), (BAC), (TLT), (TSLA), (AAPL), (AMZN), (GOOGL), (FB)

When I ran the international equity trading desk at Morgan Stanley during the 1980s, there was always one guy I was trying to recruit and that was David Tepper at Goldman Sachs. Whenever we did a trade with David, we lost money. If we sold David a stock it usually took off like a rocket.

Global Market Comments October 22, 2021 Fiat Lux Featured Trade: (OCTOBER 20 BIWEEKLY STRATEGY WEBINAR Q&A), (DIS), (TLT), (TBT), (FXI), (BABA), (BIDU), (JD), (USO), (JPM), (MS), (GS), (BITO), ($BTCUSD)

Below please find subscribers’ Q&A for the October 20 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley. Q: Why are stocks so high? Won’t inflation hurt companies? A: Inflation hurts bonds (TLT), not companies, which is why we are short the bond market and have been short for most of this year.

Global Market Comments October 21, 2021 Fiat Lux Featured Trade: (MY 20 RULES FOR TRADING IN 2022)

Global Market Comments October 20, 2021 Fiat Lux Featured Trade: (THE HARD TRUTH BEHIND BUYING IN NOVEMBER) (NOTICE TO MILITARY SUBSCRIBERS)

To the dozens of subscribers in Afghanistan, Somalia, and Iraq, and the surrounding ships at sea, thank you for your service! I think it is very wise to use your free time to read my letter and learn about financial markets in preparation for an entry into the financial services when you muster out. Nobody

Global Market Comments October 19, 2021 Fiat Lux SPECIAL BITCOIN ISSUE Featured Trade: (WHERE DOES BITCOIN GO FROM HERE?) ($BTCUSD), (ETH), (CRPT), (BLOK), (MSTR)

I first got involved with bitcoin in 2011, when a subscriber wanting to thank me for a spectacular investment performance GAVE me ten Bitcoin. They were then worth $1 each. Then, I forgot about them. When they appreciated to $100 in 2013, I decided to sell them and take the family out to dinner at

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.