Global Market Comments August 3, 2021 Fiat Lux Featured Trade: (TESTIMONIAL), (TEN MORE TRENDS TO BET THE RANCH ON), (AAPL), (AMZN), (GOOGL), (TSLA), (CRSP), (EDIT), (NTLA)

Global Market Comments August 2, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or TAKING A BREAK) (AAPL), (AMZN), (FB), (MSFT), (TSLA), (JPM), (TLT), (SPY)

When things can’t be better, they really can’t get any better, and there is no upside left. As I expected, big tech companies announced earnings for the ages, the top four totaling a staggering $56.6 billion in profits in Q2, or $226.4 billion annualized. That compares to total US Q1 profits of $2.347 trillion. Then

“There are no great men, only great challenges that ordinary men are forced by circumstances to meet,” said WWII Admiral “Bull Halsey.

Global Market Comments July 30, 2021 Fiat Lux Featured Trade: (JULY 28 BIWEEKLY STRATEGY WEBINAR Q&A), (SPY), (CRSP), (TLT), (TBT), (BABA), (BIDU), (FXI), (RAD), (TSLA), (NASD), (NKLA), (NIO), (INTC), (MU), (NVDA), (AMD), (TSM), (VXX), (XVZ), (SVXY), (FCX), (ROM), (SPG)

July 28 Biweekly Strategy Webinar Q&A Below please find subscribers’ Q&A for the July 28 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV. Q: What is your plan with the (SPY) $443-$448 and the $445/450 vertical bear put spreads? A: I’m going to keep those until we hit the lower strike price on either

Global Market Comments July 29, 2021 Fiat Lux Featured Trade: (TESTIMONIAL), (HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING), (GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY), (PALL), (GS), (RSX), (EZA), (CAT), (CMI), (KMTUY), (KODK), (SLV), (AAPL)

Hi John, You are a wonderful example for men to follow. Energetic, roping a steer? Climbing a mountain with a 40lb backpack for 10 miles? Incredible. But the big one is your humble willingness to help us little guys who need your help. You take the jitters out of trading for us. And I

Global Market Comments July 28, 2021 Fiat Lux Featured Trade: (COFFEE WITH RAY KURZWEIL) (GOOG)

Global Market Comments July 27, 2021 Fiat Lux Featured Trade: (HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

Global Market Comments July 26, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or GETTING INTO STUDIO 54), (AAPL), (AMZN), (TSLA), (GOOGL), (FB), (NVDA), (TLT)

During the heyday of my Morgan Stanley career in the 1980s, back when I had an unlimited expense account, a favorite place to take clients was Studio 54. The place was full of rock stars, the music was piercing, and strange things were happening in dark corners. It was all the perfect adventure for the

Global Market Comments July 23, 2021 Fiat Lux Featured Trade: (INDUSTRIES YOU WILL NEVER HEAR FROM ME ABOUT) (AMZN), (DIS), (FB), (MSFT), (VIX)

Global Market Comments July 22, 2021 Fiat Lux Featured Trade: (HOW DID THOSE TECH LEAPS WORK OUT?) (AAPL), (AMZN), (MSFT)

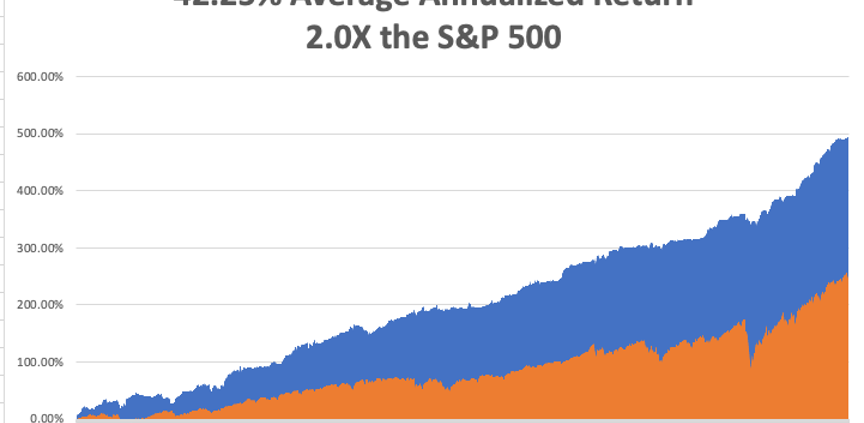

A month ago, I sent you a research piece about the merits of long-term LEAPS in the major technology stocks (click here for the link). They included: Amazon (AMZN) January 2022 $3,200-$3,400 vertical bull call spread Microsoft (MSFT) January 2022 $240-$270 vertical bull call spread Apple (AAPL) January 2022 $120-$130 vertical bull call spread So,

“Language does not provide the means for us to describe the destruction before us,” said Chancellor Angela Merkel about the damage from the climate change-induced flooding in Germany.

Global Market Comments July 21, 2021 Fiat Lux Featured Trade: (AN INSIDER’S GUIDE TO THE NEXT DECADE OF TECH INVESTMENT), (AMZN), (AAPL), (NFLX), (AMD), (INTC), (TSLA), (GOOG), (FB)

Global Market Comments July 20, 2021 Fiat Lux Featured Trade: (SHOPPING FOR FIRE INSURANCE IN A HURRICANE) (VIX), (VXX), (XIV) (THE ABCs OF THE VIX) (VIX), (VXX), (SVXY)

Global Market Comments July 19, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE DELTA CORRECTION IS HERE) (AMZN), (AAPL), (FB), (MSFT), (TAN), (FSLR)

Right now, the fate of your investment portfolio, and indeed your life, is in the hands of a minority of anti vaxers in the Midwest. If the surge in the delta variant burns out in weeks or a month, the current market correction won’t extend any more than 5% and you should be loading the

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.