With the latest effort to expand quantitative easing through the Fed purchase of individual corporate bonds, we must consider what else our central bank has up its sleeve. With American interest rates already near zero, the markets will take the rates for all interest-bearing securities well into negative numbers. This has already happened in Japan

Thanks for all your help with my trading. Your service is very effective. As you know I went heavily into some LEAPS two days ago including United Airlines, (UAL), Delta Airlines (DAL), Wynn Resorts (WYNN), MGM Resorts International (MGM), and Simon Property Group (SPG) that have returned as much as a 25% ROI over that

Global Market Comments April 26, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE CORRECTION IS OVER) (PAVE), (NFLX), (AAPL), (AMD), (NVDA), (ROKU), (AAPL), (AMZN), (MSFT), (FB), (GOOGL), (TSLA), (KSU), (CP), (GS), (UNP) (LEN), (KBH), (PHM)

This is a classic example of if it looks like a duck and quacks like a duck, it’s definitely not a duck….it’s a giraffe. In stock market parlance, that means we have just suffered an eight-month correction which is now over. Look at the charts and a correction is nowhere to be found. The largest

Global Market Comments April 23, 2021 Fiat Lux Featured Trade: (I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE), (SOME SAGE ADVICE ON ASSET ALLOCATION)

Global Market Comments April 22, 2021 Fiat Lux Featured Trade: (THE IDIOT’S GUIDE TO INVESTING), (TSLA), (BYND), (JPM) (TESTIMONIAL)

Global Market Comments April 21, 2021 Fiat Lux Featured Trade: (WHY TECHNICAL ANALYSIS NEVER WORKS) (FB), (AAPL), (AMZN), (GOOG), (MSFT), (VIX)

Global Market Comments April 20, 2021 Fiat Lux Featured Trade: (WATCH OUT FOR THE COMING COPPER SHOCK) (FCX), ($COPPER)

Global Market Comments April 19, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or LIE BACK AND THINK OF ENGLAND) (JPM), (BAC), (AAPL), (FXI), (TLT), (VIX), (TSLA)

If you have to ask what this classic phrase from Britain’s colonial past means, you are too young to know. The stock market equivalent is that there is nothing to do. Just sit back and relax, watching the value of your stocks go up every day. Let the greatest monetary and fiscal stimulus work its

Global Market Comments April 16, 2021 Fiat Lux Featured Trade: (APRIL 14 BIWEEKLY STRATEGY WEBINAR Q&A), (TSLA), (JPM), (ROM), (AAPL), (MSFT), (FB) (CRSP), (TLT), (VIX), (DIS), (NVDA), (MU), (AMD), (AMAT) (PLTR), (WYNN), (MGM)

Below please find subscribers’ Q&A for the April 14 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA. Q: How do you choose your buy areas? A: It’s very simple; I read the Diary of a Mad Hedge Fund Trader. Beyond that, there are two main themes in the market right now: domestic recovery

Global Market Comments April 15, 2021 Fiat Lux Featured Trade: (CYBERSECURITY IS ONLY JUST GETTING STARTED), (PANW), (HACK), (FEYE), (CSCO), (FTNT), (JNPR), (CYBR)

Global Market Comments April 13, 2021 Fiat Lux Featured Trade: (A NEW THEORY OF THE AMERICAN ECONOMY)

Global Market Comments April 13, 2021 Fiat Lux Featured Trade: (REVISITING THE ROM) (ROM) (BRING BACK THE UPTICK RULE!)

Now that technology stocks have returned from the grave, it is time to increase our exposure to the sector. After all, we are two weeks into a rally that could last until the rest of the year. It was the stabilization of interest rates that did the trick. While ten-year US Treasury yields (TLT) were

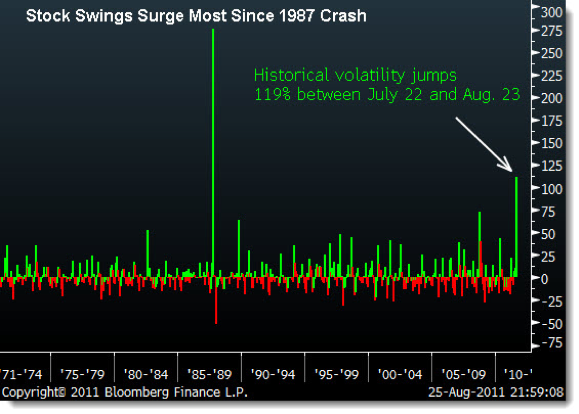

When the Dow crashed 514 points in a single day a few years ago, the market lost a staggering $850 billion in market capitalization. High frequency traders were possibly responsible for half of this move, but generated a mere $65 million in profits, some 7/1,000’s of a percent of the total loss. Are market authorities

Global Market Comments April 12, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, THE MELT UP IS ON!), (SPX), (TLT), (DIS), (GM), (TM), (ZM), (SQ), (PYPL), (JPM), (MSFT), (V)

I have a new roommate. Her name is Goldilocks. The neighbors have been sneaking peeks at her through the curtains at night and raising their eyebrows because she is slightly older than my kids, or about 50 years younger than me. I have no complaints. Suddenly, the world looks a brighter place, I’m getting up

Global Market Comments April 9, 2021 Fiat Lux Featured Trade: (HOW TO HANDLE THE FRIDAY, APRIL 16 OPTIONS EXPIRATION), (TLT), (TSLA), (TSM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.